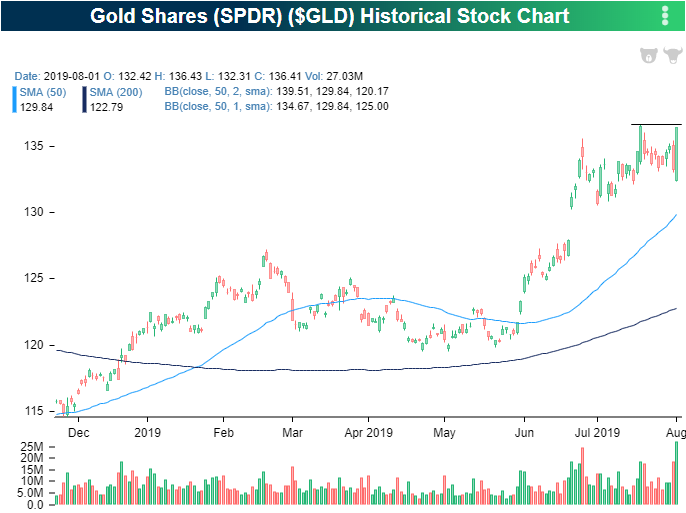

Outside Day for Gold (GLD)

Even though assets have been selling off across the board in response to Wednesday’s Fed decision and the President’s announcement of increased tariffs yesterday, there is one bullish point to be found. Yesterday, gold (GLD) had initially moved slightly lower around the open but then surged into the close, finishing the day only a couple of cents off of the intraday high. Not only did GLD fully recoup the morning’s losses, but it also gained back the previous day’s losses and then some. This outside day/bullish engulfing pattern is typically seen as a bullish technical signal.

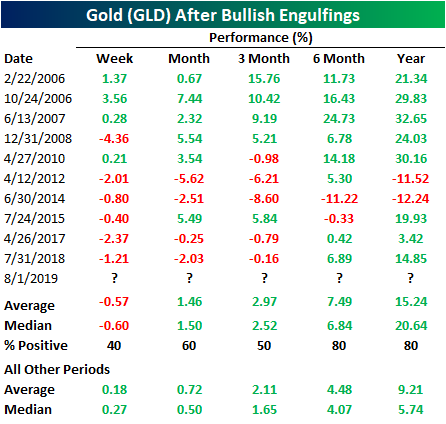

This pattern has occurred a total of 35 times in the history of the Gold ETF (GLD). Below we show the 10 previous times that this pattern was observed after not having occurred in the previous six months. Despite being a bullish setup, performance in the next week has actually had a negative bias with an average return of -0.57%. The past five times have seen a loss in the following week. Likewise, three months out sees better than average returns but the probability of GLD trading higher is the just the same as a coinflip. But, generally, in the months and year after, GLD continues to trend higher on average with more consistent gains in the next month, 6 months, and year periods. Returns are also better than normal across these time frames. Start a two-week free trial to Bespoke Institutional to access our interactive Security Analysis tool and much more.

Fakeouts

Throughout the course of the entire year, large caps have been leading the market higher, and they are the only market cap range of the equity market to actually make new highs in the most recent leg higher for equities. After this week’s pullback, though, the S&P 500 is coming perilously close to breaking through support at the prior highs from April and last fall. A close below those levels today would not be a great mood-setter for the bulls heading into the weekend.

For Mid and Small Caps, the picture is even less optimistic. The S&P 400 Mid Cap index never came close to a new high in the most recent rally, but it did appear to break its downtrend from the highs late last year. But that breakout quickly turned to a fakeout this week as the S&P 400 broke back down below its prior downtrend line and is breaking below the 50-DMA today.

For the small-cap Russell 2000, it’s an identical picture. In this case, the break above the downtrend line was even more short-lived, and like the S&P 400, the Russell 2000 is not only back below its 50-DMA, but it also isn’t that far from breaking below its 200-DMA. Start a two-week free trial to Bespoke Premium to receive our best equity research on a daily basis and gain access to our Trend Analyzer and Chart Scanner tools.

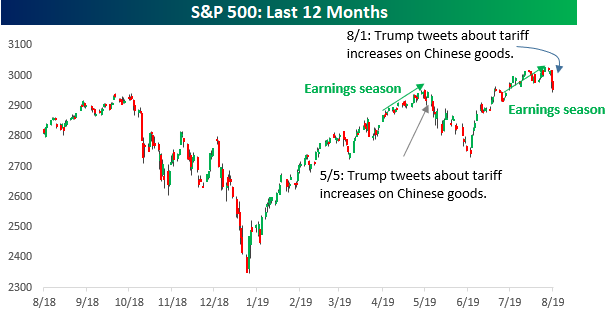

Earnings Season Déjà Vu

Is it happening again? After what has to this point been a perfectly good earnings season for the US stock market sending the S&P 500 to new all-time highs in the process, the President spoiled the party yesterday when he tweeted that a new round of tariffs would be instituted on Chinese Imports. Stocks had erased all of their declines from Powell’s Wednesday press conference by mid-day Thursday, but then the President’s tweet sent equity markets reeling with the Dow falling more than 1%, while the yield on the 10-year US Treasury fell back below 2%.

If this whole scenario sounds familiar to you, that’s because we saw the same thing last quarter. Remember back in April when the S&P 500 rallied to new highs in the early weeks of earnings season? There was a feeling then that the market was finally breaking out of its rut and on the path to a sustained breakout. But then over the first weekend of May, on a Sunday afternoon no less, the President sent out a series of tweets outlining his plan for increased tariffs on Chinese imports. The following Monday, the market opened lower and kept falling throughout the month. By the end of May, the S&P 500 was down 6.6% for the month, making it the worst May for the S&P 500 since 2010. August has historically been an iffy month for the stock market as many on Wall Street take vacations and try to relax, but if the market follows the earnings season script from last quarter, this will be an August of little rest. Start a two-week free trial to Bespoke Premium to receive our best equity research on a daily basis.

Bespoke’s Morning Lineup – Jobs Report? What Jobs Report?

Normally, the first Friday of the month is a day where everyone on Wall Street is freaking out about the latest jobs report. After yesterday’s tweetstorm by the President, though, jobs have taken a back seat.

Global markets are still reeling in the aftermath of the President’s new round of tariffs scheduled to take effect on 9/1. Interest rates around the world are plunging, stock markets have taken hits squarely on the chin, and the President’s attempt to jolt markets (thereby forcing the Fed’s hand into rate cuts) has continued.

The US equity market is set to open 35 bps lower despite a small rally off session lows, the Treasury curve is aggressively bull flattening as longer-term bonds price in risks of a recession while the front end prices a slightly easier Fed, and the dollar declines modestly.

Continue reading in today’s Morning Lineup.

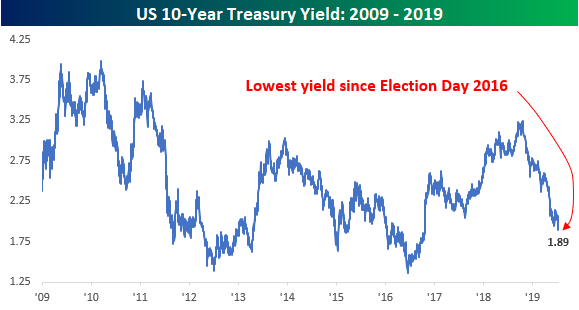

President Takes Matters into His Own Hands

The President has been frustrated with the Federal Reserve’s prior rate hikes and now the lack of a more substantial cut in rates. Just the other day, Trump was quoted as saying, “Obama had zero interest rates, we have ‘normalized’ rates. While the Fed hasn’t helped the President’s cause, he has seemingly taken matters into his own hands with his policy towards China. Each time he ratchets up the rhetoric against China, it tends to put additional downward pressure on interest rates, and following Thursday’s tweets, the yield on the 10-year plummetted below 1.9%.

Ironically enough, the last time the 10-year yield was this low was on Election Day 2016. While short-term borrowing costs are up as the FOMC has hiked rates during Trump’s time in office, the yield on the 10-year isn’t much different. Under the eight years of President Obama, the yield on the 10-year averaged 2.47%, while under Trump the average yield has been 2.57%.

The chart below shows a shorter-term look at the 10-year yield over the last year and it has practically been in free-fall the entire time. Ever since late 2018, every time the yield has attempted to make a move above its 50-DMA, it has reversed lower, with the most recent leg lower in May coinciding with another series of tweets concerning tariffs on Chinese goods.

While not a lot of stocks have benefitted from the President’s policy tweets on Chinese tariffs, the impact of lower interest rates has been cheered on by the homebuilders as they have practically been a completely inverse image of the move in rates. Just yesterday, the group hit a new high before pulling back a bit, but lower long-term interest rates mean lower mortgage payments, and that helps to make housing more affordable for millions of millennials looking for a place of their own. Start a two-week free trial to Bespoke Premium to receive our best equity research on a daily basis.

The Closer – Who Does This Serve? – 8/1/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with our commentary on the situation surrounding the President’s announcement of further tariffs as well as an analysis on the volatile reaction across asset classes. We finish with a look at some macro data including today’s release of US Markit PMI, Bloomberg Consumer Comfort, and Construction Spending.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

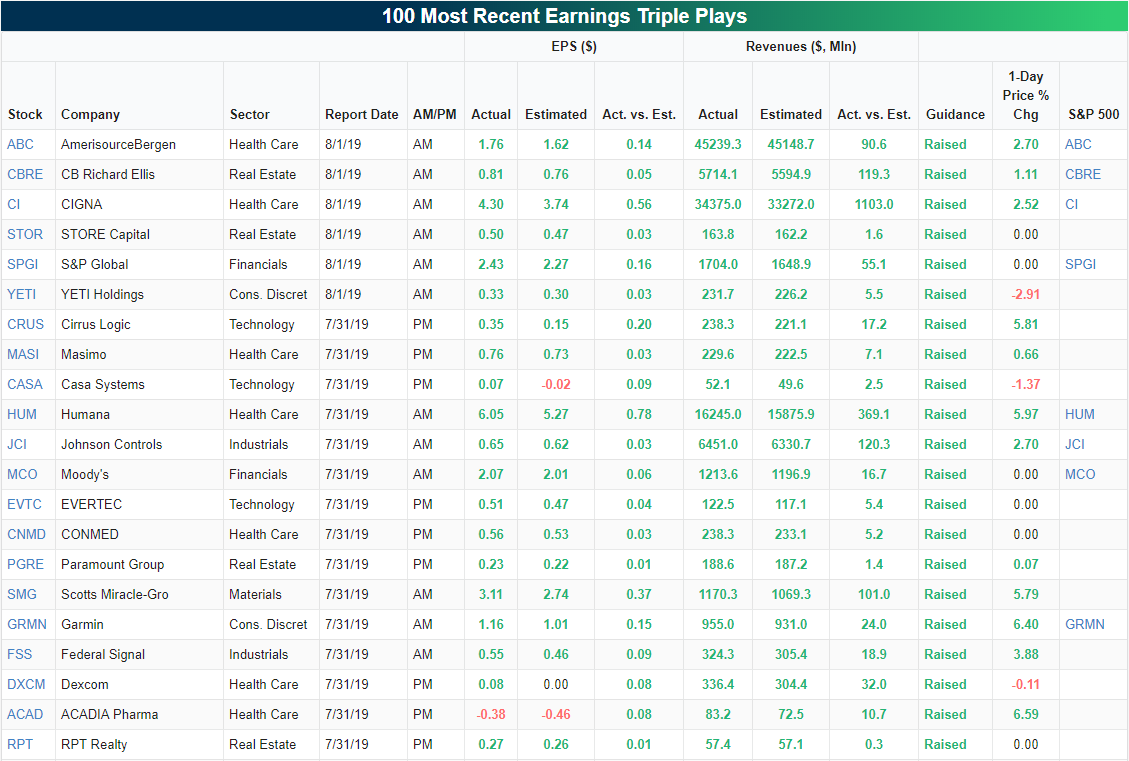

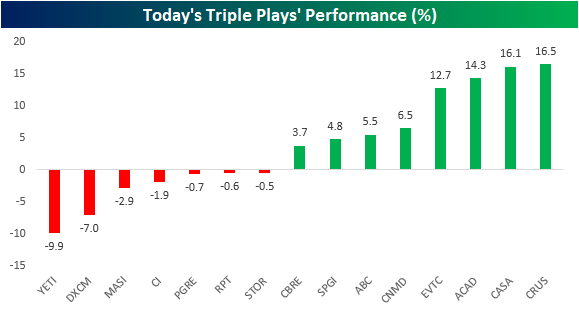

Not Even Triple Plays Are Safe

Today is one of the busiest days this earnings season with 258 total reports, and the triple plays have continued to come in at a healthy clip. Since yesterday’s close, there were another 15 companies that reported triple plays. Of these stocks, most have been Health Care (6), Real Estate (4), and Technology (3). Some of today’s notables include S&P 500 members AmerisourceBergen (ABC), CB Richard Ellis (CBRE), CIGNA (CI), and S&P Global (SPGI).

Of the four S&P 500 triple plays, only CI is trading lower today. CI is not alone in a negative reaction to its triple-play though. As the market is tumbling for the second day in a row, a third of the triple plays from the past day are witnessing declines. That is a bit unusual considering of the 50 triple plays so far this earnings season, the average earnings day reaction has been a gain of 7.5%.

YETI (YETI) has taken it on the chin the worst today. This was the company’s third triple play in its four quarters of earnings history. At the day’s lows, YETI was down over 14% before paring some of these losses. The stock is still the worst performer of today’s triple plays. Tipping between gains and losses today, STORE Capital (STOR) could potentially end an 8 consecutive quarter run of positive earnings reaction days if it finishes today in the red. On the other hand, EVERTEC (EVTC), ACADIA Pharma (ACAD), Casa Systems (CASA), and Cirrus (CRUS) are all up double digits. For CASA, this is only the second time that it has even seen a positive reaction to earnings. Before this report, the stock averaged a 11.06% decline following its quarterly reports. Start a two-week free trial to Bespoke Institutional to access our Earnings Explorer and much more.

B.I.G. Tips – July Employment Report Preview

Now that the most anticipated Federal Reserve rate cut in history has come and gone, traders have immediately set their sites on the next meeting in September and whether or not there will be another cut in rates at that meeting. A key driver of whether or not rates get cut again is economic data like tomorrow’s Non Farm Payrolls report for July. Remember that last month’s report, which was sandwiched between July 4th and a weekend came in much stronger than expected setting off a market decline on fears the FOMC would not be as dovish as many investors had hoped. It’s also important to remember, though, that expectations for FOMC policy oscillated wildly in the weeks that followed as traders extrapolated every data point out to infinity. In other words, whatever the narrative is that comes out of Friday’s meeting, don’t expect it to last for long.

Heading into tomorrow’s report, economists are expecting an increase in payrolls of 165K, which would be a decline of nearly 60K from June’s stronger than expected reading. In the private sector, economists are also expecting an increase of 165K, which represents a decline of 26K from June. The unemployment rate is expected to drop back down to 3.6%, average hourly earnings are expected to grow at a rate of just 0.2%, while average weekly hours are expected to be unchanged at 34.4.

Ahead of the report, we just published our eleven-page preview of the July jobs report. This report contains a ton of analysis related to how the equity market has historically reacted to the monthly jobs report, as well as how secondary employment-related indicators we track looked in July. We also include a breakdown of how the initial reading for July typically comes in relative to expectations and how that ranks versus other months.

For anyone with more than a passing interest in how equities are impacted by economic data, this July employment report preview is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

B.I.G. Tips – Death by Amazon – 8/1/19

Our “Death By Amazon” index was created many years ago to provide investors with a list of retailers we view as vulnerable to competition from e-commerce. In 2016, we also created our “Amazon Survivors” index which is made up of companies that look more capable of dealing with the threat from online shopping. To see how the two indices have been performing lately and view the full list of stocks that make up the indices, please read our newest report on the subject available to Bespoke Premium and Bespoke Institutional members.

To unlock our “Death By Amazon” and “Amazon Survivors” indices, login or start a two-week free trial to either Bespoke Premium or Bespoke Institutional.

Bulls Finally Back Above Average

So far, earnings season has been solid with above-average beat rates, guidance spread, and positive price reaction. This has certainly played a factor in improved sentiment in this week’s AAII survey. Bullish sentiment jumped 6.7% to 38.4%. Though it is still within a normal range, the percentage of investors reporting as bullish is now the highest since early May when it rose to over 43%. While earnings have likely positively impacted sentiment, we must also note that due to the timing of the survey, yesterday’s FOMC decision is likely to weigh little on this week’s results.

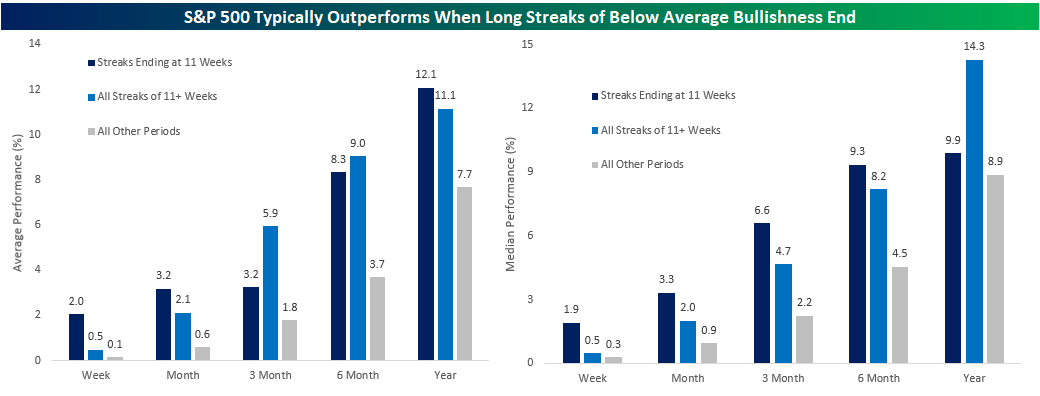

This week’s increase also ended a streak of eleven consecutive weeks that bullish sentiment remained below the historical average of 38.16%. As we mentioned last week, this sort of streak may sound like a negative, but there has been plenty of historical precedents. Since the beginning of the survey, there have been 18 other streaks that have gone 11 weeks or more, four of which have ended right at 11 weeks just like the most recent one. While any extended streak of below-average bullish sentiment has typically lead to outperformance, those that have ended at the eleventh week have actually done even better.

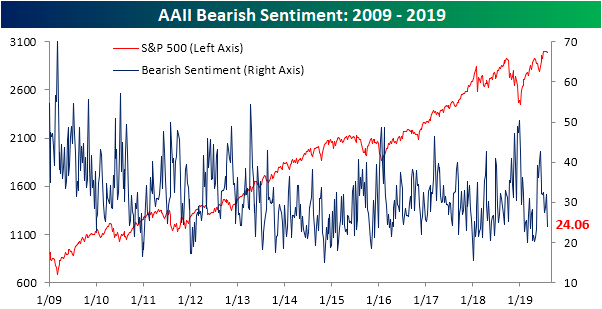

With the increase in bullish sentiment, bearish sentiment has fallen back to the lower end of its range, settling at 24.06%. This was the largest drop in the number of investors reporting as bears since June as the market rebounded from May declines. Speaking of those May declines, the last time bearish sentiment was this low was in the first week of May.

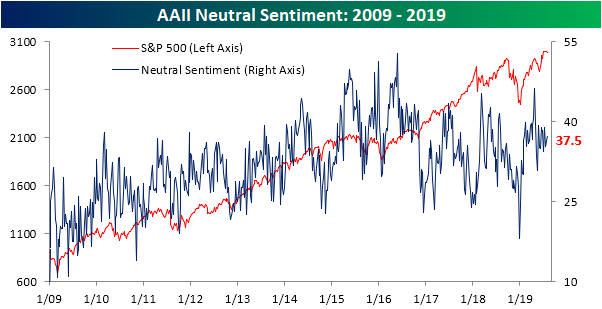

While both bears and bulls saw significant changes, neutral sentiment held firm only moving a bit more than 1%. At 37.5%, neutral sentiment continues to sit in the upper end of the past few year’s range and above the historical average of 31.52%. While bullish sentiment’s streak above its historical average may have come to a close, this week coincidentally marked the eleventh consecutive week of above-average neutral sentiment. The streak is even more impressive when taking into account the fact that the percentage of investors reporting as neutral has been elevated all year with 26 of the 30 weeks in 2019 seeing above-average neutral sentiment. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.