Trend Analyzer – 8/8/19 – Defensives Hold

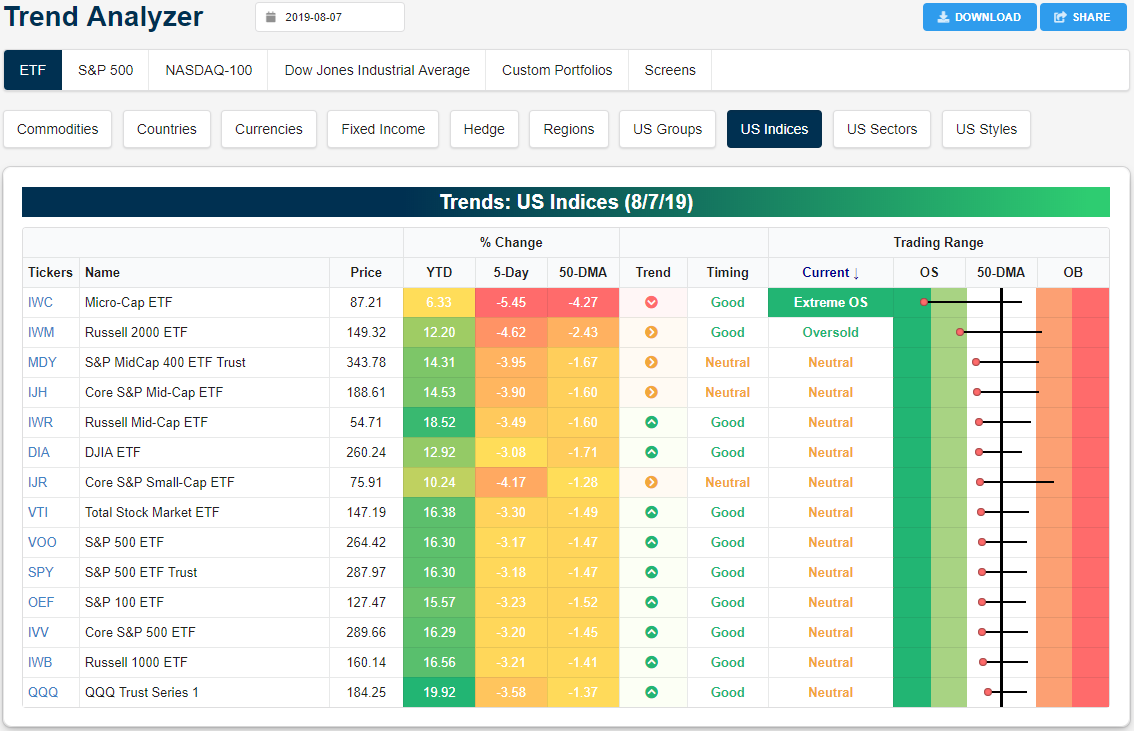

As stocks bounced back intraday yesterday, the major index ETFs held firm in neutral territory, but still remain below their 50-day moving averages. Only the Russell 2000 (IWM) and Micro-Cap ETF (IWC) remain oversold, with IWC over 2 standard deviations below the 50-DMA. IWC has by far been the weakest ETF of this group over the last week with a decline of more than 5%. IWM has been the next worst performer falling 4.62%. Although everything is down, large-cap indices like the Dow (DIA) have seen lesser—but still over 3%—declines.

Of the individual sectors, given the macroeconomic tensions in the past week, there has been continued rotation into defensives. Both the Utilities Sector ETF (XLU) and Real Estate Sector ETF (XLRE) have actually risen over 1% in the past five days. XLRE’s gains have even brought it into overbought territory. While Consumer Staples (XLY) did not rise like these two, it is also one of the only ETFs that is still above its 50-DMA. Meanwhile, Energy (XLE) has been the worst performer falling over 7% over the last week. Now over 6% below its 50-DMA, it has reached extreme oversold territory thanks to weakness in oil. XLE is also the only sector ETF to show a downtrend in our Trend Analyzer. Start a two-week free trial to Bespoke Institutional to access our Trend Analyzer and much more.

Commodities Internal Divergence

We’ve seen some interesting trends in the commodities space over the last few weeks. As shown in the snapshot from our Trend Analyzer tool below, the precious metals group has been surging higher and now sits in extreme overbought territory, while the energy and agriculture groups sit in extreme oversold territory.

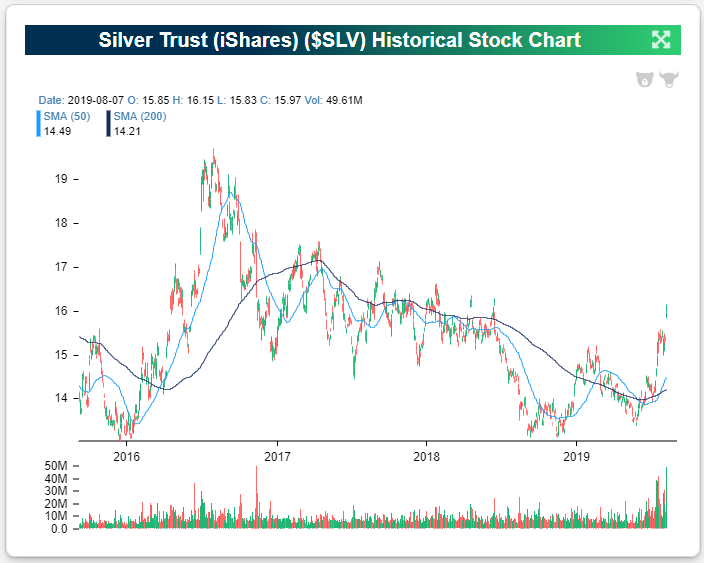

Both gold (GLD) and silver (SLV) are up 5%+ over the last week, and they’re now 7%+ above their 50-day moving averages. This has left them more than two standard deviations above their 50-day moving averages. Even though our trend algorithm now shows them as being in 6-month uptrends, the fact that they’re so extended to the upside gives them a “poor” timing rating. An investor looking to get long the space would be better served waiting for some downside mean reversion.

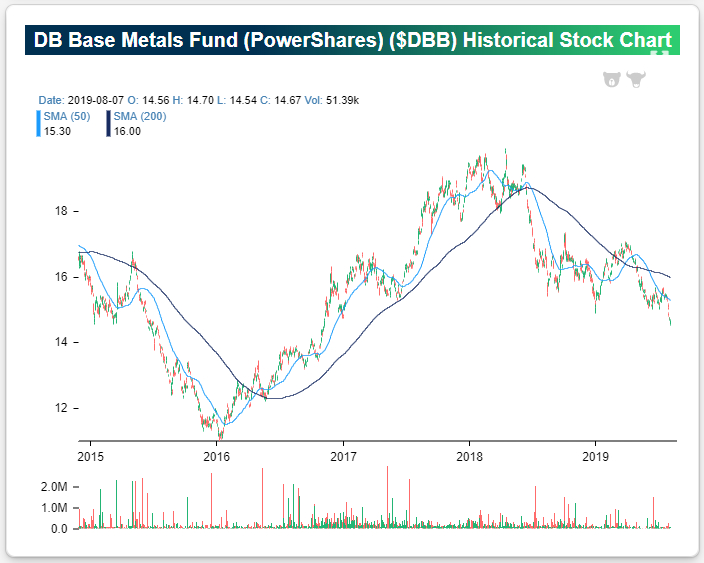

On the flip-side, base metals (DBB), agriculture (DBA), and energy (DBE) are down 4%+ over the last week and more than two standard deviations below their 50-day moving averages. While they’re noted as being in either sideways trends or downtrends, the fact that they’re so oversold gives them a “good” timing rating. An investor that has recently seen their actual allocation slip below their target allocation to these areas could add exposure here given how oversold they are.

Below is a six-month chart of the silver ETF (SLV) from our Security Analysis page. Yesterday was a very impressive breakout with a big gap higher.

The long-term chart of SLV going back to 2016 looks much different, however. The recent move higher barely puts a dent in the declines seen from mid-2016 to late 2018. But one thing the recent move higher has done is break the multi-year downtrend that was in place. The recent series of higher highs and higher lows is a promising sign for SLV bulls.

The most oversold commodity ETF right now is Base Metals (DBB). It’s literally falling off the chart.

Longer-term going back to 2015, DBB is still well above lows seen in early 2016, but it continues to make lower lows on a regular basis. The drop seen over the last week marked another significant breakdown. Start a two-week free trial to Bespoke Premium to access Bespoke’s most actionable research reports.

Bespoke’s Morning Lineup – China Headlines Subside (For Now)

After a rocky few days for global financial markets, there’s an eerie sense of calm in the market today as both US futures and treasury yields are little changed (but depending on when you read this, there’s a good chance that things could change). Oil is trading higher by close to 2% after reports yesterday that Saudi Arabia has put all options on the table in its efforts to stop the decline in crude oil prices, while gold is down nearly 1% but still above 1,500 per ounce as the flight to safety is on hold for now. Continue reading in today’s Morning Lineup.

The Closer – Just Another Flat Day for Equities and Treasuries – 8/7/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we recap the dramatic price action in the major indices and Treasuries, putting into context the strong intraday reversals. Turning to commodities, we then take a look at the divergence between gold and copper prices. We also show S&P 500 performance when the metals have acted as they have. We finish tonight with a recap of today’s bearish EIA data print.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Trend Analyzer – 8/7/19 – Fixed Income Running Hot

Although major equity indices managed a modest rebound yesterday, they all still sit over 4% lower versus last week. The Micro-Cap (IWC) has seen even worse declines in this time with a decline of 6.52%. IWC is also the only major index ETF in extreme oversold territory and in a downtrend over the past six months. While the Russell 2000 (IWM) is also oversold, the rest of the ETFs have actually moved into neutral territory following yesterday’s gains. But keep in mind the fact that one week ago, all of these ETFs were overbought across the board.

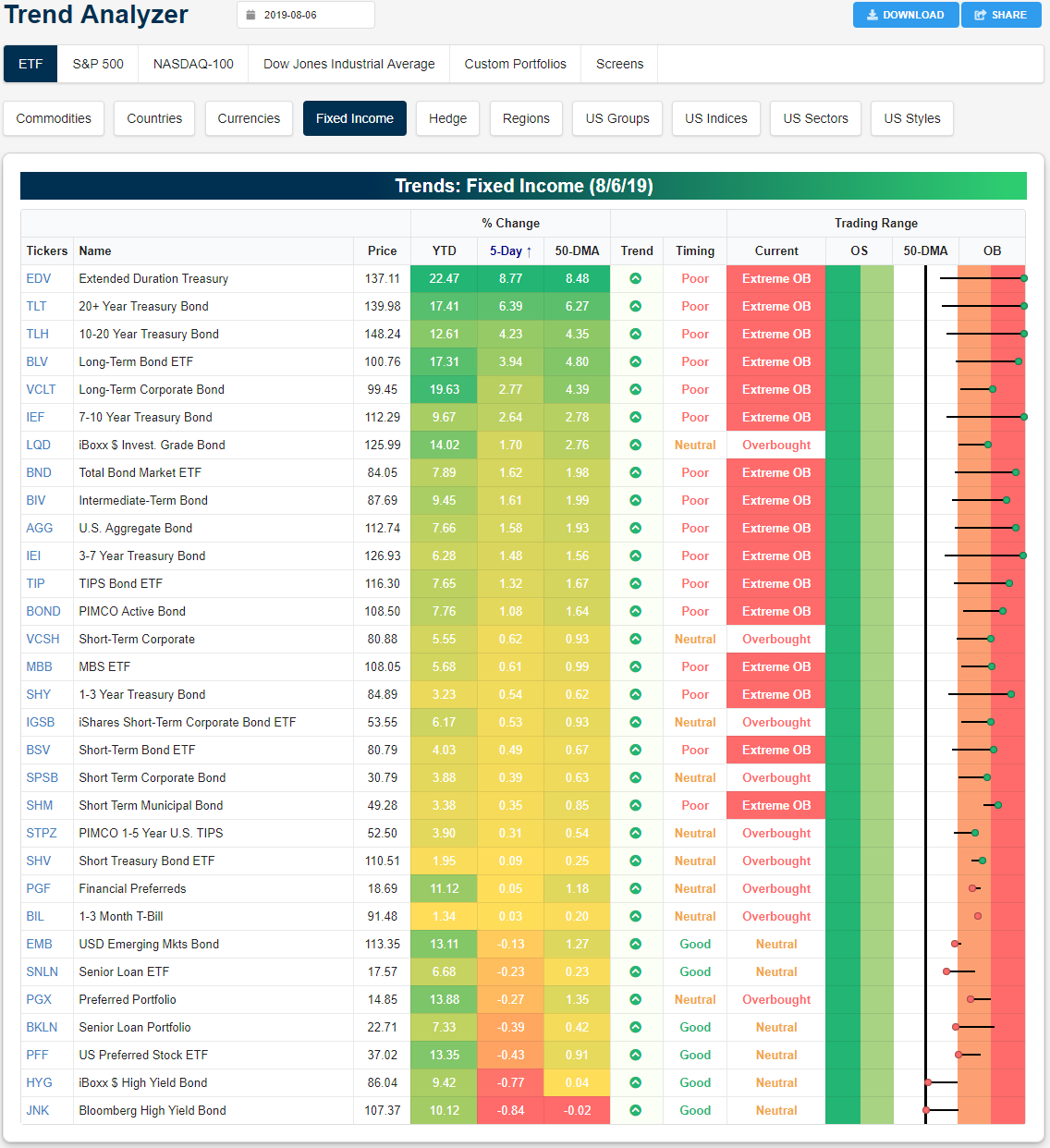

While risk assets have gotten hit hard, fixed income has been surging. So much so that of the 31 fixed-income ETFs in our Trend Analyzer, 15 are now over 2 standard deviations above the 50-DMA. Medium to long term treasury ETFs tracking the 3-7 year (IEI), 7-10 year (IEF), 10-20 year (TLH), 20+ year (TLT), and the Extended Duration Treasury (EDV) are all even more extended at over 3 standard deviations above the mean. These have also gained the most in the past week with EDV seeing the largest gains at 8.1%. Meanwhile, high yield credit has declined. The Bloomberg High Yield Bond ETF (JNK) and iBoxx High Yield Bond ETF (HYG) have fallen 1.43% and 1.36%, respectively. Senior loans (SNLN) and Preferred Stock (PFF) have also fallen. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer and much more.

Bespoke’s Morning Lineup – The Death of Yields

Global equities were trying to stabilize around the world overnight and this morning. Chinese equities were modestly lower, Japanese stocks were mixed, and Europe was rallying. US futures, for their part, were positive but have now given up all of those early gains and are firmly negative. Oil is modestly lower, precious metals like gold and silver are breaking out, while cyclical metals like copper are flat and iron ore is in free fall with a five-day decline of over 20% as trade fears hurt the outlook for global growth. The real story this morning is the collapse in yields both here in the US and around the world.

Continue reading in today’s Morning Lineup.

The Closer – Turnaround Holds True; Wither Energy – 8/6/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we cover quite a few topics including what led the bounce back today, S&P 500 sector weightings and the drop to multi-decade lows for Energy, analyst buy ratings by sector, and the average share price of stocks in the S&P 500.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Agriculture Data Lagging Stocks

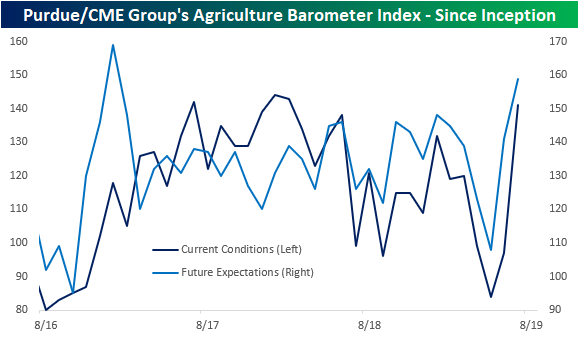

The Purdue University/CME Group’s Agriculture Barometer Index released today at its joint highest level since January 2017. The index—which surveys 400 agriculture producers on economic/industry sentiment— saw solid gains in both current and future expectations. In fact, the index for current conditions jumped 44 points to 141; the largest increase since the barometer’s inception. As with the headline reading, expectations rose to 159 which is the highest level since January 2017.

The major caveat to these numbers is the timing of the survey. The survey was conducted from July 15th to the 19th which would not pick up effects from recent trade developments. Throughout the ongoing trade war, US agriculture has been a major bargaining chip for China. The most recent spat has resulted in China officially ceasing the purchase of US agricultural products. Additionally, the effects of the USDA’s Market Facilitation Program which is essentially relief to farmers affected by tariffs is also likely to not be factored into this data. In other words, it is hard to put much weight on these numbers given all that has occurred since the data collection period.

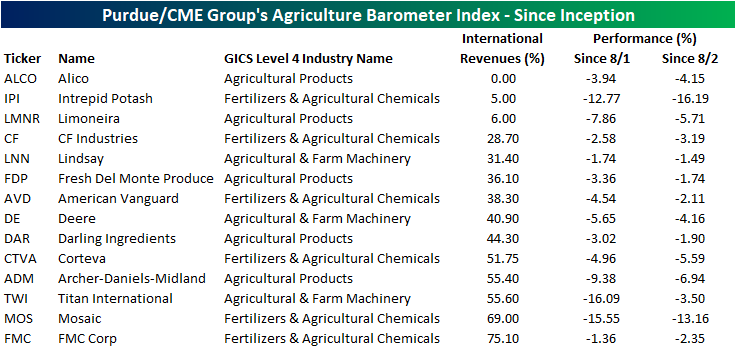

Although it is too early to show up in some economic data points, stock prices of agriculture-related business have underperformed since trade tensions ramped up last week. In the table below, we show the stocks in the S&P 500 and Russell 2000 with an agricultural focus. As shown, not a single one has risen since last Thursday when the President initially announced more tariffs, and each one has also fallen since Friday’s close (last price before China’s retaliation). While the broader market has also declined in this time, these agriculture stocks have more dramatically underperformed falling 6.4% on average since August 1st versus a 2.6% decline in the S&P 500 and 3.45% decline in the Russell. Some of these stocks that have seen the worst declines also boast the highest degree of international exposure. The three worst performers are Intrepid Potash (IPI), Titan International (TWI), and Mosiac (MOS) which have all fallen double-digits in just the span of a few days. They also have the added catalysts of weak earnings on top of headline news. TWI reported Thursday morning and MOS and IPI reported this morning. Start a two-week free trial to Bespoke Premium to access Bespoke’s most actionable research reports.

JOLTS Stronger Than Expected

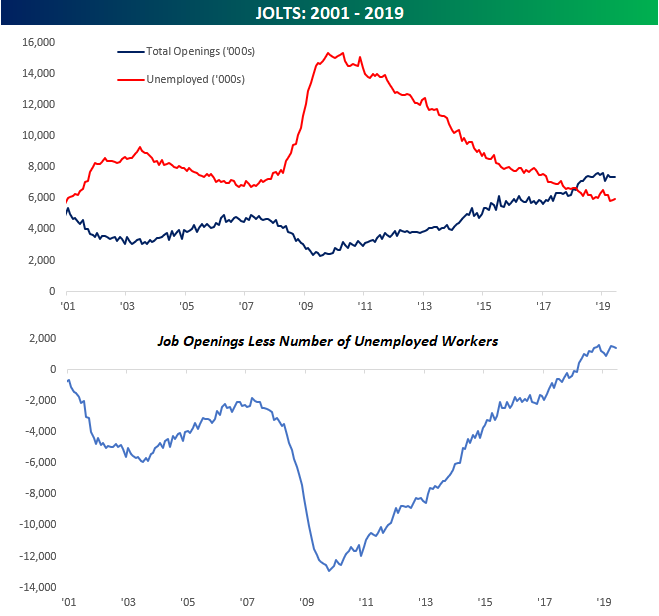

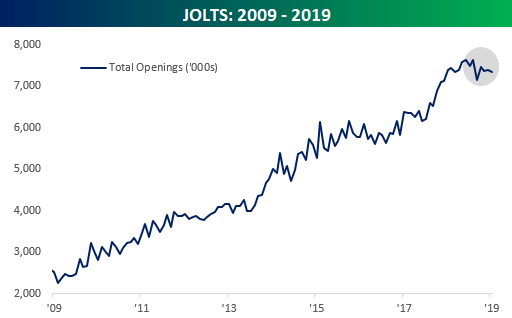

This morning’s release of the Job Openings and Labor Turnover Survey (JOLTS) for the month of June showed a stronger than expected picture in terms of the number of job openings, while last month’s was revised higher. Economists were expecting the number of job openings to come in at 7.326 million but the actual level was 22K stronger at 7.348 million. Besides the fact that the June reading was higher than expected, the most notable aspect of the JOLTS report continues to be how there are more job openings than there are available workers. The shift in the jobs vs. available workers dynamic first shifted in February 2018 but has remained that way ever since and currently stands at 1.373 million more jobs than there are workers. While the ‘shortage’ of workers raised concerns that it would accelerate upward pressure on wages, at this point we have yet to see signs that wages are beginning to spiral out of control.

While the above picture portrays a jobs market that is red hot, we would note that there has been some slowing in recent months. As shown in the chart below, the last time the JOLTS survey made a new high was seven months ago in November. Things are far from falling off a cliff when it comes to the employment picture, but for the time being, they aren’t accelerating either. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Chart of the Day: Summer Flops for Disney (DIS)

In today’s Chart of the Day, we preview Disney’s (DIS) upcoming earnings report and also highlight a key trend that has historically impacted the performance of its stock following prior August earnings reports.

To view the report and see how Disney tends to react to its August earnings reports, start a two-week free trial to any of our research membership levels.