Bespoke Brunch Reads: 8/18/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

Negative Rates

Depositors Are Next as Nordic Banks Buckle Under Negative Rates by Kati Pohjanpalo and Frances Schwartzkopff (Yahoo!/Bloomberg)

Banks in areas where policy rates are negative have so far avoided charging negative rates to depositors but that may start to change as other fees fail to support the profit drag of negative funding rates. [Link]

A Danish bank is offering mortgages at a 0.5% negative interest rate — meaning it is basically paying people to borrow money by Will Martin (Business Insider)

While depositors may end up being charged for holding money in their accounts, borrowers in Denmark are getting the chance to borrow at sub-zero rates. [Link]

Investors Ponder Negative Bond Yields in the U.S. by Sam Goldfarb and Daniel Kruger (WSJ)

A survey of speculation on what future interest rate policy could bring to the US bond market, including the possibility of borrowers getting paid to take loans. [Link; paywall]

We Not Working

WeWork Officially Files To Be The Last IPO by Thornton McEnery (Dealbreaker)

A deeply sarcastic look at this week’s WeWork IPO filing, filled with self-dealing, dubious terminology, massive losses, complex corporate structures, concentrated ownership, and all manner of other foibles. [Link]

WeWork’s S-1: some quick observations by Jamie Powell (FT Alphaville)

More detail on WeWork and it’s massive, can-you-believe-they’re-actually-trying-to-get-away-with-this IPO filing. [Link; registration required]

Tech Dystopia

Three Years Of Misery Inside Google, The Happiest Company In Tech by Nitasha Tiku (Wired)

A massive read on the internal mess at Google, catalyzed by the election of President Trump but a long time coming in many other respects. [Link; soft paywall]

I Tried Hiding From Silicon Valley in a Pile of Privacy Gadgets by Joel Stein (Bloomberg)

Getting rid of the sometimes-accidental, sometimes-intentional surveillance apparatus of Silicon Valley can be incredibly difficult. [Link; soft paywall]

The Techlash Has Come to Stanford by April Glaser (Slate)

Similar to the financial industry’s fall from grace as a destination for graduates after the financial crisis, big tech is losing – or more properly, has lost – its cache as a place for Stanford students to work after their schooling is complete. [Link]

Google’s hate speech-detecting AI appears to be racially biased by Donna Lu (New Scientist)

A new study finds that the algorithm used by Google to identify hate speech appears to have a racial bias, focusing on language used by blacks more than whites. [Link; soft paywall]

At The Vanguard

How to Profit in Space: A Visual Guide by Robert Wall, Yaryna Serkez and Joel Eastwood (WSJ)

An amazing visual guide to the massive array of useful and junk objects in orbit around our planet, as well as a dive into the improving economics of launches. [Link; paywall]

A clean energy breakthrough could be buried deep beneath rural Utah by Sammy Roth (LAT)

One potential solution to the problem of storing energy produced by renewables is to push air underground into a massive salt cavern, then extract it as needed, matching supply and demand. [Link]

ClimaCell weather app alerts when it’s about to rain, down to the minute, all around the world by Jason Samenow (LMT Online/WaPo)

A new Boston-based company claims the ability to predict minute-to-minute weather forecasts at the street level in 50 countries. [Link]

Investing & Personal Finance

Bankruptcy filings rising across the country and it could get worse by John Aidan Byrne (New York Post)

Bankruptcy filings are up 3% YoY through July, which isn’t a very large spike given the low aggregate level, but deterioration is something to keep an eye on. [Link]

New To Investing? You May Be Better Off Picking Stocks At Random, Study Finds by Ben Renner (Study Finds)

While a few losses can be useful learning experiences, amateur investors are actually worse than random picks of stocks when they start investing. [Link]

The longevity of the world’s largest ETF rests on the lives of 11 U.S. millennials by Rachel Evans, Vildana Hajric, and Tracy Alloway (LAT/Bloomberg)

The story of SPY’s limited life tied to the longevity of 11 individuals born between 1990 and 1993; their deaths would trigger the wind-down of the biggest ETF in the world. [Link]

Fitness

The Trendiest Fitness Class Now: Working Out Alone at Home by Hilary Potkewitz (WSJ)

Streaming services that run from simple phone apps to complex exercise equipment wired to on-demand services are gaining popularity. [Link; paywall]

China

Huawei Technicians Helped African Governments Spy on Political Opponents by Joe Parkinson, Nicholas Bariyo and Josh Chin (WSJ)

An investigation by the Journal shows that Huawei worked with governments in Africa to help suppress opposition groups via its technology embedded in wireless networks. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 8/16/19

This week’s Bespoke Report newsletter is now available for members.

In this week’s newsletter, we discuss what drove stocks to a third small weekly loss in a row. Crashing bond yields, firming US data, respectable earnings results, and slowing but not collapsing global economic data: all are pieces in the puzzle. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

The Closer: End of Week Charts — 8/16/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Fixed Income Through the Roof

Our Trend Analyzer does a great job of finding those assets that are at extremes either on the oversold side or the overbought side. While equities are mostly oversold at this point, fixed income is in the stratosphere. Below is a look at the most overbought fixed income ETFs at the moment. Dozens of them are in extreme territory at 2-3 standard deviations above their 50-day moving averages. You don’t see readings like this often, and they’re due for some mean reversion. Start a two-week free trial to one of Bespoke’s premium research offerings.

Home Builder Sentiment Keeps Climbing

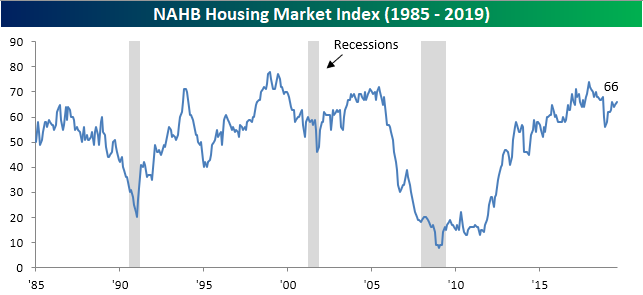

The NAHB’s Housing Market Index for August saw its second straight month with a modest increase bringing it to 66 compared to expectations of an unchanged 65. Although the index has been grinding higher since plummeting to its late 2018 low, it is still well off of its December 2017 record high of 74.

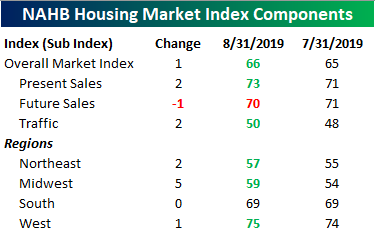

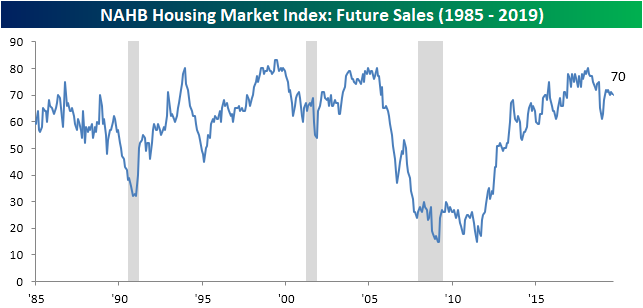

Breaking down the indicator by its sub-indices, improved present sales and traffic led to a stronger index in August. Both rose by 2 and are now at their highest levels of 2019. Future sales outlook still remains bleaker though as it declined to 70 in August. As shown in the chart below, in addition to the spike lower at the end of last year, future sales have been in a downtrend since February 2018. Unlike present sales and traffic, the rebound of future sales’ off of the December low has not seen promising follow-through.

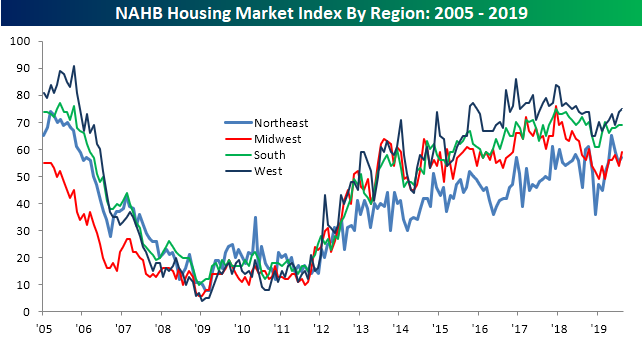

Of the individual regions, sentiment in the West continues to be the strongest improving to 75 in August. Granted this is still off of its cycle highs; as is the case for each of the regions. The other regions generally saw improvements as well, other than the South. While the South did not improve, it did hold steady at a solid reading of 69. The Midwest jumped by 5 points and the Northeast also improved to 57. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Morning Lineup — A Break for Rates

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – On Support, Strong Data Day, Economic Surprises Perking Up – 8/15/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, as small caps and US equities on a relative basis test support, we show the massive short interest in copper. After today’s massive slug of economic data, we recap the releases of quarterly productivity and costs, Empire State and Philly Fed indices, industrial production volumes, retail sales, homebuilder sentiment, and finally, the improvement in the Citi Economic Surprise Index.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Sentiment Still Bearish But That’s A Good Sign

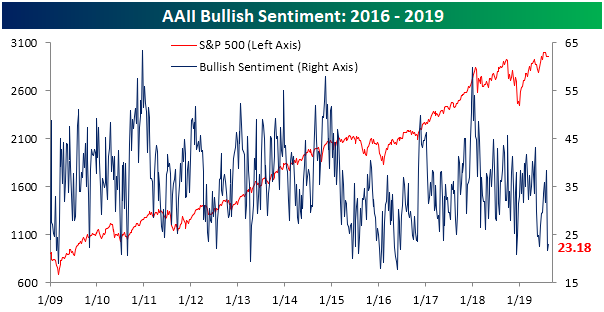

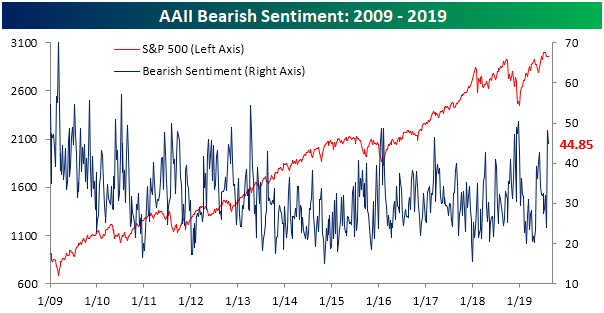

In last Thursday’s Chart of the Day, we noted that AAII‘s sentiment survey saw a sharp bearish turn as the percentage of investors reporting as bears saw the fourth largest increase in the history of the survey. This week, sentiment saw modest improvements but continues to have a bearish bias. Bullish sentiment was up modestly to 23.18% from 21.66% last week. At this level, bullish sentiment is still over a standard deviation below the historical average.

Bearish sentiment saw a larger move declining 3.3% to 44.85%. Like bullish sentiment, this move did little in regards to changing where the sentiment reading sits relative to history. Bearish sentiment remains at an extreme of over 1 standard deviation above the historical average.

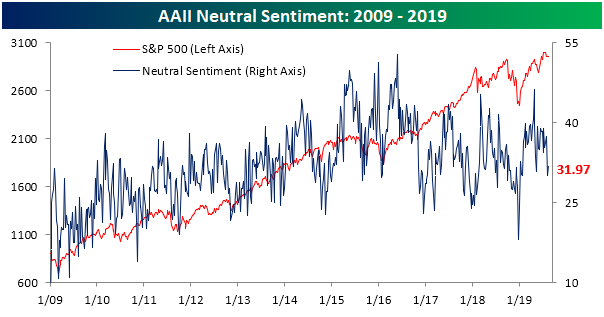

The losses in bearish sentiment did not entirely go to the bullish camp. 31.97% of investors reported neutral sentiment, which was up 1.82% from last week. While this is well below the low end of the past few months’ range, neutral sentiment is now only 0.45 percentage points above its historical average.

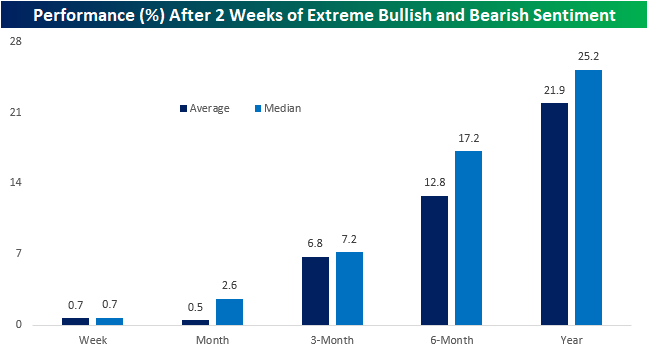

Both bullish and bearish sentiment readings were at a historical extreme (over 1 standard deviation away from the historical average) for the second week in a row. The last time this was observed was during the first week of June after May equity market declines. Typically, these can be taken as a contrarian bullish sign. In the past, there have been 16 other times that bearish sentiment was over 1 standard deviation above its average while bullish sentiment was over 1 standard deviation below its historical average for two consecutive weeks. As shown below, both average and median performance for the S&P 500 have been very strong in the weeks and months after with the S&P 500 moving higher over 80% of the time across each of these periods. Start a two-week free trial to one of Bespoke’s premium memberships to get our best investor research.

We Won’t

Below is a re-post of part of our Closer report (available to Bespoke Institutional members) from August 14th.

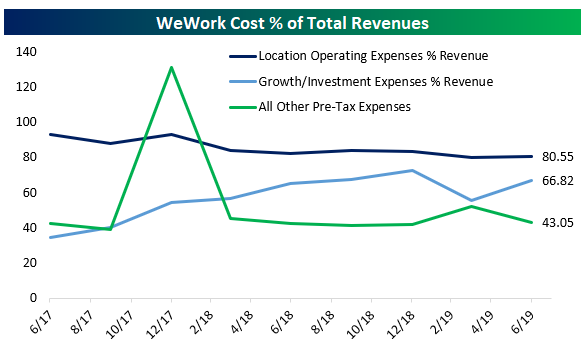

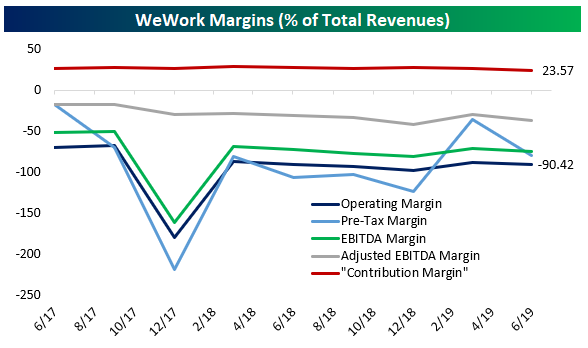

We have not been big fans of most major tech IPOs so far this year. Uber’s IPO (UBER) has been a pretty big failure so far: in addition to pricing at the bottom of its range and way below expectations in the lead-up to marketing, the stock has dropped 25% since. WeWork (WE) looks much worse. The company spends about 80% of total revenues operating its coworking spaces, with two-thirds of revenues going to expenses related to new office openings. Another 43% of revenues go to other pre-tax expenses.

As a result, the company’s pre-tax margin is –79%, with operating margins of –90%! Even adjusted EBITDA margins are hugely negative: -36.8%.

The metric the company claims is its economically relevant performance statistic is “contribution margin” which excludes location start-up costs, non-core operating expense, all sales and marketing costs, all growth/new development investments, all general and administrative expense, all depreciation and amortization, and all stock-based compensation. This is about as close to “earnings before everything” as you can get and is completely ludicrous as a way to judge a business’s costs; we strongly urge readers to evaluate the business by other, more traditional metrics that reflect total costs, growth funding, and liabilities to shareholders.

This analysis of course leaves aside the massive concerns elsewhere in the S1: self-dealing involving properties the CEO owns, possible securities law breaches, hideous financial and legal entity complexity, lease obligations north of $34bn (although a more modest $18.5bn at discounted present value), and an extremely shareholder unfriendly governance structure that concentrates massive power with the CEO. While WeWork (WE) may survive as a company, it contains a massive host of risks that are suitable for only a very narrow range of investors, if anyone; there are many, many companies out there that don’t throw up an almost comical forest of red flags. This analysis was originally published in our nightly Closer report on August 14th. Start a two-week free trial to Bespoke Institutional to access The Closer and the rest of Bespoke’s suite of Institutional products.

Fund Flows Remain Feeble

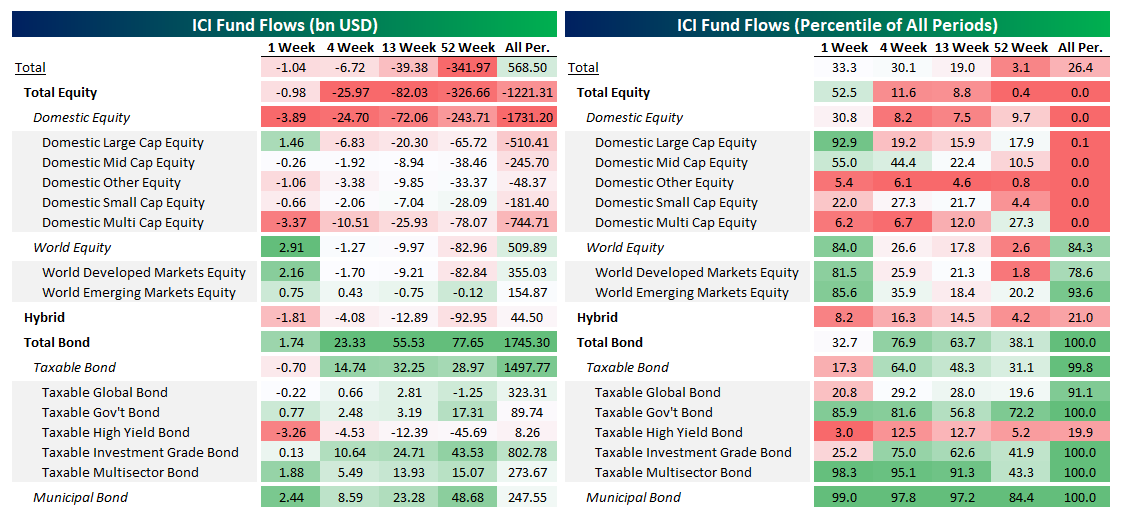

Yesterday, the Investment Company Institute updated its weekly report on the net cash available to mutual funds. These flows of cash in and out of the mutual fund industry have tilted very hard against the equity market in recent months, and that didn’t change much this week. While domestic, large cap equity funds had a pretty decent week ($1.46bn in net buying, larger than 92.9% of weeks since 2007), other categories were extremely weak. Similarly, equity-correlated fixed income in the high yield space saw massive $3.26bn outflows, weaker than 97% of weeks since 2007. Fixed income in general, though, continued to show massive inflows including $2.44bn into municipal bond funds. That’s in the 99th percentile of all periods, while rolling 4 week and 13 week fund flows are in the 97th percentile of all periods. Start a two-week free trial to Bespoke Institutional to access The Closer and the rest of Bespoke’s suite of Institutional products.

Below we show the rolling 13 week fund flows into various types of equity mutual funds since 2007. Only one week since 2015 has seen mutual fund flows into equities positive on a rolling 13 week basis. That’s obviously driven in large part by ETFs stealing market share but even by the standards of the last few years, investor flows into mutual funds have been very, very weak. It’s hard to call market sentiment excessive when retail is so desperately avoiding equity mutual fund allocations.