Trend Analyzer – 8/23/19 – Small Caps Surge

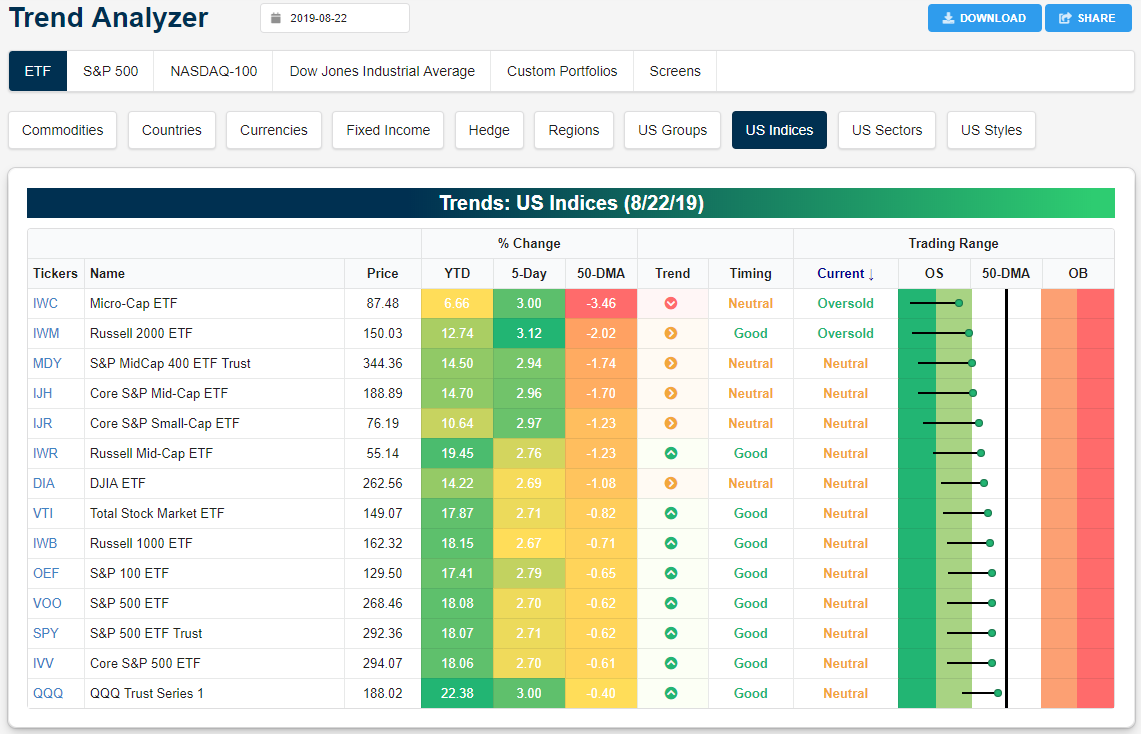

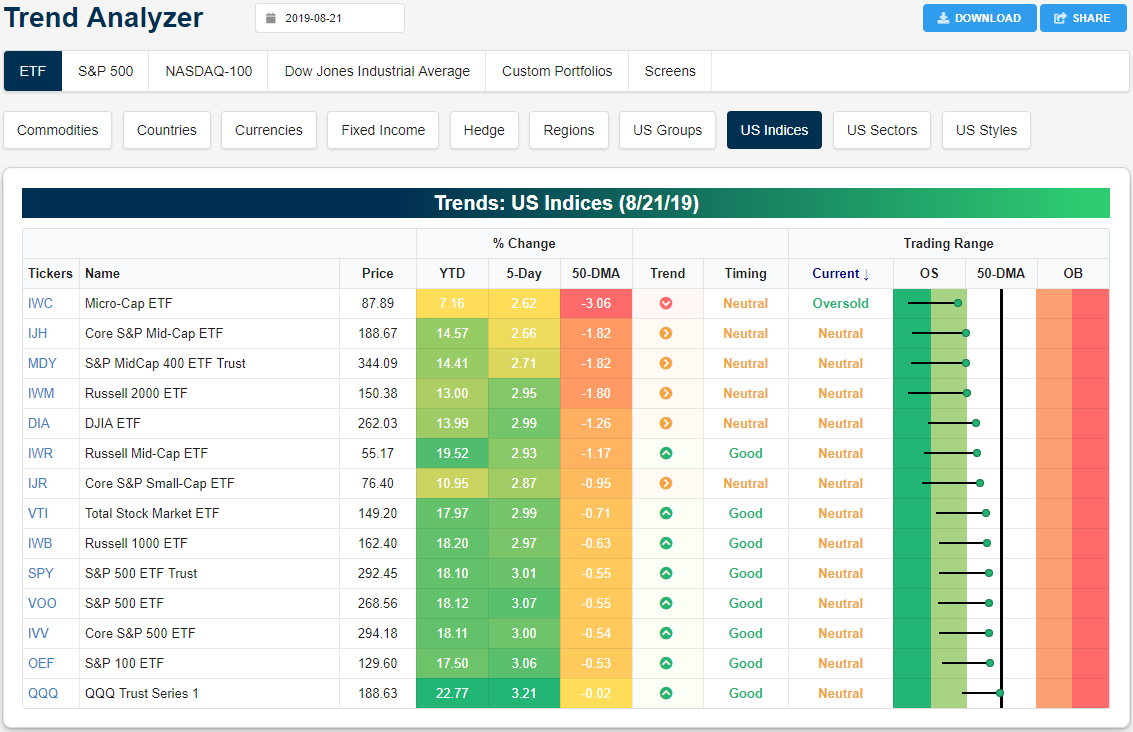

Headed into the end of the week, the overbought/oversold picture of the major index ETFs looks similar to yesterday. Each one remains below their 50-DMA as the majority are also in neutral territory. The only two outliers are the Micro-Cap ETF (IWC) and Russell 2000 (IWM). IWM managed to briefly push out of oversold territory earlier this week but yesterday’s declines brought it back below one standard deviation from its 50-DMA. Each of the small and mid-cap ETFs are similarly teetering between oversold and neutral despite having risen the most this week as a result of a bounce from more extreme oversold levels. Meanwhile, large caps are more firmly in neutral territory. The Nasdaq (QQQ) is closest to its 50-DMA, but yesterday once again failed to close above its 50-DMA.

After their massive rip higher over the past few months, precious metals have begun to see some mean reversion after reaching extreme overbought levels last week. While still overbought, each one is now down roughly 1% or more over the past five days. Oil (USO), on the other hand, has seen a solid move upwards this week but has run up to resistance and is now looking to erase all of these gains and then some this morning. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer and much more.

Bespoke’s Morning Lineup — Trade Headlines Make Another Appearance

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Get Ready For Lower Gas Prices

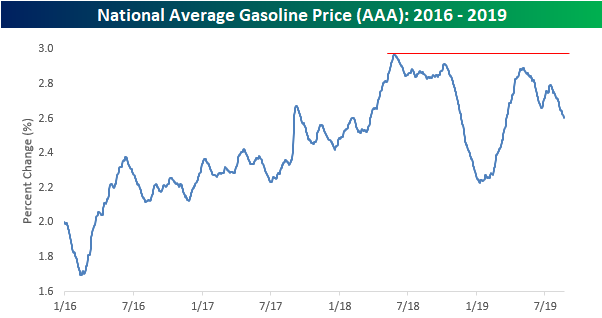

Gas prices have recently declined more than 10% based on the national average price from AAA. After hitting a 2019 peak of $2.90 in early May, we have now seen both a lower high and a lower low, taking prices back to levels last seen back in March. Purely from a chart perspective, the outlook for gas prices doesn’t look positive as the recent trend lower follows a failed rally off the 2018 lows that stalled out just below the high from earlier that year.

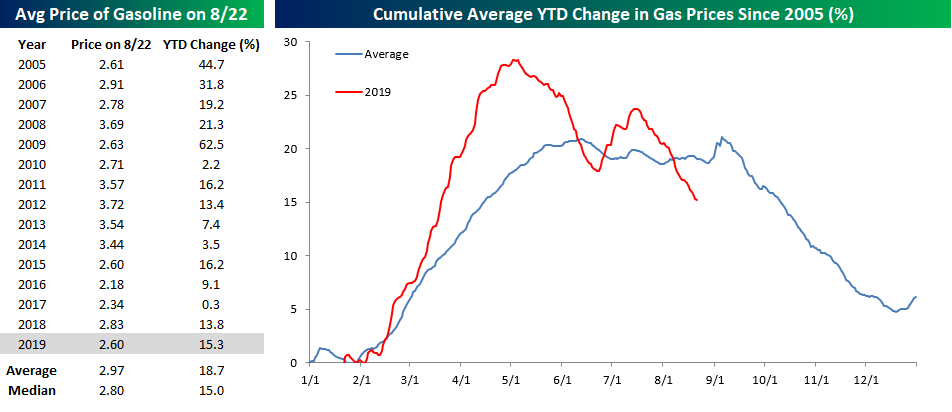

In addition to a weak technical picture for gas prices, seasonal factors are also pointing to lower prices through year-end. As shown in the chart below, when we compare prices so far in 2019 (red line) to a composite of the seasonal pattern going back to 2005 (blue line), this year is following the historical script relatively closely. Prices rallied through early May but then lost momentum heading into the summer driving season. Normally, prices peak around Memorial Day and basically move sideways with a downside bias during the summer. This year, though, the move higher to start the year was much stronger than average, while the summer drift lower had more momentum behind it as well. If the pattern continues to hold for the final four months of 2019, expect prices to keep falling. Going back to 2005, gas prices have experienced a median decline of 9.8% from 8/22 through year-end with positive returns just 35% of the time. That’s a move that would provide another boost to an already strong consumer. Start a two-week free trial to Bespoke Institutional to access our interactive Chart Scanner and much more.

The Closer – Retail Rally, Manufacturing Miss, Leading Indicator, TIPS and Rates – 8/22/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, as retail stocks surge, we show just how rare the move for the industry is and what it could mean going forward. Next, we review some of the disappointing manufacturing data released today before turning to some more positive economic data shown in the Conference Board’s Leading Indicator. We finish with a recap of today’s strong 30-year TIPS reopening and what has been driving rates recently.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Adapt or Die

A common characteristic of most investors and traders is to always be on the lookout for patterns and connections between various asset classes. Whenever one correlated asset confirms the move in another it adds a layer of confidence to an investor’s thesis. One long-held example is the Dow Transports as a leading or coincident indicator for the broader market. For decades now, many investors have followed the transports for confirmation of the broader market moves. If the transports — which move all of the physical goods in the economy — rally, it suggests that the broader market will be strong, while periods when the transports start to roll over are read as a signal that there’s an underlying weakness in the economy.

As the US economy has become more service and digital-oriented in nature, there has been a valid argument made that the transports have lost some of their importance as an indicator of the broader economy. Along these lines, we have suggested that rather than transports, semiconductors may represent this century’s ‘transports’ as they are a part of just about everything in this digital age. Whether you agree with this or not isn’t important, but the important takeaway is that just because two asset classes have been highly correlated in the past doesn’t mean that they will remain that way in the future. It’s one thing to recognize a correlation between two asset classes, but it’s much more important to understand why they are correlated and be on the lookout for factors that may change the status quo in the future.

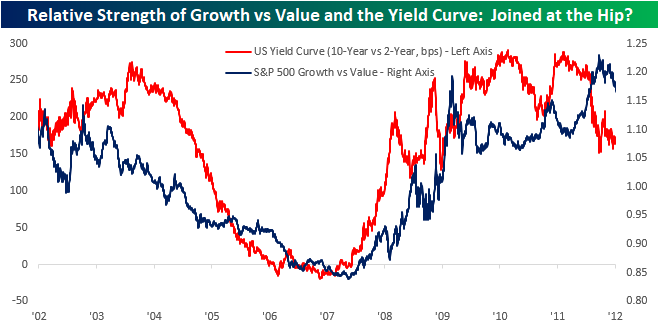

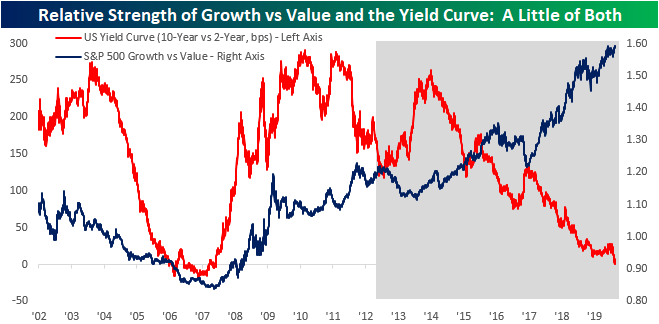

One example of a radical change in a relationship between two asset classes is the interaction between the relative strength of growth and value stocks versus the slope of the yield curve. From 2002 through 2011, the two were closely correlated. As the curve flattened in the early part of this century, growth stocks underperformed value by a wide margin (falling blue line). Then in mid-2007, as the curve steepened and came out from inverted territory, growth stocks started to rip higher relative to value. Beginning in 2009, though, the curve stopped steepening and the relative strength of growth relative to value stalled out. The two series were so closely joined at the hip during this ten-year stretch that the correlation coefficient between the two was +0.82, which is indicative of two series moving in lockstep with each other.

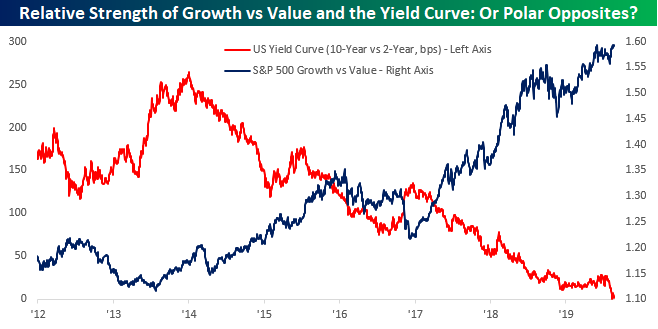

If the paths of the yield curve and the relative strength of growth versus value couldn’t be separated from 2002 through 2011, the relationship soured in 2012 when the two came down with a case of the ten-year itch. At that point, they couldn’t separate fast enough. The chart below shows the same two series from the start of 2012 through the present. Now, when one goes up the other goes down and vice versa, as the paths are nearly exact opposites. In fact, in the nearly eight years since 2012, the correlation between the two is -0.90.

In the chart below we have shown the two series over the entire time period spanning 2002 through 2019. The non-shaded area represents the period covered in the first chart, while the shaded area covers the second period. Right around the time where the shaded period starts is when the positive correlation turned on a dime, and beginning in 2013 when the curve started to flatten, investors who were still hanging on to the idea that a flatter yield curve was a green light for value stocks, saw what turned out to be an extended period of misery relative to the performance of growth stocks. In the words of Intel Founder Andy Grove, “Adapt or Die.” Start a two-week free trial to Bespoke Institutional to access our interactive Chart Scanner and much more.

S&P 500 Stocks Breaking Out

Over the past few sessions, the S&P 500 has been sitting in the upper end of this month’s range. It will still take a bit more work from the bulls to help break the index out of this range and even more work to move back to previous all-time highs. As for some of the individual stocks within the index, today we want to highlight some recent breakouts or potential breakouts.

Unlike the broader S&P, most of the stocks shown below have entirely recovered recent losses and are now in the process of breaking out to new highs. Such is the case for Accenture (ACN), ANSYS (ANSS), Celanese (CE), Home Depot (HD), HLA Tencor (KLAC), and Tyson Foods (TSN). For some others like Norwegian Cruise Line (NCLH) and QUALCOMM (QCOM), the breakout is instead from a downtrend.

The breakout for HD is perhaps the most recent development following the stock’s surge in response to earnings earlier this week. Similarly, TSN had been stuck under resistance around $83 since May, but a positive reaction to earnings on August 5th was just the catalyst needed for the stock to break out. After a mild pullback in the middle of this month, TSN is beginning to make its push higher again.

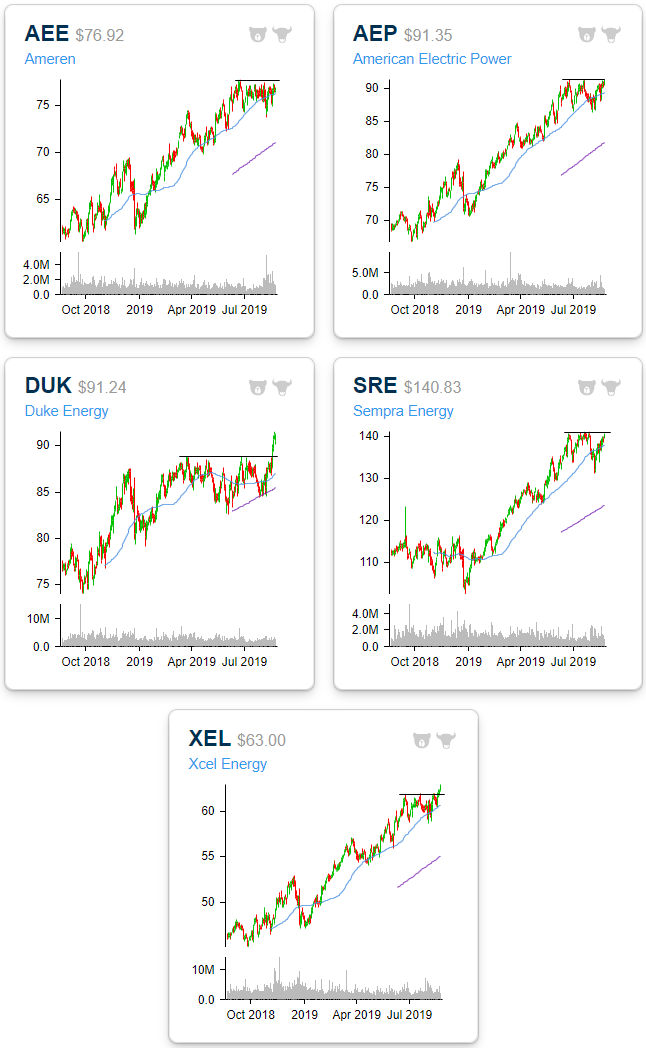

While the overall sector is currently the most extended at over 2 standard deviations above its 50-DMA, the Utilities sector (XLU) notably has a significant number of stocks eyeing a breakout. Many of these have been in strong uptrends throughout the past year but have taken a pause since June. After rebounding off of early August lows, these stocks have come back up to these June resistance levels. Xcel Energy (XEL) has already broken out and if XEL and the rest follow the script of Duke Energy (DUK), there is further upside for these stocks. Start a two-week free trial to Bespoke Institutional to access our interactive Chart Scanner and much more.

Positive Sentiment Grinds Higher

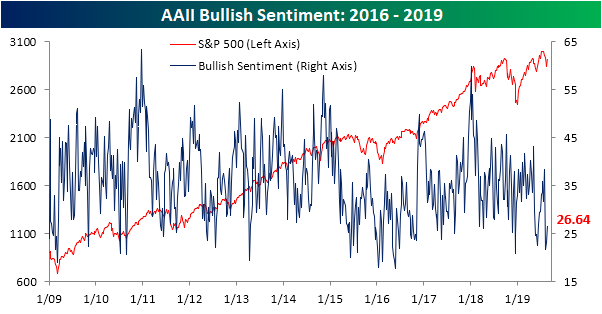

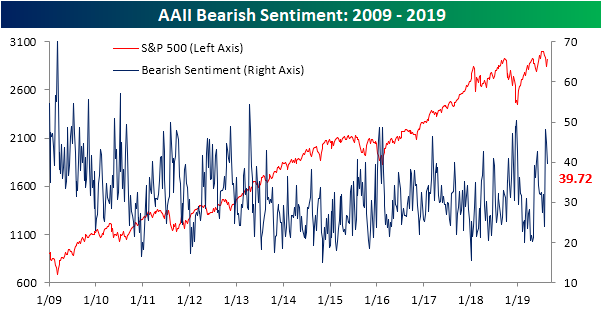

Even though the S&P 500 is up around 3% from last week, all the volatility has helped to keep a lid on optimism. This week’s AAII survey showed a second straight weekly increase in positive sentiment with 26.64% of investors reporting as bullish. Although it is off the lows of 21.6% from the first week in August, bullish sentiment remains more than one standard deviation below its historical average.

Bearish sentiment, on the other hand, has fallen more considerably from its more extreme reading at the beginning of the month. Down 8.5 percentage points from this recent high, bearish sentiment is now at 39.72%. With a decline of just over 5 percentage points from last week, bearish sentiment is still above its historical average of 30.35% but it is also in more of a normal range (unlike bullish sentiment, bearish sentiment is under one standard deviation from this average).

As investors exit the bearish camp, they are more or less cautiously optimistic. As such, neutral sentiment has been on the rise over the past two weeks, and it is now at 33.64%. That is slightly above its historical average. Even though it has been making its way higher, neutral sentiment is also still well below the range of the mid to upper 30’s that it was in for most of 2019. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Claims Edge Towards The 2019 Low

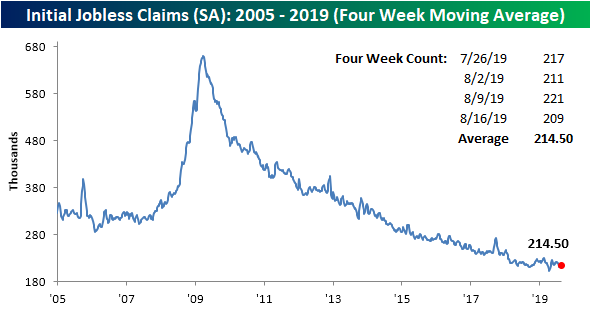

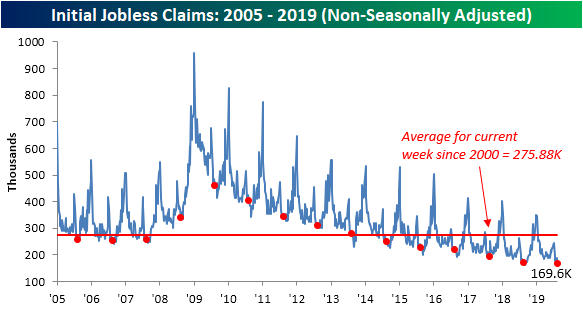

Last week’s reading on initial jobless claims came in at 220K (revised up to 221K) which was above the past several weeks’ range. This week’s claims data fell back to the opposite end of this range with a 209K print. This handily beat expectations of a drop to only 216K and was the largest one-week decline in claims since the first week of July when it fell by 14K. As per usual lately, although this does not mark any new low, it is still a healthy reading. Seasonally adjusted claims have now remained at or below 300K for a total of 233 consecutive weeks and at or below 250K for 98 weeks.

The move in the four-week moving average for claims, which helps to smooth out the fluctuations of the high-frequency indicator, was unexciting this week with a tiny 0.5K increase from last week. While the increases have been small, this week marked the third straight week that the moving average has moved higher. So far in 2019, there have been three other streaks like this with each one ending at the fourth week.

Non-seasonally adjusted claims came in at 169.9K this week, which is over 17K below last week’s number. For the current week of the year, this was the largest week-over-week drop in claims in five years when it fell by 20K in 2014. This was also the lowest number for the NSA data for the current week of the year (33rd week) of the cycle. This week’s NSA print was also 3.7K lower than the comparable week last year.

We must also note that over the coming weeks due to seasonal patterns, claims typically see their lowest levels of the year (usually in the final week of August or the first week of September). Start a two-week free trial to Bespoke Premium.

Trend Analyzer – 8/22/19 – Overbought/Oversold See-Saw

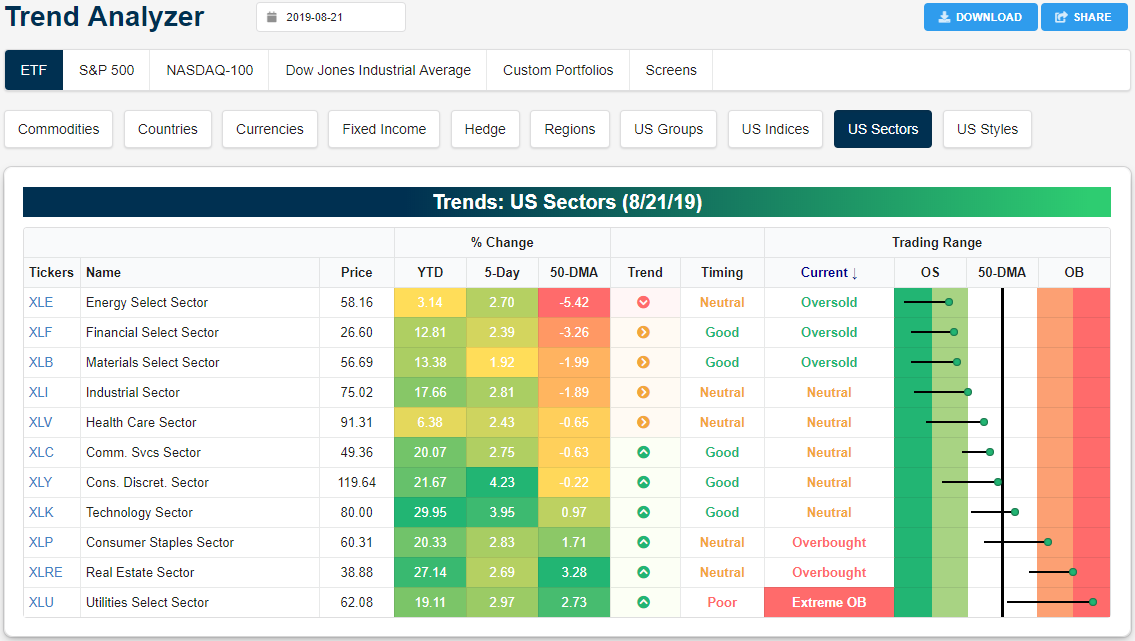

Major US index ETFs have seen a major bounce off of oversold levels over the last week. You can see the big jump in the snapshot from our Trend Analyzer tool below. Even with gains of 2-3% across the board over the last week, however, all of the ETFs shown remain below their 50-day moving averages. Bulls still have work to do to put the onus back on the bears.

As stocks sit higher versus last week, defensives are once again overbought with Utilities (XLU) at extreme levels and Real Estate (XLRE) not far behind. Along with Technology (XLK), these ETFs are the only ones that are currently above the 50-DMA. Meanwhile, more cyclical sectors like Energy (XLE), Financials (XLF), and Materials (XLB) all remain oversold. Granted, as with the small and mid-caps above, these three ETFs in addition to Industrials (XLI) and Health Care (XLV) were sitting at extreme oversold levels this time last week. Start a two-week free trial to Bespoke Premium to gain access to our popular Trend Analyzer tool and much more.

Bespoke’s Morning Lineup — More Retail Rallies

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.