Bespoke’s Morning Lineup — Drifting Higher

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Copper, Curve, Mortgage Rates, Sector Valuation, Manufacturing – 8/26/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at copper’s 52-week low as the 2s10s curve made new flats for the cycle. We also show the lag in the drop in mortgage rates compared to bond yields. Next, we show just how much investors have flocked to defensive sectors this year before finishing with a review of today’s manufacturing data including durable goods and our Five Fed Manufacturing Composite.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Battle of the Dow 30 Pharmas — PFE vs. MRK

Pfizer (PFE) and Merck (MRK) have been the two pure pharmaceutical plays in the Dow Jones Industrial Average since PFE was added to the index in April 2004 (MRK was added in 1979). Over the years, these two Health Care behemoths have trended mostly inline with each other, as the correlation between their daily prices going back to 1980 is 0.96. Every now and then, however, the two diverge as has been the case recently.

Below is a price chart of Pfizer (PFE) since 1980 with special focus on the last five years. As you can see, the stock trended higher from 2014 through late 2018, but this year it has struggled, especially recently as the company lowered guidance at the end of July and announced a deal to combine its Upjohn business with Mylan (MYL). To many analysts in the sector, the terms of the deal with MYL seemed to be expensive for PFE. As of today, PFE is down 20% year-to-date.

Merck (MRK), on the other hand, has had a great 2019 (up 12% YTD) and is finally approaching its all-time closing high of $89.80 reached on November 29th, 2000.

Below is a chart showing the ratio between PFE’s share price and MRK’s share price since 2000. (Both of these stocks last split in 1999.) When the line is rising, PFE’s share price is outperforming MRK’s share price and vice versa. You can see that since 2008, the ratio has traded back and forth between 0.4 and 0.7. PFE’s recent underperformance has left the ratio at the very bottom of the range over the last 10+ years.

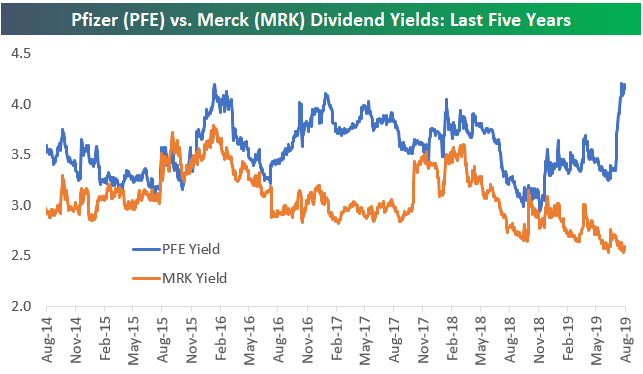

Both of these blue-chip pharmas are big dividend stocks, but along with price their dividend yields have started moving in opposite directions. PFE last upped its dividend in December 2018 right as its stock price was peaking. With its share price down 20% YTD, PFE’s dividend yield has shot up to 4.16%. Merck (MRK) last hiked its dividend in July 2018, and while that caused its yield to move above 3% for a short period of time, the rise in its share price has left it with a yield of just 2.57% at the moment.

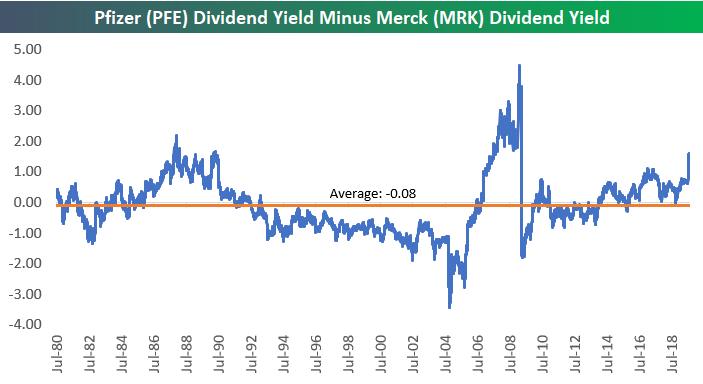

Since 1980, the average spread between PFE’s dividend yield and MRK’s dividend yield has been extremely close at just -0.08 percentage points. As shown below, the current spread of 1.59 ppts is as high as it has been in more than ten years. Start a two-week free trial to Bespoke Premium for more of Bespoke’s actionable equity market research.

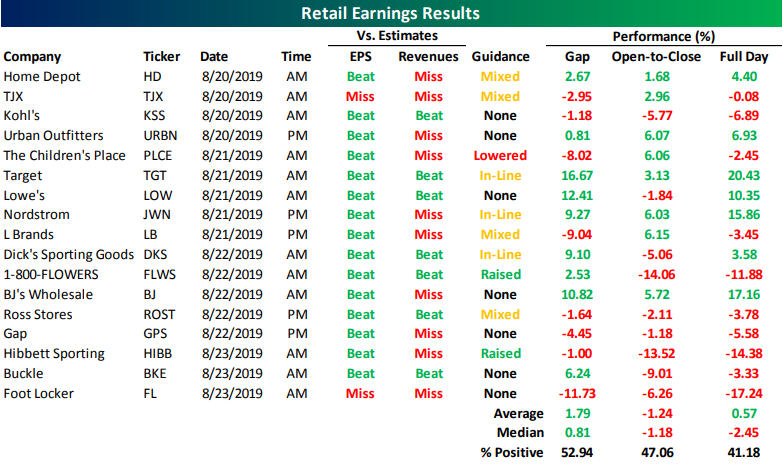

Retail Earnings Still in Focus

As we made note of in Friday’s Bespoke Report, retailers were one of the highlights last week as stocks like Target (TGT) and BJ’s Wholesale (BJ) saw some of their best reaction to earnings in their histories. Despite large gains for some retailers, Friday declines weighed heavy on the average performance of these stocks. Not a single one that reported Thursday night or Friday morning was positive in response to earnings.

Bottom line beat rates were solid as 88% of retailers that reported last week surpassed estimates. Only TJX (TJX) and Foot Locker (FL) missed on EPS. Revenues, on the other hand, were a bit weaker as less than half beat. For comparison, the rolling 3-month revenue beat rate for all stocks from our Earnings Explorer is 57.49%. Guidance also left something to be desired as only two of the ten companies giving any guidance raised forecasts. Ironically, those two that raised guidance—1-800-FLOWERS (FLWS) and Hibbett Sporting (HIBB)—both fell more than 10% on their reaction days!

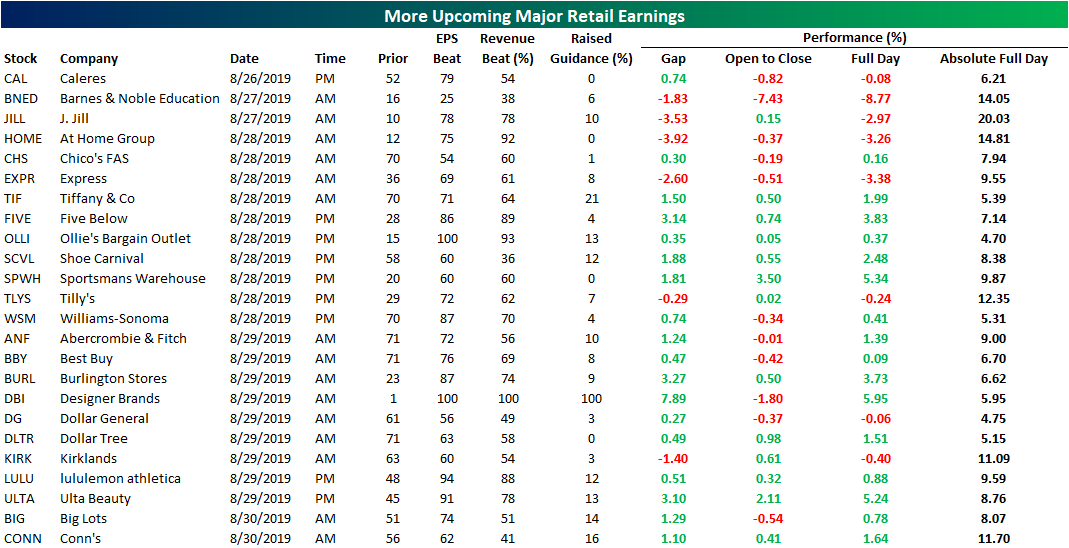

This week, retail continues to dominate the earnings calendar with 24 retail stocks reporting second-quarter results. Some notables include luxury retailer Tiffany & Co (TIF) and, on the other end of the spectrum, dollar stores like Dollar General (DG) and Dollar Tree (DLTR). Two-thirds of the stocks reporting this week have averaged a full day gain in response to earnings. Some of the most volatile of these in either direction are Barnes & Noble Education (BNED), J. Jill (JILL), and At Home (HOME) which have averaged absolute moves of over 14%. Bespoke Institutional members can view these stocks’ earnings history and stock reaction in response using our Earnings Explorer tool.

Mixed Fortunes in Consumer Discretionary

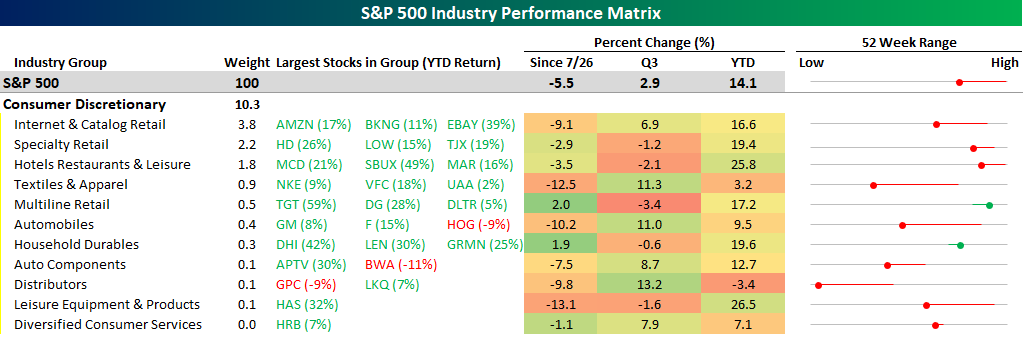

Since the S&P 500’s closing high in late July, most industries in the index have seen declines. Of the 60+ active industries, just ten are up since the close on 7/26, and only one (Construction Materials) is up over 5%. On the downside, eleven industries are down over 10%, including Energy Equipment and Services which is down 19%!

Among the 11 major sectors, one where there has been disparate performance among the individual industries within it is Consumer Discretionary. The graphic below shows each of the industries within the Consumer Discretionary sector, their overall weight in the S&P 500, the performance of the largest stocks in each industry, a performance summary, and then a snapshot of where each industry is trading with respect to its 52-week range (red or green circle) and where it was trading on the day of the S&P 500’s peak.

While the Consumer Discretionary sector remains in the upper end of its one-year range after trading near 52-week highs back in late July, individual industries are all over the map with respect to their 52-week ranges. For starters, Distributors, which is a very small industry, is trading right near 52-week lows. Similarly, another three industries (Textiles, Auto Components, and Autos) are in the lower half of their one-year ranges. Outside of these four industries, the remaining seven are all in the upper half of their 52-week range, and two are even up since the S&P 500 peaked in late July. As shown in the graphic, Multiline Retail has rallied 2% since late July and is trading closer to the high end of its 52-week range than any other industry in the sector. Who would have thought a couple of months ago that Multiline Retail would be a leading industry in the sector? But that’s what happens when a stock like Target (TGT), which is the largest stock in the industry, rallies 20% on earnings.

Behind Multiline Retail, the only other industry in the sector that is up since 7/26 is Household Durables, and that group’s strength has been driven by homebuilding stocks which have benefited from extremely low-interest rates and better affordability. Start a two-week free trial to Bespoke Institutional to access our interactive Security Analysis tool and much more.

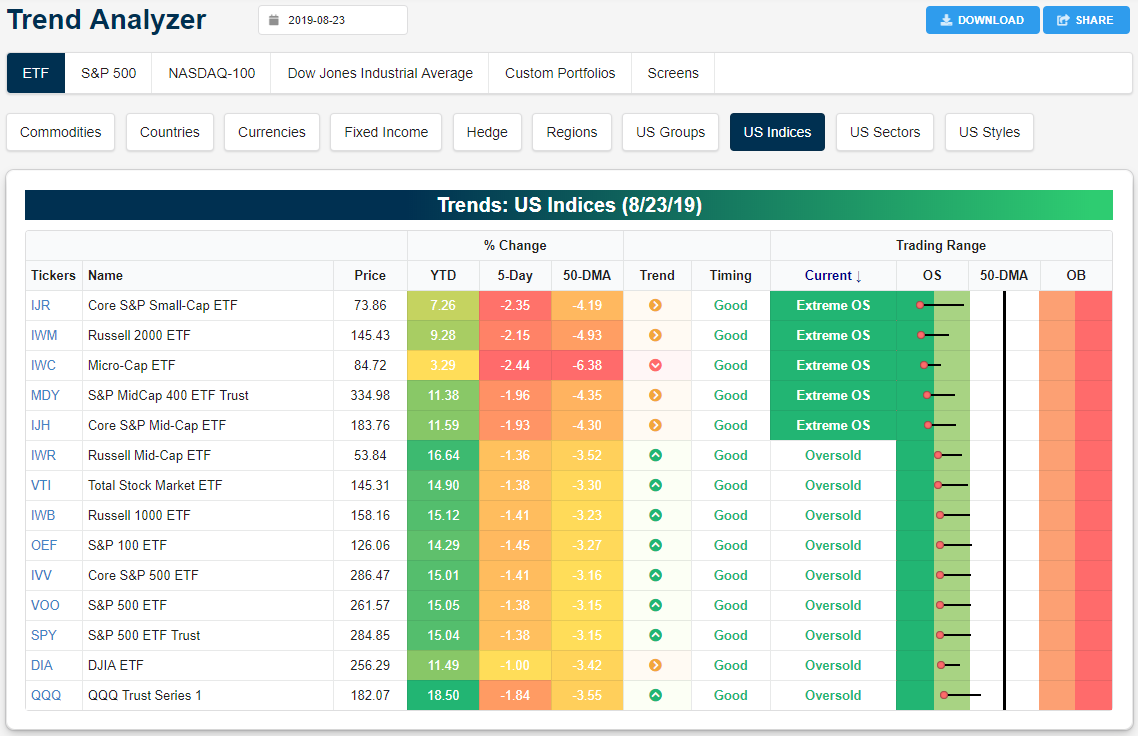

Trend Analyzer – 8/26/19 – No Longer Neutral

The major US indices initially headed into Friday looking to close out the week higher, but a series of tweets from the President sent stocks into a tailspin leading the indices to finish down on the week. These losses led the major index ETFs in our Trend Analyzer to finish the week solidly in oversold territory. Small and Mid-caps fell even more dramatically and are now over 2 standard deviations below their 50-days.

Taking a look across the chart patterns of these same ETFs in our Chart Scanner tool, each one has been range-bound over the past month after falling off of prior highs. Large caps have been trading between their 50 and 200-day moving averages. Small and mid-caps, on the other hand, have fallen below both of these moving averages. Furthermore, small-caps came the closest to falling out of this range on the steep declines on Friday. For example, the Micro-Cap ETF (IWC) has not taken out the intraday and range low of $84.58 from August 15th, but Friday did mark the lowest close of this period at $84.72. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer, Chart Scanner, and much more.

Bespoke’s Morning Lineup — Tweet-nical Analysis

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Bespoke Report — 8/23/19

This week’s Bespoke Report newsletter is now available for members.

In this week’s newsletter, we look at a big week for retail earnings, more market volatility, housing numbers, and much more. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

The Closer: End of Week Charts — 8/23/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!

Crude Oil’s Descending Triangle

Earlier this week, crude oil was trading well over 2% higher than last Friday’s close. Over the past few sessions, though, oil has given up all of those gains. The catalyst for today’s declines are the Chinese retaliatory tariffs on US crude which are expected to dampen demand. This week’s negative reversal comes as the commodity ran into multiple points of resistance. For starters, the rally began to stall out mid-week when it met the converging 200 and 50-day moving averages. This also coincided with a downtrend that traces itself all the way back to the highs from late last year. In fact, crude is down around 30% from these previous highs.

Overall, the technical picture for crude oil is not in a great place as the chart is forming a descending triangle pattern. Despite the big gains at the beginning of 2019, over the past few months, crude has been making consistent lower highs and lower lows. Given this most recent failure to retake the moving averages and break out of the downtrend, the next major support level to watch is around $50 which is a level that has held up at multiple times in the past few months. This support also draws back to late last year prior to the collapse in December. Start a two-week free trial to Bespoke Institutional to access our interactive Security Analysis tool and much more.