What’s Driven the S&P 500?

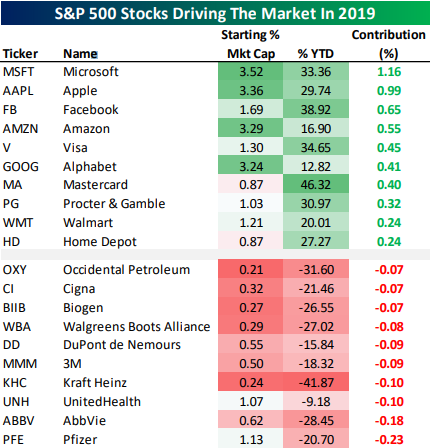

In last night’s Closer, we showed the biggest contributors to the S&P 500’s gain so far in 2019 as well as the stocks that have weighed on the index the most. Given the S&P’s 14% YTD gain, it’s probably not surprising to hear that only one stock in the entire S&P 500 has weighed on the total index performance by at least 20 bps: Pfizer (PFE). On the other hand, 11 different stocks have added at least 20 bps to total index performance in 2019. We show the 10 best and worst-performing stocks this year by the overall contribution to the S&P 500’s performance in the table below. As shown, mega-cap Tech like Microsoft (MSFT) and four of the five FAANG names have been the biggest contributors. When you add them all up, they’ve accounted for roughly 26% of the S&P’s gain this year. Two credit card companies — Mastercard (MA) and Visa (V), and two retailers — Walmart (WMT) and Home Depot (HD) — have also been big contributors to gains.

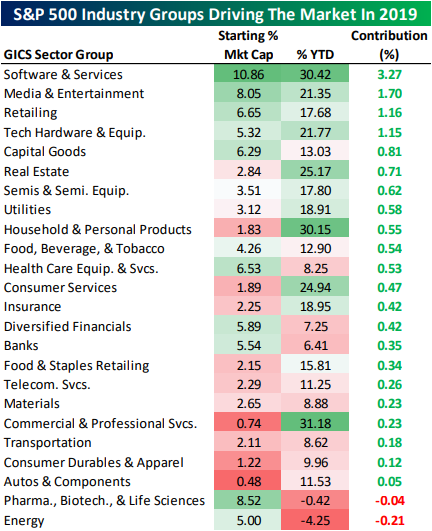

At the industry group level, health care stocks related to Pharmaceuticals, Biotech, and Life Sciences are one of only two industry groups to weigh on S&P 500 performance this year. Energy is the other standout with a 4% decline. Software & Services is the best performer, driving 3.3 percentage points of the S&P’s 14% gain this year. Media & Entertainment, Retail which includes Amazon (AMZN), and tech Hardware are the only other groups that have added at least 1% to the total 14.46% gain for the S&P 500 so far in 2019.

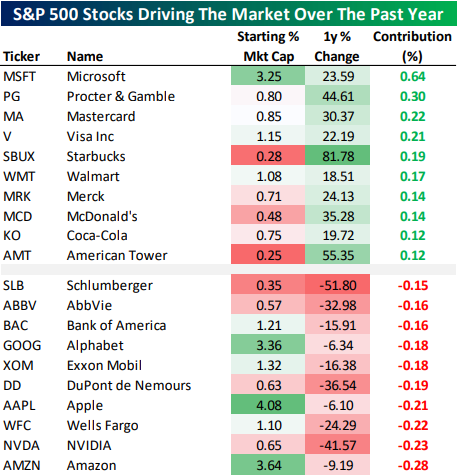

While YTD numbers look really great, things are not so hot versus this time last year; the S&P 500 is actually slightly lower year-over-year. As a result, the gap between the contribution of gainers and those of decliners is much narrower. Only four stocks drove a gain of at least 20 bps for the headline index over the past year: Microsoft (MSFT), Procter & Gamble (PG), Mastercard (MA), and Visa (V).

We note that the top ten gainers are almost exclusively very blue-chip stocks: large tech companies, credit card networks, and some consumer names. Only the cell phone tower REIT American Tower (AMT) is unusual in this list of big-cap, well-known stocks. Losers are concentrated in Health Care, Banks, and Tech.

While Alphabet (GOOG), Apple (AAPL), and Amazon (AMZN) aren’t down drastically versus last summer, their market caps are big enough to have cost a lot of performance for the S&P 500’s overall performance. Smaller cap stocks like NVIDIA (NVDA), DuPont (DD), AbbVie (ABBV), and Schlumberger (SLB) are a verry different story.

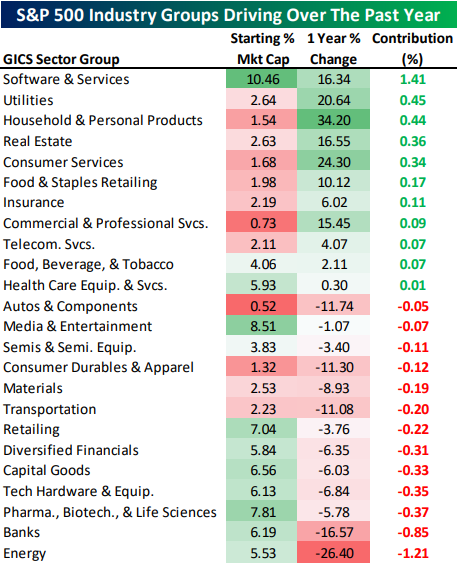

At the industry group level, there have been more decliners than gainers, though only Energy and Banks have cost the index more than 80 bps; on the flip side only Software has been a greater than 80 bps gainer. Defensive industry groups like Utilities, Household & Personal Products, and Real Estate have all driven the S&P 500 higher while cyclical industry groups like Capital Goods and Tech Hardware have weighed. Start a two-week free trial to one of Bespoke’s premium research services.

This Isn’t Normal

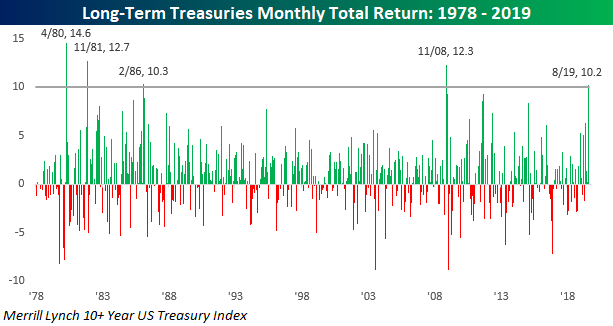

Being long bonds these days probably feels like being long tech stocks in the late 1990s. Every day you look at your portfolio, you expect it to be higher than the last time. This month through yesterday, the Merrill Lynch 10+ Year US Treasury Index is up over 10% and that doesn’t even include the rally we are seeing today. If the gains we have seen so far hold up into month-end, it will go down as just the 5th month since 1978 that long-term treasuries gained more than 10% in a single month. The last time we saw this large of a move in the long-term Treasury market was more than 10 years ago in November 2008, and before that you have to go all the way back to February 1986. In other words, this kind of move isn’t normal.

Besides the fact that long-term Treasuries are up over 10% this month, August marks the fourth straight month of gains for the asset class, and while that may not sound like much, the last time we saw a streak of four or more months of gains was in January 2015. With all these gains, the Merrill Lynch 10+ Year Treasury Index is up over 22% YTD. 22%! Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorer, Triple Plays, and much more.

Bespoke’s Global Macro Dashboard — 8/28/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Trend Analyzer – 8/28/19 – Damage Done to Small Caps

Stocks remain oversold with small and mid-caps once again tipping into extreme oversold territory. Recent price action in the equity market has done the most damage to small caps. Despite breaking into neutral territory just over a week ago, the Core S&P Small-Cap ETF (IJR) has become the most oversold with a 2.88% decline over the last five trading sessions. The Russell 2000 (IWM) has seen equally large losses which have resulted in its trend to shift from ‘sideways’ to ‘down’ in our Trend Analyzer. The Micro-Cap ETF (IWC) is also in a downtrend and has fallen the most in the past week. Although most of the major index ETFs are still up by double-digit percentages in 2019, the same cannot be said for small caps. IWM’s 8.84% YTD gain is the best among small caps while IWC is only up 2.82% YTD.

In the commodities space, only precious metals have managed to edge out any sort of gain in the past week as gold and silver ETFs sit over 2% higher. Silver has outperformed much more dramatically, rising 6.11%. Despite this recent outperformance, SLV is still slightly lagging behind gold in terms of YTD performance, even if it extended in the short-term. Currently, SLV is 12.53% and more than two standard deviations above its 50-day. Both Gold Shares (GLD) and DB Precious Metals (DBP) are also extremely overbought while the DB Gold Fund (DGL) and the Gold Trust (IAU) just a hair below extreme overbought territory. Oil (USO) has taken it on the chin the past week after failing a test of its 50-DMA. Over the past five days, it is down 1.81%. Along with most other commodity ETFs in our Trend Analyzer, oil is in a long term downtrend while the aforementioned precious metals ETFs and Agribusiness ETF (MOO) are in uptrends. Only MOO has a good timing score given this uptrend in combination with its oversold levels. Start a two-week free trial to Bespoke Institutional to access our interactive Trend Analyzer and much more.

Bespoke’s Morning Lineup – Quietly Lower

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Stocks Driving The Market, Home Prices, Labor Over Capital – 8/27/19

Log-in here if you’re a member with access to the Closer.

As a quick programming note, tune in to see Bespoke’s Paul Hickey on CNBC’s Squawk Box tomorrow morning at 7 AM ET.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we take a look at the S&P 500 stocks that have been the biggest contributors to the S&P 500’s gains so far in 2019. We also look at the stocks that have driven the index the most over the past 12 months. Finally, we take a look at today’s economic data releases that were centered around housing and manufacturing.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Anaplan (PLAN) Still Flawless on Earnings

Anaplan (PLAN) now has four earnings reports under its belt as a public company, and it is setting a high standard for itself with a triple play in each of these quarters! Its most recent quarterly release came this morning, and while EPS was still negative at -$0.12, it beat analyst estimates. Revenues also beat, growing at a solid clip of 46.2% YoY. The company also raised guidance for the fourth time in a row.

In terms of stock price reaction to earnings, PLAN has usually been very strong rising over 10% each time with last quarter’s 18.22% gain being the best of these. Today is bucking that trend though as the stock gapped down 3.82% at the open even after its triple play. It traded as low as -8% on the day later in the morning, but it has seen buying this afternoon and is now down just 3% on the day. PLAN has been in a solid uptrend since its IPO but has been moving sideways in the month leading up to this report. Yesterday’s intraday high tested resistance at the previous high around $60, but with the stock failing to react positively to earnings today, it has yet to break out higher. We’ll be monitoring this one to see if it can report its 5th triple play in a row three months from now! Start a two-week free trial to Bespoke Institutional to access our interactive Earnings Explorer, Triple Plays, and much more.

Richmond Rebounds

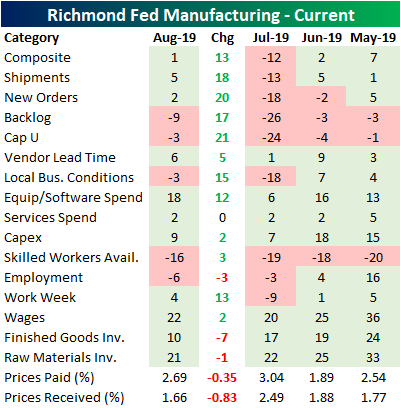

The Richmond Fed’s business condition surveys saw a dramatic rebound in August after July’s composite release came in at the lowest level since the financial crisis. The composite reading for current manufacturing conditions rose 13 points and came back into positive territory this month. This was thanks to strong breadth among the individual components as two-thirds improved with big pickups in shipments, new orders, backlogs, capacity utilization, local business conditions, equipment spending, and average workweek. Last month also saw half of these components come in with negative readings, but now only five are showing contraction. Notably, the employment component has fallen further after it turned negative last month for the first time since 2016. This is as businesses continue to struggle to find skilled workers.Start a two-week free trial to Bespoke Institutional now to see how the Richmond Fed data impacts our tracking of manufacturing activity across the whole country in The Closer tonight.

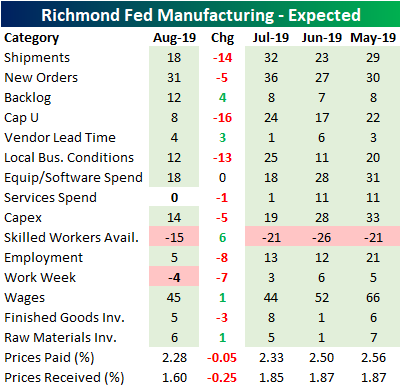

While current conditions improved dramatically, expectations six months out actually came in weaker. Only 29% of the components saw an improvement from June as many saw the opposite change from their current condition counterpart. For example, although shipments, new orders, capacity utilization, local conditions, and average work week all saw sizable gains in current conditions, the outlook for these components have simultaneously worsened. Companies are also expecting prices paid and received to fall further. Meanwhile, despite falling rates and the Fed’s cut last month, current conditions for capex remains subdued compared to where it has stood over the past year and expectations are not looking like there will be any pick up either. It is a similar story for equipment and software spending, although current conditions for this component is in better shape.

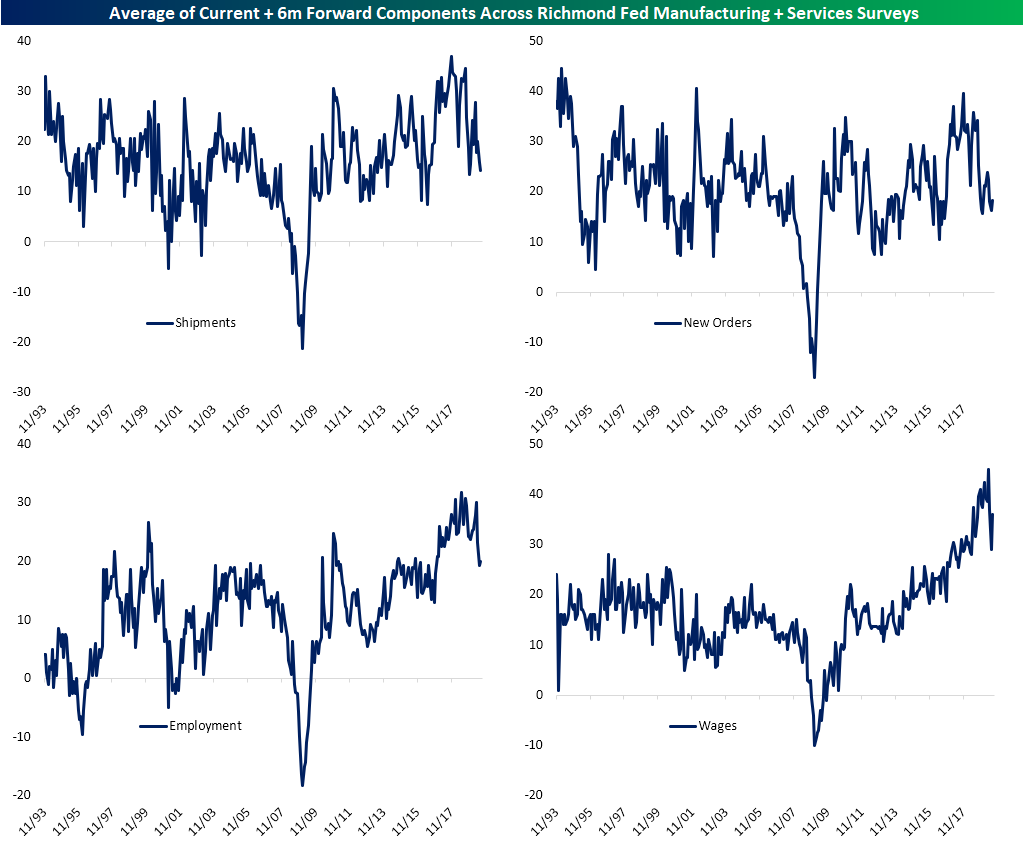

Looking at the averages of the current and forward-looking components for both the manufacturing and service surveys, business conditions, while not disastrous, have somewhat deteriorated over the past few months. Shipments have fallen for two straight months to the lowest level since last December. New orders are similarly at the lower end of its range, although it did improve marginally for the first time in three months in August. The indices for employment have been the real kicker. This has been nearly cut in half since April even with a small pickup this month. On average, employment indices are at their weakest level since late 2016 while wages have recovered a portion of their recent drop.

City-by-City Home Price Update — S&P Case Shiller

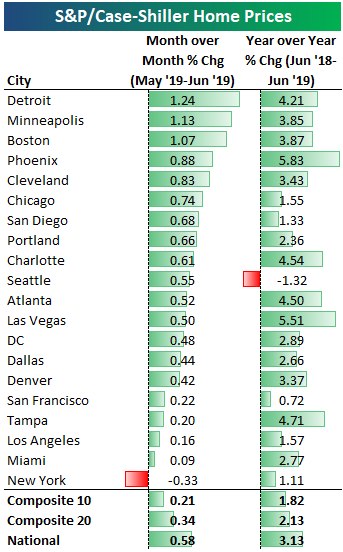

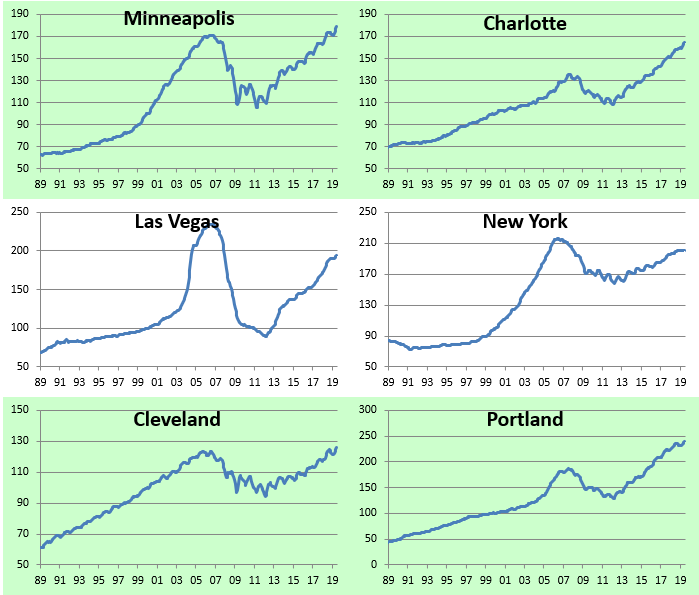

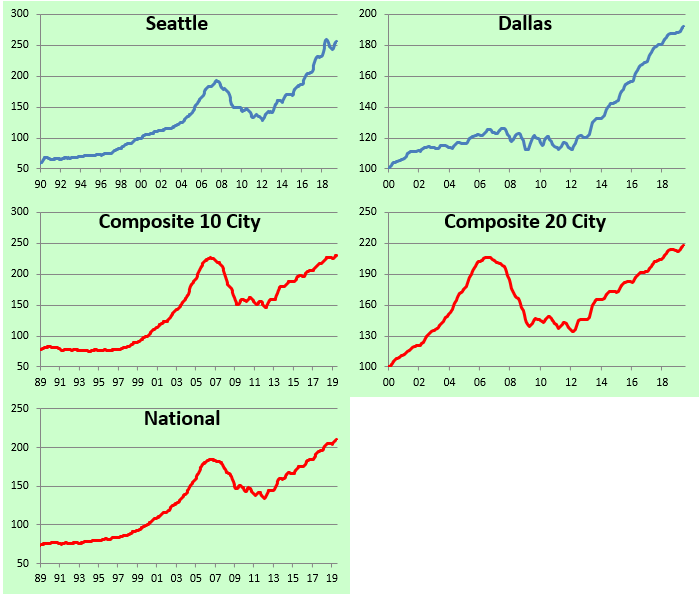

Below is an updated look at home price changes across the 20 cities tracked by S&P/CoreLogic’s Case Shiller indices. Detroit, Minneapolis, and Boston were the hottest areas for home prices on a month-over-month basis in June. All three areas saw prices increase by more than 1% MoM. The only area that saw MoM home price declines was New York at -0.33%.

On a year-over-year basis, the 10-city composite index was up just 1.82%, while the National index was up 3.13%. Seattle is the one area that is down year-over-year at -1.32%. Phoenix and Las Vegas are up the most YoY at 5%+.

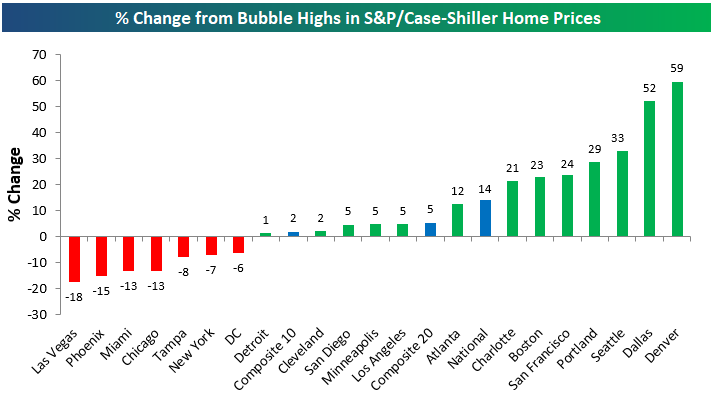

Below is a look at where home prices in each city stand versus their peak prices during the housing bubble of the mid-2000s. At this point, roughly two-thirds of cities have managed to take out their prior housing bubble highs. The only cities where prices are still below their prior highs are Las Vegas, Phoenix, Miami, Chicago, Tampa, New York, and DC. Detroit is the most recent city to take out its prior highs.

Denver and Dallas are both up the most above their prior highs at 50%+.

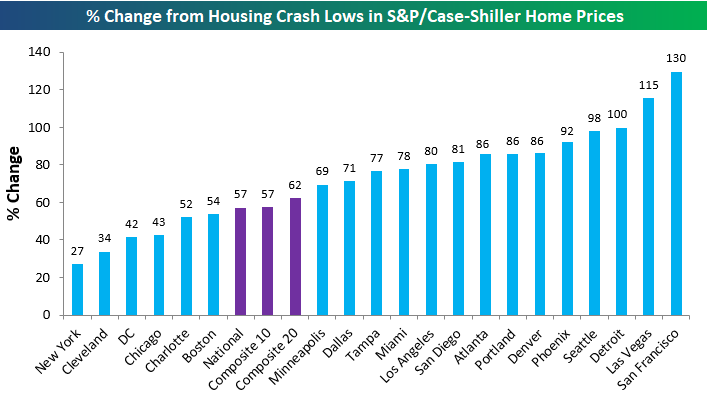

Below we show where home prices currently stand versus their housing crash lows. The composite indices are up 57-62% from their financial crisis lows, while San Francisco, Las Vegas, and Detroit are all up triple digit percentages. New York is up the least at just 27%.

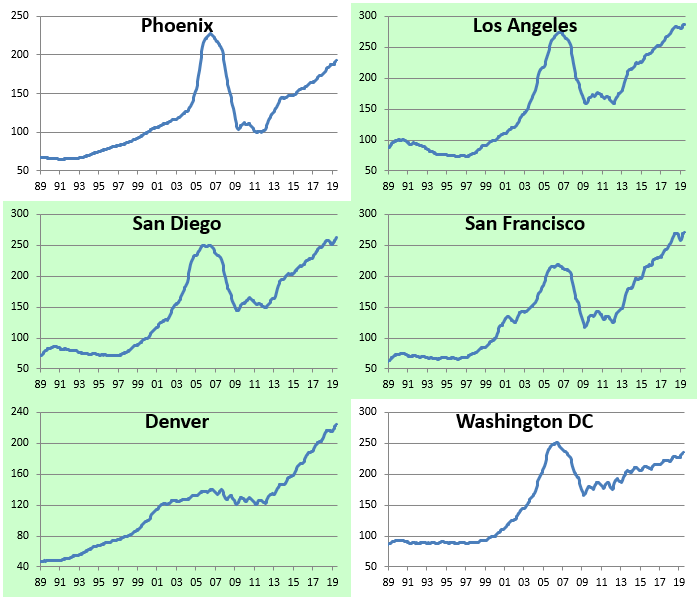

Below are charts of home prices for each city going back to 1989 (Dallas only goes back to 2000). Charts highlighted in green highlight cities where home prices have taken out their prior bubble highs. Start a two-week free trial to Bespoke Premium for more in-depth equity market and economic research.

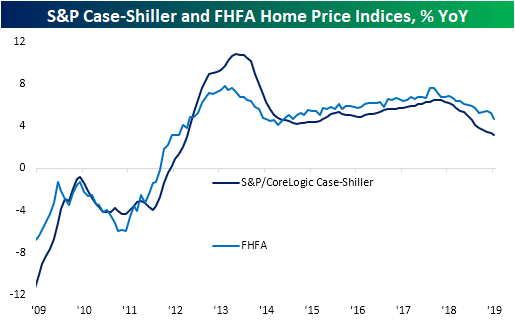

Slowing Home Price Growth

It was a busy morning for data on home prices with the releases of the June readings for S&P/CoreLogic Case-Shiller and the FHFA’s home price indices. Both indices essentially told the same story for home prices: still growing, but at the slowest rate in years. The S&P/CoreLogic reading was expected to show home prices grew by +3.30% YoY compared to +3.43% last month. Results were even weaker with home prices slowing to +3.13% for June while the May release was revised down to +3.35%. This marks the slowest growth since September of 2012 when home prices grew +3.0% YoY. For this index, June marked the 15th consecutive month of declines in the YoY growth rate. That has surpassed a 14-month long streak ending February 2015 and is now the longest since a 41-month long streak that came to a close in February of 2009 when prices were falling over 12% YoY.

The monthly FHFA Home Price index came in at 4.7% YoY which was lower than the prior reading for May of 5.2%. While it is not part of any dramatic streak like the S&P/CoreLogic index, this was the lowest growth rate since early 2015. One important thing to note, though, is that these two home price readings did not take into account all of the effects of the most recent plunge in rates or the Fed’s July rate cut because they’re on a two-month lag. Start a two-week free trial to Bespoke Premium for more in-depth equity market and economic research.