Manufacturing Activity Comes to a Grinding Halt

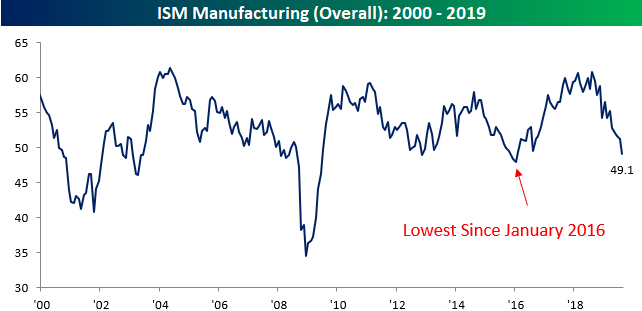

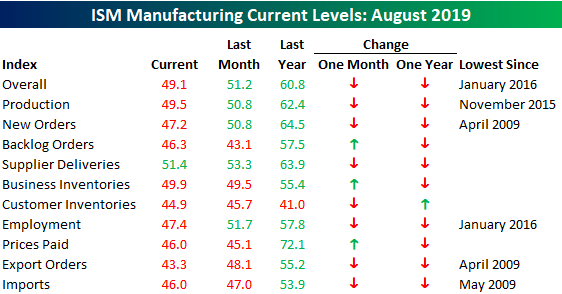

Here’s a question for you. Given the escalation of trade tensions with China and the increased uncertainty surrounding the global economy, how on earth were economists expecting activity in the US manufacturing sector to increase in August? The reality is that the manufacturing sector was not only weaker than expected, it contracted for the first time in three years! While economists were expecting the headline ISM Manufacturing index to increase from 51.2 up to 51.3, the actual reading came in at 49.1 for the fifth straight monthly decline in the index. The last time the ISM Manufacturing Index declined for five months straight was in January 2016 which also happens to be the last time it was lower than it is now.

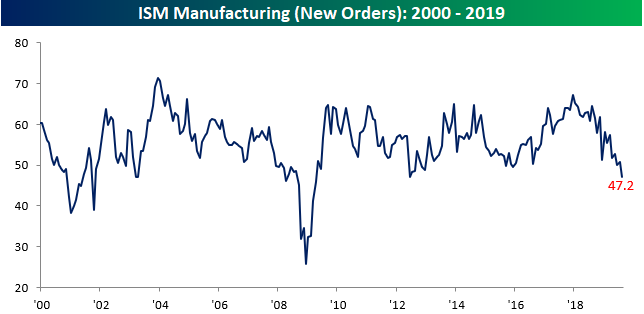

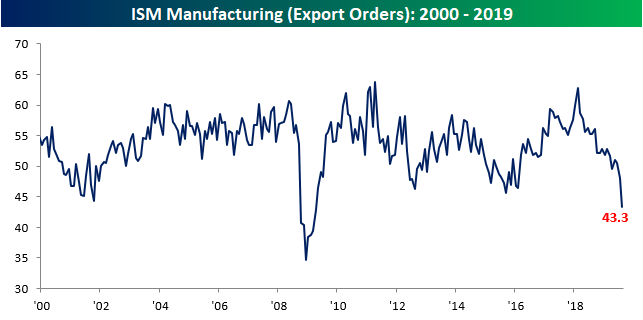

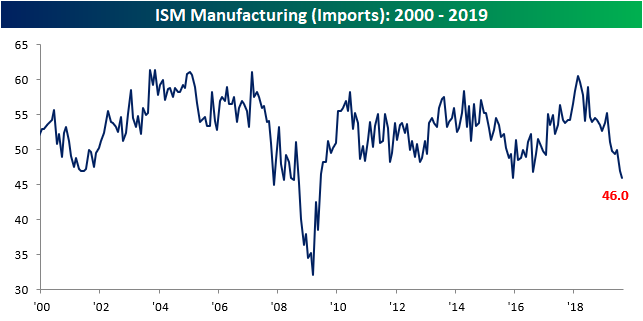

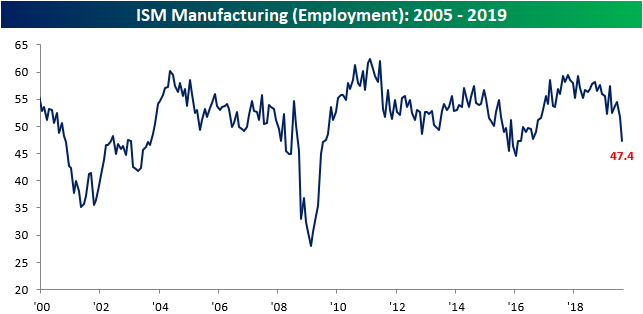

The internals of this month’s report were also very weak. For starters, we saw the most flips from growth (>50) to contraction (<50) in a monthly report since August 2016. On top of that, just one category in the report – Supplier Deliveries- is above 50. The last time there was such broad-based weakness was in June 2009! In the case of Production, current levels are the weakest since November 2015, but for New Orders (first chart below), things haven’t been this weak since April 2009. The same goes for Export Orders and Import Orders (second and third charts below). If you think that the ongoing trade war with China isn’t impacting global trade, think again. Finally, ahead of the August Jobs report on Friday, the Employment Index (bottom chart) of this month’s report fell to 47.4 which is the lowest level since January 2016. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Labor Day Seasonality

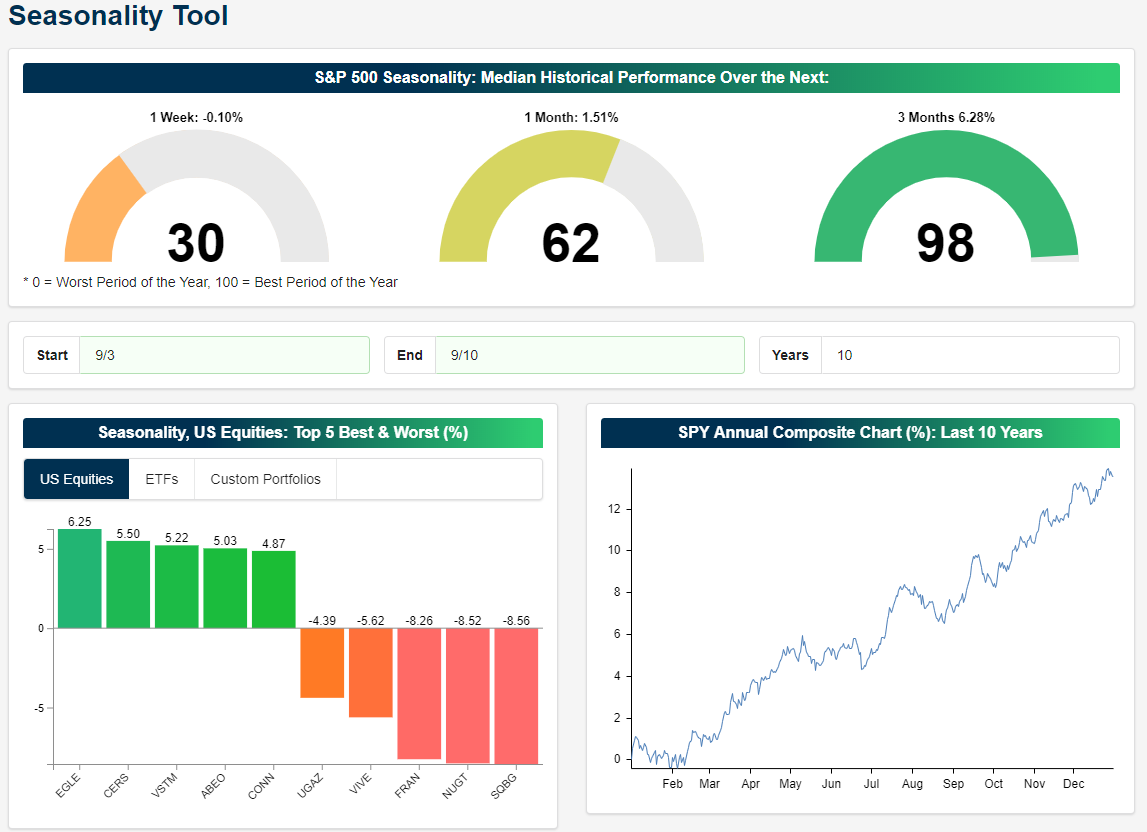

We are now headed into the home stretch of the year and fortunately for bulls even though September is the worst month of the year, market performance over the next three months is one of the best periods of the year. As shown in the screenshot from our Seasonality Tool below, performance of the S&P 500 over the next week over the past ten years has been fairly weak with a 0.1% median decline. One month performance is slightly better with a modest gain of 1.51%, but 3 months out the S&P 500 has been higher by an average of 6.28%.

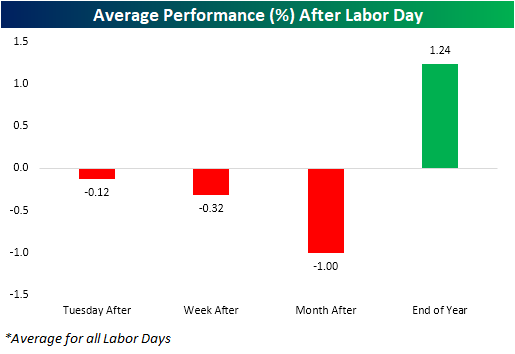

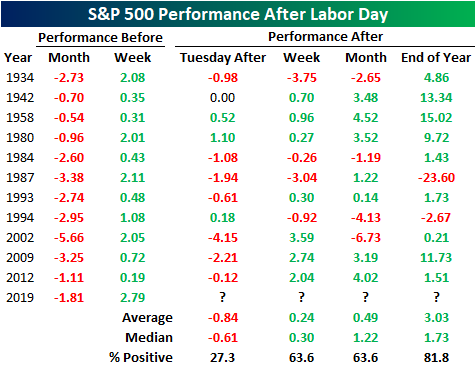

Coming off of the long Labor Day week, we wanted to take a look at seasonality around the holiday. As shown below, similar to what our Seasonality Tool is showing, going back to 1928, near term performance of the S&P 500 has been weak after Labor Day with declines that Tuesday after the holiday, the week after and one month after. But by New Year’s Eve, the index is higher by an average of 1.24%. Furthermore, the index has only been up in the weeks after Labor Day less than half of the time, while it is positive 70% of the time by the end of the year.

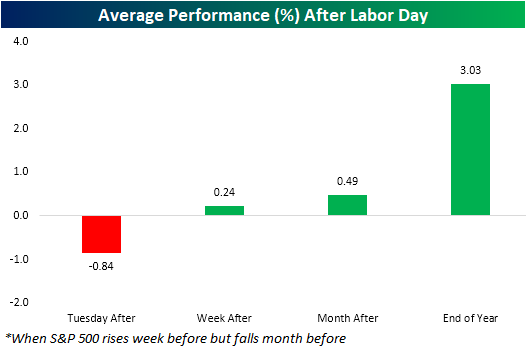

When it comes to what has happened over the month leading into the holiday weekend, with the S&P falling 1.81% in August but rising 2.8% last week, this year has actually been more of a setup for outperformance relative to seasonal patterns around Labor Day. As shown in the chart below, average performance in the days, weeks, and months following Labor Days that were preceded by declines in the month leading up to the holiday but gains in the week before typically have been stronger than other periods (11 prior occurrences). In fact, the week and month after Labor Day have typically been positive rather than negative after similar scenarios to the current one. Start a two-week free trial to Bespoke Institutional to access our interactive Seasonality Tool and much more.

In the table below, we break down the performance across each of the eleven prior times that this has occurred. The Tuesday Labor Day is actually more consistently negative than other years—which we have ended up see play out this year. Again though, longer-term performance gets stronger and is more consistently positive. By the end of the year, there have only been two years where the S&P 500 was lower after similar price action to the current situation. One of those declines was in 1987 when the S&P fell 23.6% through the end of the year. Needless to say, this was a bit of an outlier.

The Warren Buffett Berkshire Stock Portfolio — Q3 2019

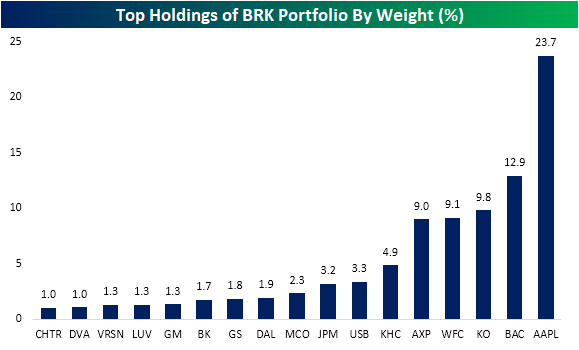

In data from its most recent 13-F filing, Warren Buffett’s Berkshire Hathaway (BRK/A) portfolio showed significant additions to its positions in Bank of America (BAC), US Bancorp (USB), Amazon (AMZN), and Redhat (RHT) which was acquired earlier this year. With these additions, the portfolio is still very overweight financial stocks, which is 45.4% of the portfolio, and technology which makes up for another 26.5% of the total portfolio thanks to a large position in Apple (AAPL). As shown below, Buffett’s position in AAPL is the largest single holding of the portfolio at 23.7%. The next highest is BAC at nearly half of that and a number of other financials stocks also take up 1% or more of the portfolio. The consumer staples and discretionary sectors also make up sizeable portions of the holdings at 15.2% and 7%, respectively. While several holdings were added on to, the company trimmed its position in Charter Communications (CHTR) and closed out of its position in USG (USG) which was acquired earlier this year. CHTR still is one of the larger holdings in the portfolio at around 1% in spite of this cut.

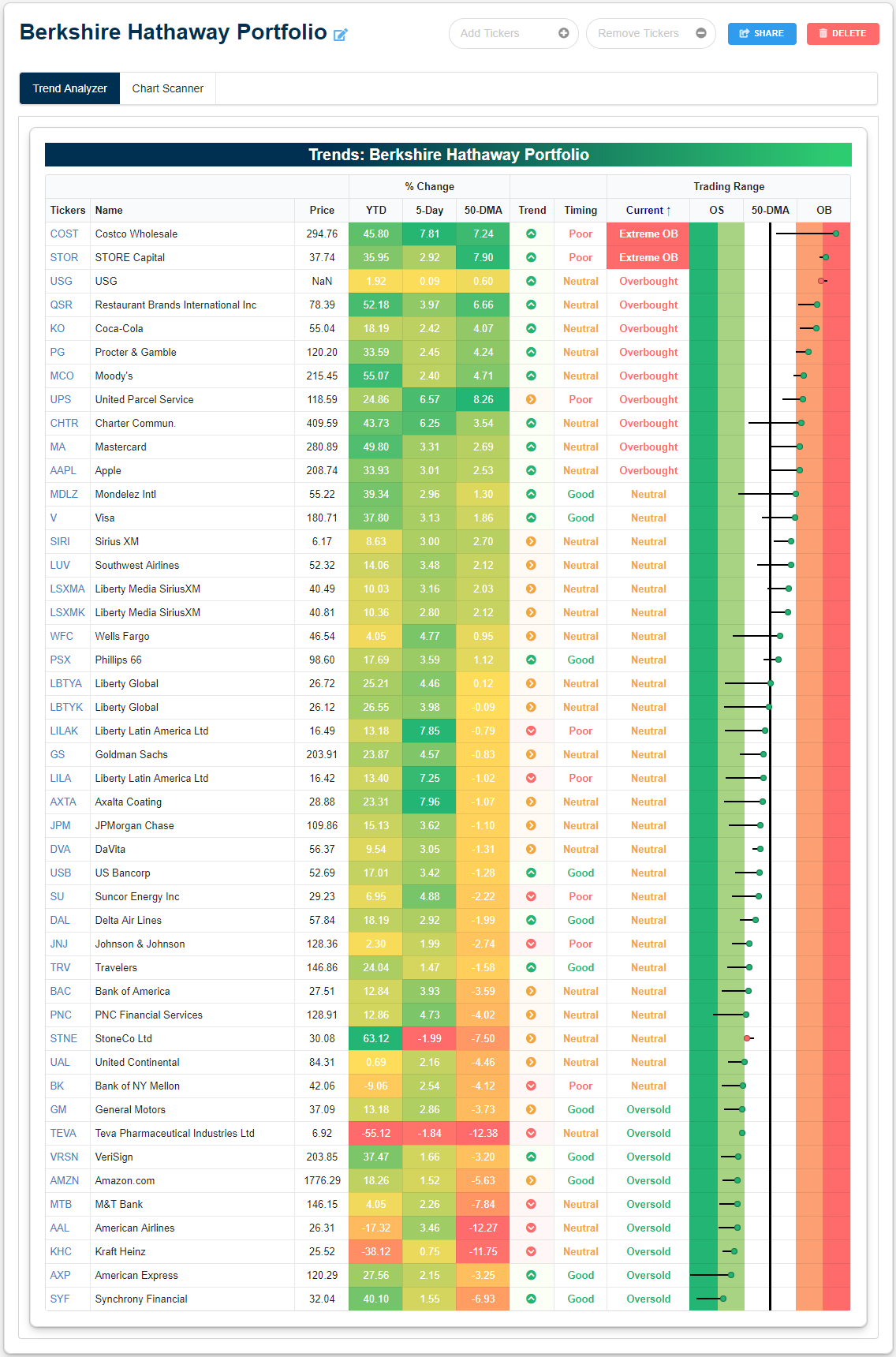

In the table below, we show each of the portfolio’s holdings as well as the percentage of the total portfolio value the stock takes up, its price, and both YTD and QTD performance. As shown, YTD the portfolio has done pretty well with only eight stocks down. But Q3 has been a tough quarter as more than half have fallen. The worst of which has been Teva Pharmaceuticals (TEVA) which is down 26.54%; tacking on to its 56.03% YTD decline. Fortunately TEVA was only 0.19% of the portfolio as of the end of Q2. American Airlines (AAL), Kraft Heinz (KHC), and M&T Bank (MTB) are all also down over 10% this quarter. While not quite as bad as TEVA, KHC’s 41.08% decline this year is also notable. Each of the aforementioned stocks that the company increased their position size on also has fallen in Q3. With a heavyweight in the sector, the performance of the portfolio’s financial stocks has been somewhat mixed. Moody’s (MCO) has been the second best performing stock behind StoneCo (SNTE) with its 53.35% YTD gain, and while this quarter it has continued to do well rising just under 10%, every other financial stock is down this quarter. On the bright side, there are more stocks that are up over 10% than those that have fallen 10%. Given the surge in real estate, the best of these has been STORE Capital (STOR) which has risen 15%. STOR is the only real estate stock in the portfolio. United Parcel Services (UPS), Restaurant Brands International (QSR), VeriSign (VRSN), Costco (COST), and Procter & Gamble (PG) are also all up double digits.

We created a custom portfolio of Buffett’s holdings so that members can use our tools to keep track of these stocks. In terms of longer-term trends as well as overbought and oversold levels, as shown in our Trend Analyzer below, the portfolio’s holdings are a bit all over the place. An equal share of the portfolio’s stocks (19) are in uptrends and trending sideways. The remaining nine stocks are in long term downtrends. After recent mean reversion, a majority are now sitting in neutral territory while there are also more that are overbought than oversold. Only Costco (COST) and STORE Capital (STOR) are currently at any sort of extreme levels (both overbought at more than 2 standard deviations above their 50-days). Start a two-week free trial to Bespoke Premium to use our Custom Portfolios tool where you can easily monitor portfolios like Buffett’s.

ISM Commodities Survey Falls Again

Although the Prices Paid component of the ISM Manufacturing report for August showed a slight increase this month, at a level of 46, it still remains well in contraction territory. Looking at the results of this month’s Commodities survey within the report also reflects the fact that downward price pressures remain in effect. In this month’s ISM Manufacturing report, respondents noted price increases in just two commodities and price declines in 11. This represents the fifth straight month that more commodities were up in price than down in price and took the three-month rolling average down to negative 8.3. While five straight months of negative readings undoubtedly indicates a weak pricing environment for manufacturers, we would note that back in the 2015/2016 period, there were 17 straight months where more commodities were reported as down in price than up in price.

While the relationship hasn’t been perfect, we would note that over time, changes in the direction of the ISM Commodities survey (light blue line) have tended to coincide with or precede changes in direction of the y/y readings in CPI. Looking at the chart, both series tended to track each other pretty closely from 2015 through mid-2018, but since then, we’ve seen a much steeper descent in the commodities survey than we’ve seen in CPI. That would suggest that either the commodities survey has to start rising again or else CPI may see downward pressure in the months ahead. One thing we would note is that since 1999, when the commodities survey has been two points either above or below the current level of -8.3, the average y/y CPI reading has been +0.5% versus the current level of 1.8%. Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Consumer Pulse Report — September 2019

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

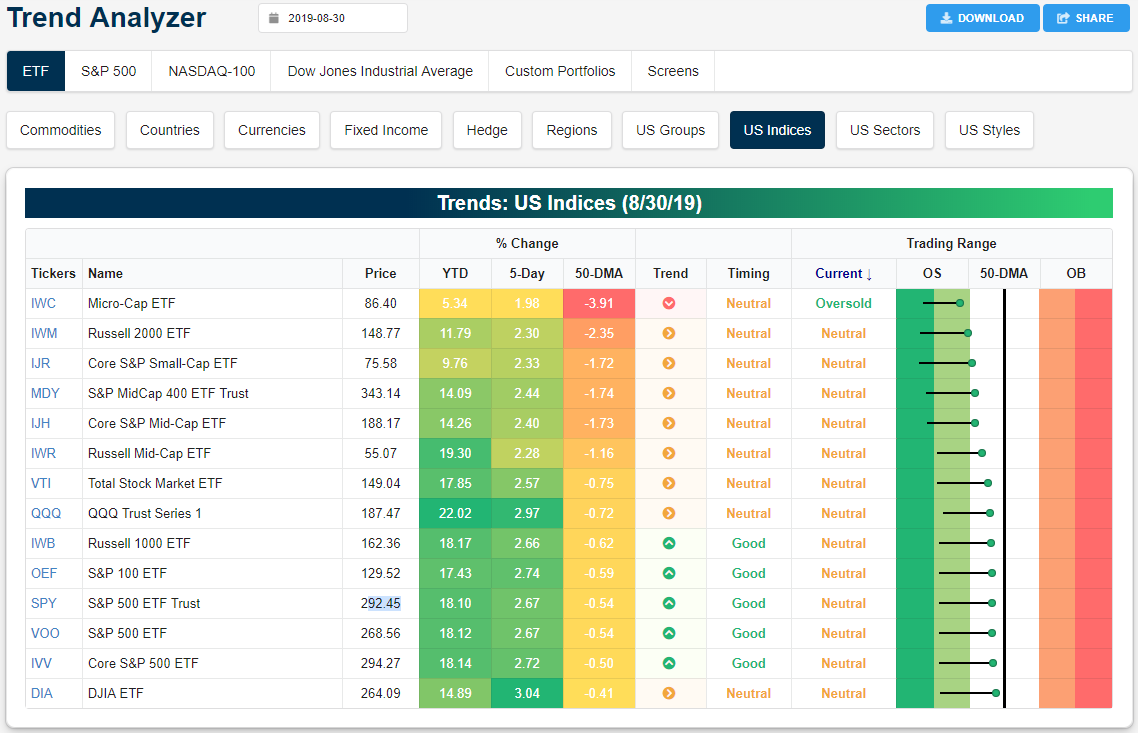

Trend Analyzer – 9/3/19 – Rejecting Resistance

The major US indices managed to finish August on a higher note as each one experienced mean reversion last week. Except for the Micro-Cap ETF (IWC), each of the major index ETFs tracked in our Trend Analyzer worked off their oversold levels to finish the week in neutral territory. At the start of last week, small and mid-caps were actually over 2 standard deviations below their 50-DMAs. There is still not a single ETF that has managed to break above their 50-DMAs despite last week’s rally. The closest to its 50-day is the Dow (DIA) which outperformed last week rising over 3%. The Nasdaq (QQQ), while further below its moving average, similarly rose just under 3%.

Although the major indices finished the week higher, they also fell on Friday. These declines came as the indices entered the upper end of the past month’s range. As for the Dow (DIA), it was the only ETF to have significantly broken above this range. But at the same time, it also failed to retake its 50-DMA. It is a similar story for most other large cap indices like the S&P 500 (SPY) and S&P 100 (OEF) which also rejected resistance at both the upper end of the past month’s consolidation and their 50-DMAs. Small and midcaps, on the other hand, failed to break out of their short term downtrends after running into resistance at the high end of these channels. Start a two-week free trial to one of Bespoke’s premium equity market research offerings.

Bespoke’s Morning Lineup – September Scaries

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

Bespoke Brunch Reads: 9/2/19

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium for 3 months for just $95 with our 2019 Annual Outlook special offer.

China

Member Survey: August 2019 (US-China Business Council)

This very long survey of US businesses on the subject of China is a bit much to summarize in a pithy sentence, but some of the specific responses are surprising. [Link; 20 page PDF]

Trump’s New Trade War Tool Might Just Be Antique China Debt by Tracy Alloway (Bloomberg)

Long-since defaulted bonds issued before Mao turned China into the People’s Republic are a source of speculation, making collectible pieces of paper seem like they’re an actual investment. [Link; soft paywall]

Costco just opened its first store in China and the response is insane by Brian Sozzi (Yahoo! Finance)

While American companies don’t always find success in the tilted playing field of the Chinese economy but the initial reaction to Costco from consumers in China is a big thumbs up. [Link; auto-playing video]

Taxes

Huge hoard of Norman coins reveals medieval tax scam by Mark Brown (The Guardian)

Coins discovered recently show evidence that Norman era coinage in Britain was victim to counterfeiting that debased currency and reduced tax liability for the moneyed classes. [Link]

Addicted to Fines (Governing)

How the combination of concentrating economic activity and poor governance have left large chunks of the country dependent on revenue generated by issuing tickets and other forms of police activity. [Link]

The Minimum Wage Is a Sales Tax on the Middle Class by Matthew C. Klein (Barron’s)

Studies of very large minimum wage hikes in Eastern Europe suggest that businesses respond to the higher labor costs by raising prices. In effect, consumers pay the higher wage costs, meaning the whole minimum wage hike functions a bit like a sales tax. [Link; paywall]

Real Estate

Your Next Home Might Be Appraised by a Robot by Ryan Dezember (WSJ)

New rules are raising the price cap on homes that are exempt from valuation by an actual human being, meaning millions of sales will now have no third-party evaluation of the house attached to them at all. [Link; paywall]

Restaurants

Chicken sandwich mania at Popeye’s: big crowds, long waits and our critic’s take by Michael Mayo (South Florida Sun Sentinel)

August saw a frenzy for chicken sandwiches at Popeye’s across the country, with customers drawn in by the new $4 chicken sandwich. [Link]

Hiring Is Very Hard for Restaurants These Days. Now They May Have to Fire. by David Yaffer-Bellany (NYT)

On top of higher wages demanded by workers in a tight labor market, the Social Security Administration is stepping up enforcement of fake numbers, cracking down on labor provided by undocumented immigrants which have long been the backbone of the restaurant industry. [Link; soft paywall]

Values

Historic Asset Boom Passes by Half of Families by David Harrison (WSJ)

While households with large amounts of wealth have seen their assets surge, those in the bottom half of the wealth distribution are lagging far behind despite a booming stock market and strong equity market rally over the past decade. [Link; paywall]

Incoming Harvard Freshman Deported After Visa Revoked by Shera S. Avi-Yonah and Delano R. Franklin (Harvard Crimson)

In a ridiculous abuse of power, an immigration official revoked an incoming freshman’s visa because some of his social media contacts had posted political views that the officer disagreed with. [Link]

Americans Have Shifted Dramatically on What Values Matter Most by Chad Day (WSJ)

A national poll show younger Americans are much less invested in patriotism, religion, and childrearing, but similarly inclined towards hard work, community involvement, and tolerance. [Link; paywall]

Evolving Tech

Older people are embracing video games. For some, that means stardom. by Kalhan Rosenblatt (NBC)

For older Americans who are often isolated, video games are offering a unique way to connect with other people and even stardom in a world of game streaming that eats up almost as many hours as games themselves. [Link]

Uh-oh: Silicon Valley is building a Chinese-style social credit system by Mike Elgan (Fast Company)

Concerns have grown over the authoritarian social credit system, which ties criticism of the government as well as other activity to all sorts of negative outcomes. Now, companies in the insurance, hospitality, transportation, and technology industries are all introducing similar if less comprehensive systems of social control. [Link]

Google Tries to Corral Its Staff After Ugly Internal Debates by Jack Nicas (NYT)

After years of keeping the stage open for debate among employees, Google has issued new workplace guidelines designed to keep debates from destroying productivity and the company’s entire culture. [Link; soft paywall]

I Visited 47 Sites. Hundreds of Trackers Followed Me. by Farhad Manjoo (NYT)

An illustration of how detailed tracking of our digital footprints have become as tracking software from across the internet follows users around. [Link; soft paywall]

Drugs

Cocaine has been found in some European shrimp, and it’s part of a disturbing trend of drug-filled shellfish by Aylin Woodward (Business Insider)

Drugs excreted by humans after consumption are piling up in river ecosystems, including some small freshwater shrimp in one study. [Link]

Bonds

Three U.S. bond kings wield same strategy, get same result: lag their peers by Jennifer Ablan (Reuters)

Star fixed income position pickers have fallen behind as bond prices have surged this year, with Gundlach, Ivascyn, and Minerd all lagging behind historic outperformance. [Link]

5G

Cities Are Saying No to 5G, Citing Health, Aesthetics—and FCC Bullying by Christopher Mims (WSJ)

Powerful radio antennas designed to help the rollout of 5G broadband wireless are sparking local resistance over concerns for health and property values. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

The Bespoke Report – 8/30/19

This week’s Bespoke Report newsletter is now available for members.

In this week’s newsletter, we look at the market’s performance this week and month, review economic data, sentiment and high yield spreads, and discuss the latest inversion of the yield curve. We have also included a comprehensive review of the price and relative strength charts of every Industry within the S&P 500. To read the Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!

The Closer: End of Week Charts — 8/30/19

Looking for deeper insight on global markets and economics? In tonight’s Closer sent to Bespoke clients, we recap weekly price action in major asset classes, update economic surprise index data for major economies, chart the weekly Commitment of Traders report from the CFTC, and provide our normal nightly update on ETF performance, volume and price movers, and the Bespoke Market Timing Model. We also take a look at the trend in various developed market FX markets.

The Closer is one of our most popular reports, and you can sign up for a free trial below to see it!

See tonight’s Closer by starting a two-week free trial to Bespoke Institutional now!