Bespoke’s Morning Lineup – Who Said Talk is Cheap?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – Cross-Asset Recap, Trade, Beige, Fund Flows – 9/4/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a recap of price action in the S&P 500, VIX and credit spreads, EMFX, the USD, and precious metals. We then look at the US trade balance, including a look at trade between the US and China. We finish with a review of today’s Beige Book release and ICI fund flows.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!

Fixed Income Weekly – 9/4/19

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report we discuss the extreme level of oversold readings for global bond yields.

Our Fixed Income Weekly helps investors stay on top of fixed income markets and gain new perspective on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Low P/E, Low Return

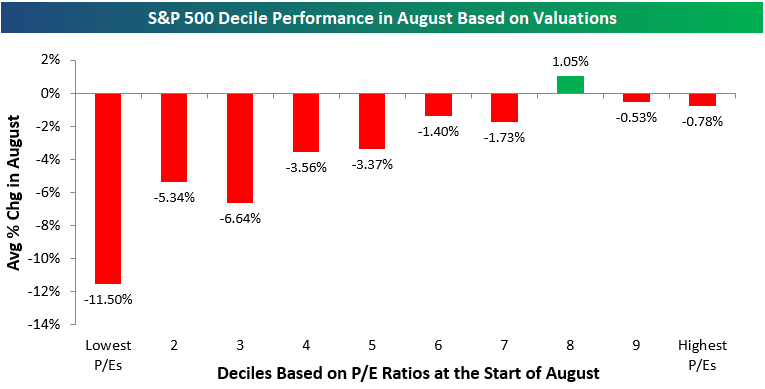

Most investors are trying to forget about August performance as quickly as possible, but we wanted to highlight a noteworthy data set about the month before it gets too far into the rear-view mirror. At the end of every month, we run our decile analysis of the S&P 500 to see which stock characteristics drove performance the most. One characteristic we look at is valuation, and in August, valuations played a big role in performance.

Below we’ve broken up the S&P 500 into deciles based on P/E ratios (trailing 12-month). Decile 1 contains the 50 stocks in the S&P with the lowest P/Es at the start of August, while decile 10 contains the 50 stocks in the index with the highest (or negative) P/Es. Each bar in the chart shows the average percentage change in August of the 50 stocks in each decile.

As shown, the 50 stocks in the S&P with the lowest P/E ratios at the start of the month fell an average of 11.5% in August! The next two deciles with the lowest P/E ratios fell more than 5% as well. On the other end of the spectrum, the 50 stocks with the highest P/E ratios fell only 0.78% in August.

You’ve certainly heard a lot about the “death of value investing” recently, and this is why! We have to think that at some point the scales will tip and head in the other direction. Start a two-week free trial to Bespoke Premium to see our full decile analysis report for August.

Utilities (XLU) Still On the Up And Up

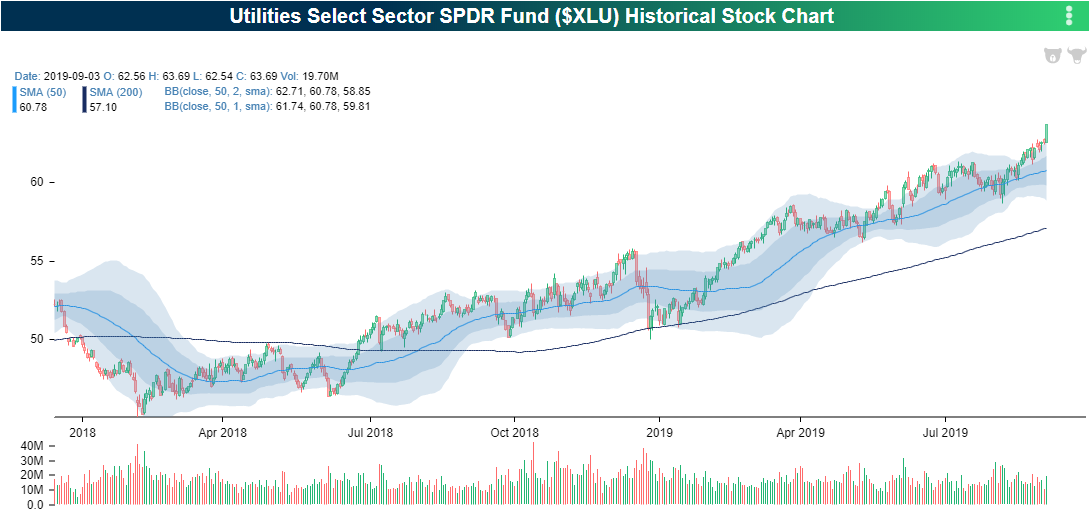

As with other defensive sectors and safe assets, Utilities (XLU) has been on a tear all year with a 22.2% gain. The sector has been in a strong long term uptrend for some time now with the most recent leg higher bringing it to extremely overbought levels. XLU now sits over 3 standard deviations above its 50-DMA thanks to yesterday’s 1.77% rally. In the past year, there have only been four other days with larger single-day gains: June 5th, May 10th, and January 31st of this year, and October 24th of last year. Only the occurrence in June also coincided with XLU moving over 3 standard deviations above its 50-day in the surrounding days.

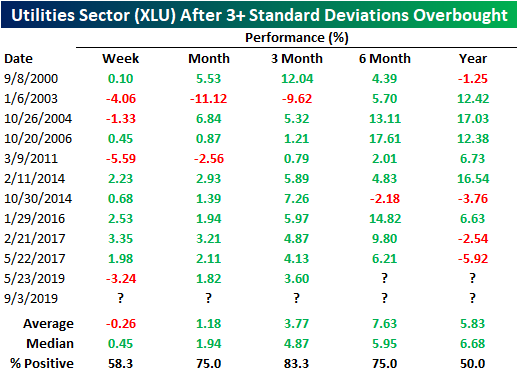

Since the Utilities Sector ETF first began trading in 1999, it has been rare to see XLU trade over 3 standard deviations above its 50-DMA. In fact, of all trading days that the ETF has been on the market, only 36 have seen XLU close at this extreme of overbought levels. Utilities do not stay this extended for long. The longest streak that where XLU has remained this overbought was 9 trading days in 2017; a majority of the time it only lasts for a single day.

Although it can be reasoned that extremely overbought levels would lead to some degree of downside mean reversion, historically that has not necessarily been the case. As shown in the table below, performance following periods where the ETF closed over 3 standard deviations above its 50-DMA after having not done so for 80 days have actually generally held a positive bias. Only in the following week has XLU averaged a decline, but median performance is positive with a 45 bps gain. Returns are consistently positive one month, three months, and half a year later. For both three and six months out, there has only been one occurrence each that XLU was not higher. Six months later has been the strongest of these time periods, averaging a 7.63% gain. One year later, while still positive on average with multiple occurrences of double-digit returns, XLU has only been higher 60% of the time. Start a two-week free trial to Bespoke Institutional to access our interactive Security Analysis tool and much more.

Make Up Your Mind Already

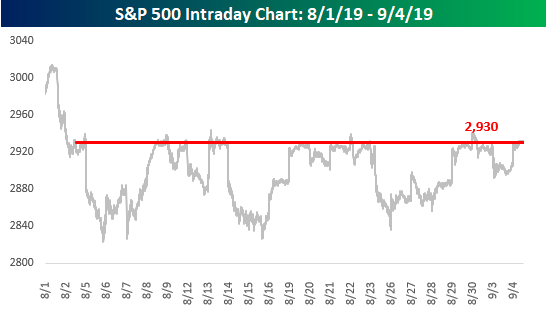

Talk about indecisive! After a moderate decline to kick off the week yesterday, US equities have more than erased those losses today. While a pretty big drop in the equity market followed by a big gain isn’t unheard of, when it goes on and on for more than a month, it’s enough to drive you nuts. Ever since early August, investors are being whipped around by a series of contradictory tweets, headlines, and “reports”. One day the trade war with China is at the point of no return. The next day the two sides are talking. It was only a couple of days ago that a peaceful solution to the protests in Hong Kong was almost out of the question. Today, everything is copacetic as CEO Carrie Lam withdrew the extradition bill that caused all the protests in the first place. On some days, Consumer Confidence, Retail Sales, Jobless Claims, etc suggest that a recession is out of the question, but then the next, reports like the ISM Manufacturing sector fall into negative territory.

Where does all the indecision leave us? Since the start of August, the S&P 500 has seen a series of eleven different rallies ranging between 1% and 4%. In between each of those rallies, though, we have seen ten different declines in the range of between 1% and 4% as well. With all the ups and downs, the S&P 500 finds itself trading at a level right around 2,930, which is a level it has crossed above and below on an intraday basis countless times over the last month, and for that matter the last year. We’ve already heard a number of stories about how companies are putting off big investment decisions until issues with trade and the economy start to sort themselves out, and based on the last month, the market has joined them. Start a two-week free trial to Bespoke Institutional to access our interactive market tools and all of our analysis.

Trend Analyzer – 9/4/19 – Extended Defensives

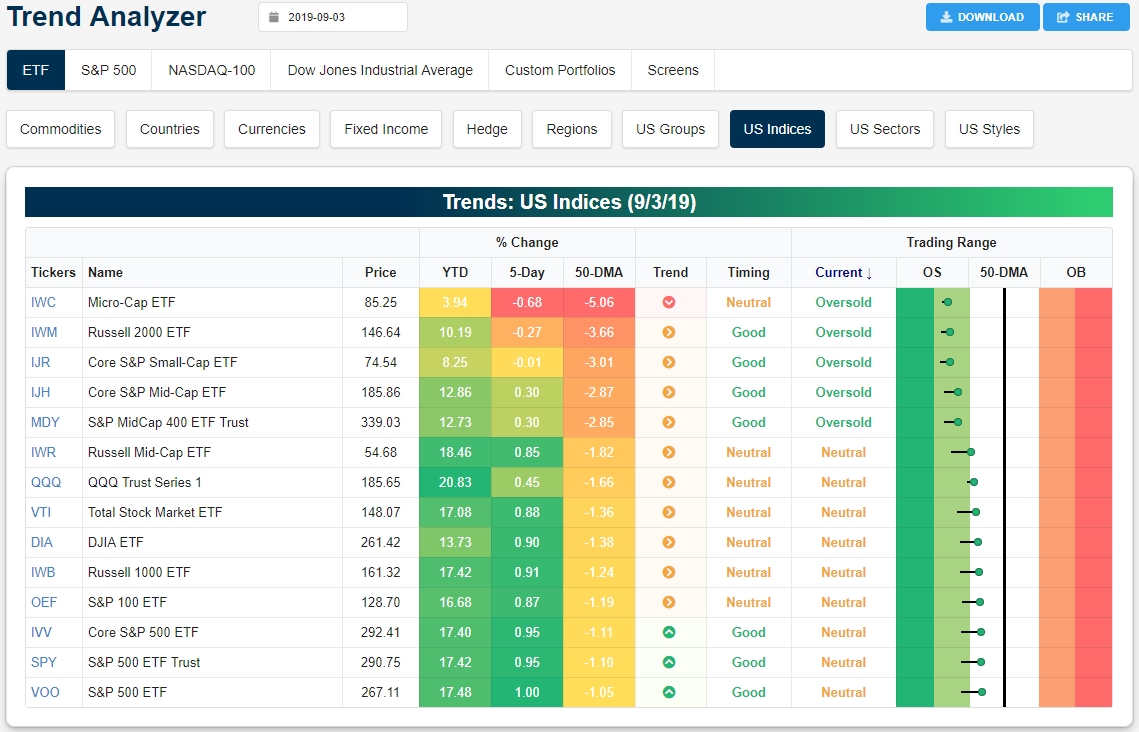

Small and mid-caps have returned to oversold territory after moving up into neutral territory at the end of last week. Meanwhile, although further below their 50-DMAs than yesterday’s open, large caps are looking to hold firm in neutral territory. The Micro-Cap ETF (IWC), Russell 2000 (IWM), and Core S&P Small-Cap ETF (IJR) are the only major index ETFs that are currently lower now than they were last week. IJR, however, has a loss of only 1 bp. Longer term trends have weakened across the board recently as only the ETFs tracking the S&P 500 (SPY, VOO, and IVV) all remain in uptrends. All others have been trending sideways over the past six months while IWC is actually in a downtrend.

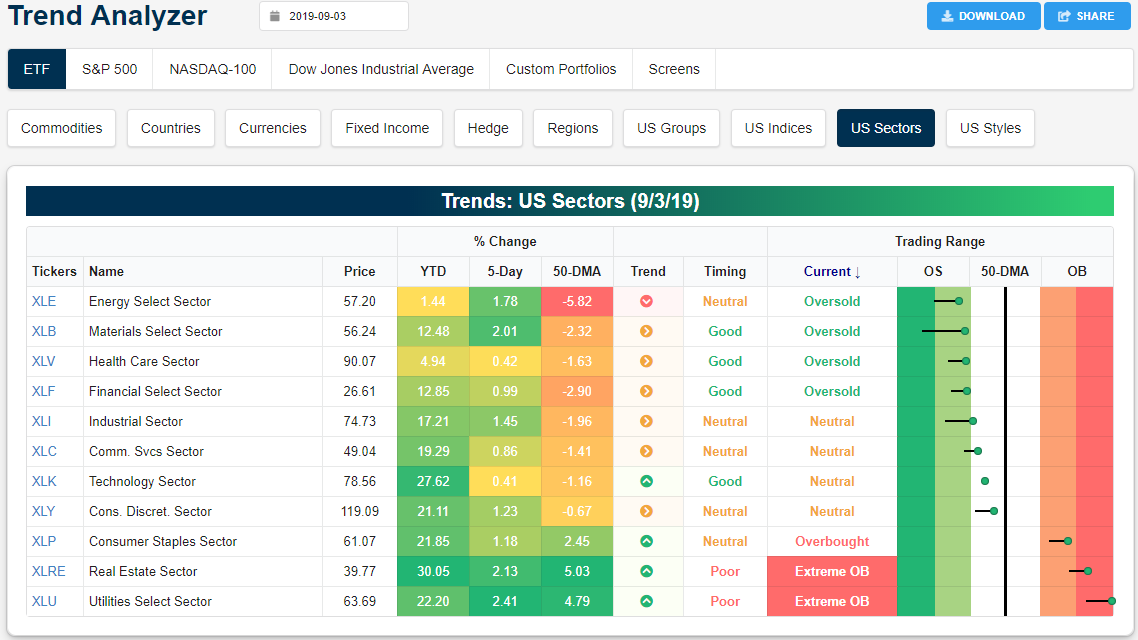

Looking at individual sectors, the overbought/oversold picture is a bit less consistent with an about equal split between oversold, neutral, and overbought. Energy (XLE) has begun to see some mean reversion recently. Still the most oversold of the eleven sectors, XLE has worked off of more extreme levels from last week and has been one of the top-performing sector ETFs over the past five days rising 1.78%. But XLE still remains in a longer-term downtrend and has only risen 1.44% so far in 2019. The Materials sector (XLB) is a similar story. After reaching extreme oversold levels last week, it has begun to rally and is closing in on reentering a more normal trading range. While these two cyclical sectors have begun to rally, so too have the defensives. Real Estate (XLRE) and Utilities (XLU) have been surging—both this week as well as this year as XLRE sits up over 30% YTD—with both seeing the best and second-best performance over the past five days which has brought them deeper into overbought territory. XLU, in particular, is now over 3 standard deviations above its 50-day, which is basically off the chart in our Trend Analyzer below! Start a two-week free trial to Bespoke Institutional to access our interactive economic indicators monitor and much more.

Bespoke’s Global Macro Dashboard — 9/4/19

Bespoke’s Global Macro Dashboard is a high-level summary of 22 major economies from around the world. For each country, we provide charts of local equity market prices, relative performance versus global equities, price to earnings ratios, dividend yields, economic growth, unemployment, retail sales and industrial production growth, inflation, money supply, spot FX performance versus the dollar, policy rate, and ten year local government bond yield interest rates. The report is intended as a tool for both reference and idea generation. It’s clients’ first stop for basic background info on how a given economy is performing, and what issues are driving the narrative for that economy. The dashboard helps you get up to speed on and keep track of the basics for the most important economies around the world, informing starting points for further research and risk management. It’s published weekly every Wednesday at the Bespoke Institutional membership level.

You can access our Global Macro Dashboard by starting a 14-day free trial to Bespoke Institutional now!

Bespoke’s Morning Lineup – Turnaround Tuesday on Wednesday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week free trial to Bespoke Premium. CLICK HERE to learn more and start your free trial.

The Closer – EM and Brent Underperform, Manufacturing, Construction Spending – 9/3/19

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight on markets? In tonight’s Closer sent to Bespoke Institutional clients, we show how US equity markets have stacked up against emerging markets. We also show the underperformance of Brent versus WTI crude oil before turning to our thoughts on the blowout of recent manufacturing data, especially in regards to ISM New Export Orders. We finish with a note on today’s construction spending release.

See today’s post-market Closer and everything else Bespoke publishes by starting a 14-day free trial to Bespoke Institutional today!