Bespoke’s Morning Lineup – 3/28/25 – Breakout Fake Out

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There’s simply no polite way to tell people they’ve dedicated their lives to an illusion.” – Daniel Dennett

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

As the S&P 500 and Nasdaq look to extend their weekly winning streaks to two, they will need some help. Overnight, Asian markets were lower across the board with the Nikkei down 0.3% while China was down 0.7% as tariff concerns continue to weigh on sentiment. In Europe, things aren’t much better as the fallout from this week’s tariff announcements and others planned for next week on April 2nd, shake investor confidence. The STOXX 600 is down about 0.5% which would put it down by about 1% for the week.

US futures are down across the board with the S&P 500 trading nearly 0.2% lower while the Nasdaq faces a decline of 0.31%. Treasury yields had been rising in recent days even as stocks struggled, but this morning, the 10-year yield is 4 basis points lower to 4.33%. Oil prices are basically unchanged at just under $70 per barrel, while gold and silver are both up about 1%. After hitting a record high two days ago and selling off by over 4% since then, copper prices are marginally lower again this morning.

This morning’s economic calendar is busy with Personal Income and Spending at 8:30, as well as the Michigan Sentiment report at 10 AM. The key report of the day, however, will be the PCE report at 8:30. How this report comes in relative to expectations will likely determine whether the week finishes with a plus sign or minus sign next to it.

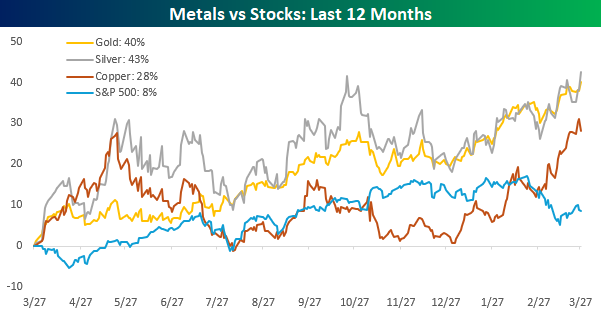

Stocks have had difficulties seeing gains lately, but hard assets like gold, silver, and copper have been ripping higher. Over the last year, gold and silver have rallied 40% or more while copper prices have risen 28%. The S&P 500 is also up on a y/y basis, but it’s up by less than a third of copper’s gain and less than a quarter of gold and silver. While gold and silver have been outperforming the S&P 500, up until just recently copper had been underperforming. Since the S&P 500’s peak in mid-February, though, all three commodities have seen their rallies pick up steam, and this week they all traded at 52-week and/or all-time highs.

This week’s move in copper was particularly interesting. After trading at an all-time high on Wednesday, copper finished the day down more than 2% from its intraday high and fell another 2%+ in Thursday’s session. As you can see in the chart, the commodity had a similar move higher and subsequent reversal early last May when it hit record highs after an even more impressive rally. While it’s tempting to look at the rally in copper as a sign of economic strength, it’s worth pointing out that the price in New York has rallied more than the price in London, and that’s because traders have been stockpiling inventories ahead of anticipated tariffs from the Trump administration.

The Closer – NIPA Revisions, Autos, Internationals – 3/27/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we kick off with some commentary regarding the North American tariff situation (page 1). We then look at the latest update of GDP data (page 2). Next, we look at the tariffs ramifications for used cars (page 3) and the advanced trade balance (page 4). We finish with a look at the historic spread between QTD performance of the US versus the rest of the world (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Q1 2025 Earnings Conference Call Recaps: Cintas (CTAS)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Cintas’ (CTAS) Q3 2025 earnings call.

Cintas (CTAS) provides uniform rental services, facility services, first aid and safety products, and fire protection solutions primarily to businesses across North America. The company reported total revenue growth of 8.4% to $2.61 billion, driven by strong customer retention and operational efficiency. Despite macroeconomic uncertainty, customer purchasing remained steady, reflecting continued demand for outsourcing solutions that stabilize cash flows. The company achieved record-high gross margins of 50.6%, benefiting from investments in technology-driven operational improvements, including SAP (enterprise software standardizing business processes) and Smart Truck (route optimization software improving logistics efficiency). Management emphasized their preparedness for potential new tariffs, citing geographic diversity and dual-sourcing strategies. Additionally, CTAS ended efforts to acquire rival uniform services provider UniFirst, citing unsuccessful negotiations. With the triple play earnings, its third such report in the last five quarters, shares rose as much as 8.5% on 3/26, bringing the stock roughly 9% from its all-time high last November…

Continue reading our Conference Call Recap for CTAS by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q1 2025 Earnings Conference Call Recaps: Winnebago (WGO)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Winnebago’s (WGO) Q2 2025 earnings call.

Winnebago (WGO) is a leading manufacturer of recreational vehicles (RVs), boats, and specialty vehicles. Known for its iconic motorhomes, travel trailers, and premium brands like Newmar and Grand Design, the company serves outdoor enthusiasts, providing products that enhance the RV experience. WGO’s results were impacted by weak retail demand and rising consumer uncertainty, leading to a reduction in guidance. The company is navigating a cautious market, with consumer sentiment and inflationary pressures dampening RV and marine sales. Notable highlights include product innovation across motorhomes (Grand Design’s Lineage Series) and marine segments (Barletta’s market share gains). The company’s tri-brand strategy in motorhomes is showing promise, while WGO Towables is undergoing a pricing reset to boost competitiveness. Tariffs remain a concern, especially for motorized RV chassis, but WGO is working on mitigating costs. The stock opened 9.1% higher on 3/27 on better-than-expected results…

Continue reading our Conference Call Recap for WGO by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Country ETF Dividends

It’s been two weeks since the S&P 500 (SPY) put in its March 13 low. Since then, SPY has risen 3.2% which is slightly above the 2.6% average gain of the ETFs tracking the stock markets of 22 major global economies. As shown below, topping the list and outperforming in that span have been emerging market countries like Brazil (EWZ) and India (INDA) which are both up well over 6.5%. Meanwhile, only two stocks are meaningfully lower in that time: Taiwan (EWT) and Hong Kong (EWH). Of those, EWT is much more closely resembling the US over a longer time frame. Since the S&P 500’s February 19 peak, it is down 7.2% which is essentially tied with Taiwan for the worst performance since then. While those are the two biggest losers, most other country ETFs have moved higher to build upon what has been impressive strength year to date. Whereas the US is down low single digits this year, most other countries have in that time risen well into the double digits.

International ETFs don’t only have momentum on their side, but they also offer higher yields than the US at the current moment. On a twelve trailing month basis, SPY’s 1.26% yield ranks as the second lowest among these ETFs. The only one that has offered a smaller, and less than 1%, yield is India (INDA). On the whole, across all 22 ETFs, the average yield stands at 3.25%. Relative to each one’s respective history, whether or not those are elevated yields vary. For example, for the S&P 500, the current yield only ranks in the 5th percentile of that 20 year range. Meanwhile, Japan’s (EWJ) 2.22% yield ranks at the low-middle end of these ETFs, but is in the top decile versus EWJ’s own history.

Like this post? Join our complimentary Dividend Discovery email newsletter to receive a dividend-centric post in your inbox a couple of times per week. If you’re interested in dividend stocks and ETFs, this newsletter is for you! CLICK HERE to sign up with just your email or click on the image below.

Bespoke’s Morning Lineup – 3/27/25 – Back to Tariffs

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I like the dreams of the future better than the history of the past.” – Thomas Jefferson

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

After selling off throughout the session yesterday in anticipation of the President’s tariffs on the auto industry, the negative tone has flowed into this morning’s session. Equities are indicated to open modestly lower, and the potentially inflationary impact of these tariffs has yields moving higher with the 10-year yield approaching 4.4%. That could change in the hours ahead as investors digest several economic reports, including revised GDP, Personal Consumption, and Core PCE. We’ll also get jobless claims at 8:30, Pending Home Sales at 10, and then the KC Fed Manufacturing report at 11.

The tariff news yesterday has foreign stocks trading mostly lower. Japan was down 0.60%, and the STOXX 600, while off its lows, is still down 0.6% as Auto stocks in Japan and Europe weigh on performance.

With stocks getting a respite from the selling last week and into early this week, we expected some subsiding of the extremely high levels of bearish sentiment in the weekly survey from the American Association of Individual Investors (AAII). Bearish sentiment did manage to decline from 59.1% to 52.2%, but this week’s reading was still above 50% and higher than 96.8% of all prior weekly readings since 1987.

The Closer – Fedspeak, Energy, CFOs – 3/26/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start report with a rundown on the latest Fedspeak (page 1) followed by a chart review of the Magnificent Seven and a handful of other stocks (page 2). We then look at the relationship between oil, rates, and the dollar (page 3). Next, we pivot over to the Dallas Fed’s Energy Survey (pages 4 and 5) in addition to the latest manufacturing data (page 6). We close out with a review of trade policy impacts on the Duke CFO survey (page 7 and 8).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke’s Morning Lineup – 3/26/25 – Trading Places

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“You make no friends in the pits and you take no prisoners. One minute you’re up half a million in soybeans and the next, boom, your kids don’t go to college and they’ve repossessed your Bentley.” – Louis Winthorpe III, Trading Places

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To view yesterday’s CNBC segment, please click on the image below, and you can read today’s Morning Lineup PDF at the link below:

After weeks of heightened volatility, markets are relatively quiet for the second straight day this morning. Enjoy the peace while it lasts! Futures were indicated lower overnight but are now slightly, and we stress the word slightly, positive. One place we aren’t seeing gains this morning is in Europe as the STOXX 600 is trading lower for the fourth time in five trading days.

Today’s economic calendar is light. The only report on the calendar is Durable Goods at 8:30. Economists expect the headline reading to fall 1% m/m after a 3.2% in January. Excluding Transports, the report is expected to show an increase of 0.2% after no change in January. Besides those two reports, we’ll also hear from two Fed speakers with Goolsbee speaking at 10:00 AM while Musalem’s comments will hit the tape just after 1:00 PM Eastern.

After trading above its 200-DMA for the first time in over two weeks Monday, the S&P 500 traded above that level for the entire session yesterday notching its third straight day of gains for the first time since early February. The S&P 500 closed above the 200-DMA, but with a cushion of just 0.4%, it has hardly been a convincing move. Given the narrow spread between the price and 200-DMA, there’s been a relatively even split between the number of sectors trading above their respective 200-DMAs. As of Tuesday’s close, six finished the day above that level while five finished below, and six finished the day within 2% of their 200-DMAs (three above and three below), so it wouldn’t surprise us to see sectors flip-flopping between trading above and below that long-term trend line.

Two sectors that flip-flopped positions in yesterday’s session were Consumer Discretionary and Consumer Staples. Starting with the Discretionary sector, Monday’s rally took the sector within spitting distance of the 200-DMA, but a late-day rally on Tuesday helped to push the sector marginally above it.

While the more cyclical Consumer Discretionary sector managed to reclaim its 200-DMA, the more defensive-oriented Consumer Staples sector traded down modestly below that level yesterday. It’s good from a market perspective to see Consumer Discretionary rallying while the defensive-oriented Staples sector lags, but at this point, rather than breaking down, the sector has simply been trendless. In each of the last six trading days, the sector closed within 1% of its 200-DMA; three of those closes were above and three were below. In other words, the only ones making money in the sector recently have been Duke & Duke.

The Closer – Quant Whipsaw, MAHA, Housing – 3/25/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with a look at the massive whipsaw in quant factors (page 1). We then check in on stocks impacted by MAHA (page 2) and the crowning of a new market cap king in Europe (page 3). After an update on the latest Treasury allotment data (page 4), we review the crude term premium (page 5) and latest housing data (pages 6 and 7). We round out tonight’s report with an update of regional Fed manufacturing data (pages 8 – 10).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Q1 2025 Earnings Conference Call Recaps: McCormick (MKC)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers McCormick’s (MKC) Q1 2025 earnings call.

McCormick (MKC) is a global leader in flavor, manufacturing and distributing spices, seasonings, condiments, and flavor solutions to both consumers and industrial customers. Its products are household staples, like Lawry’s, Frank’s RedHot, and French’s mustard, and are also embedded behind the scenes in the foodservice and packaged food industries. MKC posted 2% organic sales growth driven by volume gains in both Consumer and Flavor Solutions segments, despite cautious consumer behavior globally. Consumers continue cooking at home and seeking value, boosting core categories like spices, gravy mixes, and hot sauce, where MKC outpaced private label for a third straight quarter. High-growth and QSR customers helped offset weak volumes from large CPG clients. The company maintained full-year guidance, expects gross margins to expand 50–100 bps, and plans to offset China tariff costs through cost savings. Management remains confident in long-term consumer trends favoring home-cooked, flavorful, healthier meals. MKC opened 4.1% lower on 3/25 but recovered most of it early in the trading day…

Continue reading our Conference Call Recap for MKC by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below: