The Closer – Internationals vs. Domestics, PMIs, LMI – 4/1/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with a look at the performance of stocks with the greatest and least international revenue exposure and their response to tariff headlines (pages 1 and 2). We then pivot over to a look at credit activity (page 3) followed be a review of the latest economic data including construction spending (page 4), PMIs (page 5), LMI (page 6 and 7), JOLTS (page 8), and finally Indeed job postings (page 9).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke Market Calendar — April 2025

Please click the image below to view our April 2025 market calendar. This calendar includes the S&P 500’s historical average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – Spring Clean-Up

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“On April Fools’ Day, believe nothing, trust no one, just like any other day.” – Unknown

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Below is a review of asset class performance in Q1 using our ETF matrix. For domestic index ETFs, it’s been a nasty run, although we’d note that seven of the eleven US sector ETFs finished the quarter higher.

Outside of the US, however, there was green nearly everywhere in Q1. While the S&P 500 (SPY) was down 4.3%, the all-world ex-US ETF (CWI) gained 5.9% during the quarter, and country ETFs like Brazil (EWZ), China (MCHI), France (EWQ), Germany (EWG), Italy (EWI), Spain (EWP), and the UK (EWU) were all up 10%+.

Commodity ETFs outside of agriculture also posted solid Q1 gains. Both gold (GLD) and silver (SLV) gained more than 15%, while natural gas (UNG) rose 28.6%. Fixed-income ETFs posted solid Q1 returns as well.

Within US equities, the mega-caps accounted for nearly all of the S&P 500’s Q1 drop. As shown below, the five largest stocks in the S&P all fell more than 10% in Q1, and the ten largest are down an average of 11.4% YTD. The rest of the stocks in the S&P 500 are down an average of just 0.6% YTD.

The Closer – Quarter Over, Gap Down, Support – 3/31/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we kick off with a look at the intraday performance of equities (page 1) followed by an update on the performance of the 60/40 portfolio (page 2). We then provide a rundown of asset performance in Q1 (page 3) including the historic disconnect between gold, international stocks, and the S&P 500 (page 4). We also provide a decile analysis of the quarter (page 5). We cap off with a final update of our Five Fed Manufacturing composite for March (pages 6 and 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Bespoke Matrix of Economic Indicators – 3/31/25

Our Matrix of Economic Indicators provides a concise summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Bespoke’s Morning Lineup – 3/31/25 – New Lows?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“At its best, life is completely unpredictable.” – Christopher Walken

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

If Christopher Walken was right, why do the markets feel so terrible? You’ve seen all the different ways of measuring the extreme levels of uncertainty in the markets, and it only seems to get worse with each passing day. After President Trump spent much of last week downplaying the degree of tariffs that would be announced on April 2nd, so-called “Liberation Day”, last night the Wall Street Journal reported that the Administration is now re-considering an across-the-board 20% tariff. So, if you thought you had no idea what was going on, you’re not alone. Adding to that, if you think we’ll suddenly start to see certainty come Wednesday, good luck with that.

Equity futures are sharply lower to start the week even after Friday’s plunge. While the rest of the world appeared to have avoided America’s cold, that’s not the case this morning. Europe’s STOXX 600 is down close to 2% relative to Friday’s close and nearly 6% from its YTD high. Asian stocks were also lower overnight. The Nikkei plunged over 4% and is now down 12% from its high in December.

S&P 500 futures are down just about 1% this morning, and that puts the lows from mid-March into play as the current level of the SPDR S&P 500 ETF (SPY) is right between its intraday low ($549.68) and its closing low ($551.42) from March 13th. If the intraday lows from that day don’t hold, the next potential level of support is the post-Labor Day lows.

Brunch Reads – 3/30/25

Welcome to Bespoke Brunch Reads — a linkfest of some of our favorite articles over the past week. The links are mostly market-related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

I Hope You’re All Republicans: With presidential assassinations in the news for several reasons as of late including the recent release of JFK files and the attempt on President Trump’s life last year, we look back to March 30, 1981, forty-four years ago today. Just two months into his presidency, Ronald Reagan had finished addressing a gathering of labor leaders at the Washington Hilton Hotel. At 2:27 pm, as Reagan exited the hotel and waved to a small crowd, six gunshots cracked through the air. Secret Service agents immediately sprang into action, pushing the President into his limousine and subduing the shooter, 25-year-old John Hinckley Jr. Within seconds, blood was on the pavement. White House Press Secretary James Brady lay critically wounded with a bullet to the head. A DC police officer and a Secret Service agent were also hit.

Initially, Reagan didn’t even realize he’d been shot. He was inside the armored limousine when he began coughing up blood and feeling faint. A bullet had ricocheted off the limo and pierced his left lung, coming perilously close to his heart. Despite the gravity of the wound, Reagan remained calm and famously joked to doctors at George Washington University Hospital, “I hope you’re all Republicans.” Reagan survived emergency surgery and rapidly recovered, earning him a wave of public sympathy and solidifying his image as a resilient leader.

Hinckley later claimed he acted to impress actress Jodie Foster, inspired by the film Taxi Driver. He was found not guilty by reason of insanity and was institutionalized for decades. The attempt on Reagan’s life led to major reforms in presidential security but was not the last assassination attempt on a current or former US President.

Sports & Entertainment

Farewell, Cinderella: March Madness Surrenders to the Powerhouses (WSJ)

This year’s Sweet 16 is completely Cinderella-free. Every team left standing comes from just four major conferences and the lowest seed left is Arkansas, hardly an underdog. The era of plucky mid-majors sneaking through seems to be fading fast, thanks to conference realignment, NIL money, and the transfer portal turning college hoops into a high-stakes game of musical chairs. Fans might miss the charm of a true underdog run, but the brands still draw big crowds. [Link]

Continue reading our weekly Brunch Reads linkfest by logging in if you’re already a member or signing up for a trial to one of our two membership levels shown below! You can cancel at any time.

The Bespoke Report – Equity Market Pros and Cons – Q2 2025

This week’s Bespoke Report is an updated version of our “Pros and Cons” edition for Q2 2025.

With this report, you’re able to get a complete picture of the bull and bear case for US stocks right now. It’s heavy on graphics and light on text, but we let the charts and tables do the talking!

On page three of the report, you’ll see a full list of the pros and cons that we lay out. Slides for each topic are then provided on page four and beyond.

To read this report and access everything else Bespoke’s research platform has to offer, sign up for Bespoke’s 50/20 special today. Our 50/20 special gets you a full year of Premium for half off, then 20% off per month after the first year. SIGN UP HERE.

Below is a look at the performance of key ETFs across asset classes since Election Day and Inauguration Day. International markets, defensives, precious metals, and Treasuries have been the only areas of strength during Trump 2.0. What’s the right acronym for that?

Q4 2024 Earnings Conference Call Recaps: Lululemon Athletica (LULU)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Lululemon’s (LULU) Q4 2024 earnings call.

Lululemon Athletica (LULU) is an athletic apparel retailer specializing in technical athletic wear for activities such as yoga, running, and training. The company offers a range of products, including pants, shorts, tops, jackets, and accessories designed for both men and women. Known for its innovative, high-quality fabrics like Luon and Luxtreme, LULU has positioned itself as a premium brand in the athleisure market. Beyond apparel, Lululemon provides insights into the growing intersection of fitness and fashion, catering to consumers seeking both performance and style. To end its year, LULU reported a 13% YoY increase in revenue, reaching $3.61 billion. Despite this growth, the company experienced a slowdown in traffic at its 374 US stores, attributed to cautious consumer behavior amid economic uncertainties and high inflation. International markets, particularly China, showed strength, with a 21% increase in same-store sales. CEO Calvin McDonald highlighted ongoing challenges such as tariffs and increased competition from emerging brands like Alo Yoga and Vuori. Despite better-than-expected results, downbeat guidance spooked investors, dragging the stock down more than 15% in trading on 3/28…

Continue reading our Conference Call Recap for LULU by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Bespoke’s Morning Lineup – 3/28/25 – Breakout Fake Out

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There’s simply no polite way to tell people they’ve dedicated their lives to an illusion.” – Daniel Dennett

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

As the S&P 500 and Nasdaq look to extend their weekly winning streaks to two, they will need some help. Overnight, Asian markets were lower across the board with the Nikkei down 0.3% while China was down 0.7% as tariff concerns continue to weigh on sentiment. In Europe, things aren’t much better as the fallout from this week’s tariff announcements and others planned for next week on April 2nd, shake investor confidence. The STOXX 600 is down about 0.5% which would put it down by about 1% for the week.

US futures are down across the board with the S&P 500 trading nearly 0.2% lower while the Nasdaq faces a decline of 0.31%. Treasury yields had been rising in recent days even as stocks struggled, but this morning, the 10-year yield is 4 basis points lower to 4.33%. Oil prices are basically unchanged at just under $70 per barrel, while gold and silver are both up about 1%. After hitting a record high two days ago and selling off by over 4% since then, copper prices are marginally lower again this morning.

This morning’s economic calendar is busy with Personal Income and Spending at 8:30, as well as the Michigan Sentiment report at 10 AM. The key report of the day, however, will be the PCE report at 8:30. How this report comes in relative to expectations will likely determine whether the week finishes with a plus sign or minus sign next to it.

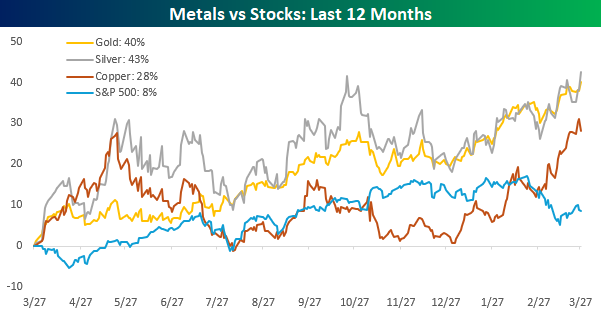

Stocks have had difficulties seeing gains lately, but hard assets like gold, silver, and copper have been ripping higher. Over the last year, gold and silver have rallied 40% or more while copper prices have risen 28%. The S&P 500 is also up on a y/y basis, but it’s up by less than a third of copper’s gain and less than a quarter of gold and silver. While gold and silver have been outperforming the S&P 500, up until just recently copper had been underperforming. Since the S&P 500’s peak in mid-February, though, all three commodities have seen their rallies pick up steam, and this week they all traded at 52-week and/or all-time highs.

This week’s move in copper was particularly interesting. After trading at an all-time high on Wednesday, copper finished the day down more than 2% from its intraday high and fell another 2%+ in Thursday’s session. As you can see in the chart, the commodity had a similar move higher and subsequent reversal early last May when it hit record highs after an even more impressive rally. While it’s tempting to look at the rally in copper as a sign of economic strength, it’s worth pointing out that the price in New York has rallied more than the price in London, and that’s because traders have been stockpiling inventories ahead of anticipated tariffs from the Trump administration.