Bespoke’s Morning Lineup – 2/21/23 – Weak Start to a Strong Week

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“In business, as in politics, it is never easy to go against the beliefs and attitudes held by the majority.” – J. Paul Getty

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Markets have been bending from the spike higher in interest rates, but they have yet to break yet. This morning, they’re getting another test as retail earnings from Home Depot (HD) and Walmart (WMT) has put a drag on futures. Dow futures are down over 300 to kick off the week, the Nasdaq is down about 1%, and the S&P 500 is down about 0.85%.

Oil prices are modestly higher this morning as they continue to churn around in the high 70s which is a range is has been stuck around for more than two months. As shown in the chart below, the low $70s has been a price floor since early December while the low 80s has been a ceiling. As the sideways range has extended at levels much lower than where they were in all of 2022, the 50 and 200-day moving averages continue to drift lower, and this morning, WTI is back below both of those levels.

The sideways range of the last 50 trading days has now shrunk below 18%, which as shown in the chart below, is the narrowest trading range since May 2021. Not necessarily extreme by historical ranges, but given the war with Russia and its impact on the oil market, it’s been a bit of a snoozer in energy markets.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bespoke Brunch Reads: 2/19/23

Welcome to Bespoke Brunch Reads — a linkfest of the favorite things we read over the past week. The links are mostly market related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

While you’re here, join Bespoke Premium with a 30-day trial!

Inflation

The world’s biggest food company says prices will rise further this year by Hanna Ziady (CNN)

Nestle guided further price increases on staple items that are staple parts of grocery shops all over the world, citing a process of “repairing our gross margin”. [Link]

There’s a new inflation warning for consumers coming from the supply chain by Lori Ann LaRocca (CNBC)

A glut of goods brought in to the US over the past year are stuffing warehouses, sending the cost to rent or buy temporary extra space soaring; logistics industries remain key inflationary drivers in the US. [Link]

Big Tech

The maze is in the mouse by Praveen Seshadri (Medium)

A founder of a company acquired by Google just before the pandemic hit describes the difficulties Google has operating at scale, while also offering his own prescriptions for how to make it out of the mess. [Link]

Yes, Elon Musk created a special system for showing you all his tweets first by Zoë Schiffer and Casey Newton (Platformer)

Frustrated that the President of the United States (yes, the President of the United States) got more engagement on a throw-away tweet about the Super Bowl, the Twitter CEO demanded his engineers boost his tweets to users and drive up engagement. [Link]

Bing AI Can’t Be Trusted by Dmitri Brereton (DKB Blog)

A series of examples showing how the not-ready-for-primetime AI chatbot rolled out by Microsoft this week, leading to an embarrassing failure. [Link]

Amazon Takes a 50% Cut of Seller’s Revenue by Jouzas Kaziukenas (Marketplace Pulse)

Transaction fees, fulfillment fees, and advertising and promotions can mean that third party Amazon sellers are surrendering more than 50% of revenue to the company amidst already-stiff competition and low margins. [Link]

Ballooning

Hobby Club’s Missing Balloon Feared Shot Down By USAF by Steve Trimble (Aviation Week)

The Northern Illinois Bottlecap Balloon Brigade reports that the last time one of its balloons was observed was at 39k feet on February 10 near Alaska. The small hobbyist group is one likely benign source for the unidentified objects the Air Force has shot down in recent weeks. [Link]

The latest info on the aerial objects we shot down by Jeff Jackson (Substack)

Freshman Congressman Jackson offers some useful briefing information he received this week that goes part of the way to explain the litany of unidentified aerial phenomena in US skies. [Link]

Auto Industry

Tesla Workers Launch Union Campaign in New York by Josh Eidelson (Bloomberg)

A group of employees who work in data processing for Tesla notified management this week that they are seeking to unionize. The company’s Buffalo plant includes roughly 800 employees in that role. [Link; soft paywall, auto-playing video]

Automobile Ads from 100 Years Ago (The Saturday Evening Post)

More than a dozen different auto manufacturers booked full page ads for their vehicles in the Saturday Evening Post from 100 years ago. Sedans and coupes dominate the offerings. [Link]

COVID

Immunity acquired from a Covid infection is as protective as vaccination against severe illness and death, study finds by Akshay Syal (NBC)

It shouldn’t be a huge surprise that exposure to an actual virus creates more immunity than vaccines (though COVID vaccines still offer great protection too). [Link; auto-playing video]

Debt Ceiling

This Is What Happens If the US Actually Hits the Debt Ceiling by Tracy Alloway and Joe Weisenthal (Bloomberg)

Bespoke’s own George Pearkes discusses the financial market and economic implications of the debt ceiling, as well as a general framework for understanding its politics. [Link; paywall]

Transitions

Decarbonization: The long view, trends and transience, net zero (Nat Bullard)

Over 100 slides on the mechanics and dynamics of moving the world away from fossil fuels after centuries of dependence. [Link]

Turning offices into condos: New York after the pandemic by Joshua Chaffin (FT)

With booming demand to live in Manhattan and falling interest for offices inside the city, conversions of office towers into apartments is under way at scale. [Link; paywall]

Taxes

Get Paid Online? Here’s How to Tell if You Owe the IRS Taxes by Aslea Ebeling (WSJ)

Online payment platforms and gig economy sites will send millions of 1099-K forms this year as part of a growing trend of Schedule C filings. [Link; paywall]

Trauma

Teen girls ‘engulfed’ in violence and trauma, CDC finds by Donna St. George (WaPo)

A remarkable study from the CDC (link; 89 page PDF) has some downright dire data on the state of American teens who are facing horrifying rates of violence. [Link; paywall]

Read Bespoke’s most actionable market research by joining Bespoke Premium today! Get started here.

Have a great weekend!

Bespoke’s Morning Lineup – 2/17/23 – Another Down Friday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The man who reads nothing at all is better educated than the man who reads nothing but newspapers.” – Thomas Jefferson

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

After yesterday afternoon’s plunge, equity futures have picked up right where they left off and are indicated to open the last trading day of the week lower. Treasury yields are higher across the curve, and crude oil is plunging as the dollar rallies. Today will be a test for the buy the dippers who failed to step in yesterday. Will they show up today, or did they start their holiday weekend early.

Heading into the last trading day of the week, the market has grown increasingly concerned that the economy and inflation is too strong for the Fed’s liking. This week’s CPI and PPI reports certainly did not provide any ammo to the camp that’s expecting inflation to quickly revert to pre-COVID norms, but they also covered a month where gas prices surged 9%. As we noted in last week’s Bespoke Report, months where national average gas prices increase 9% or more have historically seen an average monthly increase of 0.5% in CPI which is exactly how much CPI increased in January. February is only half over, but gas prices this month have actually declined over 2%, which would be one of the weaker Februarys for gas prices dating back to 2004, so that has the potential to act as a tailwind next month.

Regarding the economy, Retail Sales came in significantly better than expected this week, but with three straight significantly stronger-than-expected Januarys in a row, seasonal adjustments may not be entirely accurate in the post-COVID world. Outside of the consumer, this week’s data wasn’t entirely indicative of a booming economy either. While Jobless Claims remain near historical lows, indicators like Small Business Optimism, New York and Philadelphia Fed manufacturing reports, Industrial Production, Capacity Utilization, Building Permits, and Housing Starts weren’t exactly positive this week.

During the month of January, Housing Starts fell over 4% on a m/m basis and more than 20% y/y. Single-family units, which tend to have a greater economic impact than multi-family units, were even weaker falling by 27% while single-family Building Permits fell 40% y/y. When looking at the 12-month moving average of Housing Starts, what started as a gradual deterioration has turned into a more dramatic decline that looks increasingly reminiscent of prior rollovers that occurred during or leading up to recessions.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Bulls Step Back

The S&P 500 hasn’t moved decisively in any direction over the past week, and as a result, sentiment saw little change. 34.1% of respondents to the weekly AAII sentiment survey reported as bullish this week, down from a high of 37.5% last week.

Bearish sentiment took from those bullish losses as the reading rose up to 28.8% from 25%. Even though that is a higher reading, it is still the only other reading below 30% since last March.

Additionally, the pickup in bearish sentiment was not enough to make bears outnumber bulls. As such, the bull-bear spread saw its first back-to-back positive readings since November 2021.

Although over a third of respondents reported as bullish, this week’s predominant sentiment level was neutral. 37.1% reported as such this week. That reading has now been above its historical average of 31.4% for seven straight weeks; the longest streak since January 2021.

Other sentiment surveys have likewise taken more optimistic tones lately despite a modest pullback in bullish sentiment this week. Factoring in the Investors Intelligence and NAAIM sentiment readings, our sentiment composite remains positive but is off from its short-term peak last week. Click here to learn more about Bespoke’s premium stock market research service.

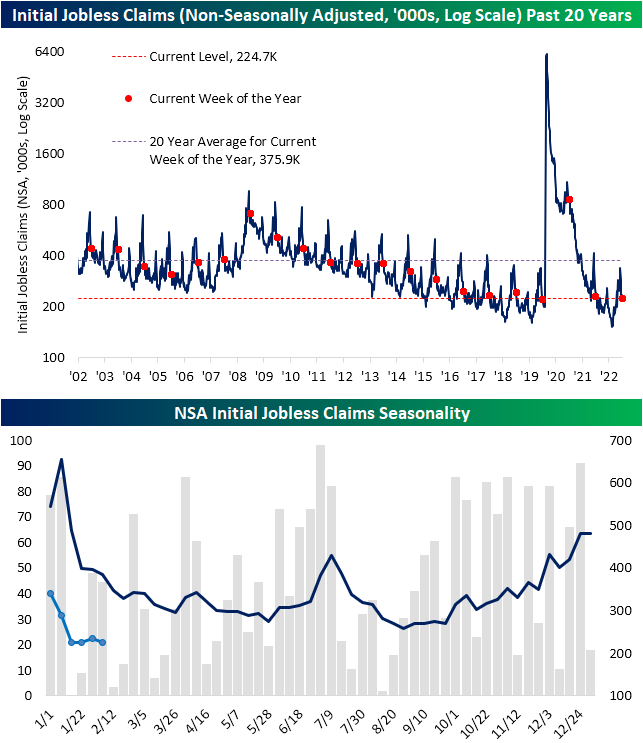

Claims Still Below 200K

Jobless claims continue to impress in the new year. For the fifth week in a row, seasonally adjusted initial claims have come in with a sub-200K reading. That is the longest streak since a 10 week long stretch ending in April of last year. Although claims have remained at a healthy level, there hasn’t been much in the way of improvement over the last few weeks with claims yet to move below the 183K low at the end of January.

On a non-seasonally adjusted basis, the first few months of the year tends to see a sharp unwind in claims, albeit with some moderation during the current week of the year which is being observed currently with fairly flat readings in claims over the past few weeks. At current levels, this year’s reading was roughly in line with the comparable week of the past several years with the exception of the much more elevated reading in 2021.

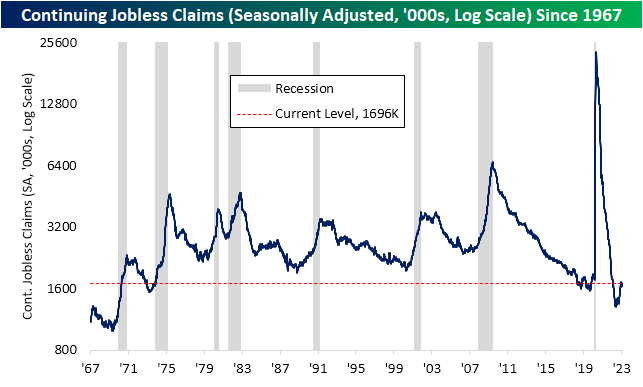

While not to say the reading is at unhealthy levels, continuing claims have not been as strong as initial claims. Claims have risen in each of the past two weeks, totaling 1.696 million in the most recent print. That is the highest level since the week of December 24th. Overall, both initial and continuing claims continue to show healthy readings without much in the way of rapid improvement or deterioration. Click here to learn more about Bespoke’s premium stock market research service.

The Bespoke 50 Growth Stocks — 2/16/23

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Bespoke’s Morning Lineup – 2/16/23 – More Data

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Like it or not, life is a game. Whoever denies that truth, whoever simply refuses to play, gets left on the sidelines.” – Phil Knight

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

There’s a tone of weakness in the market this morning ahead of another busy morning for economic data with PPI, Housing Starts, Building Permits, Jobless Claims, and the Philly Fed all being released at 8:30. The S&P 500 is poised to open down about 40 basis points (bps) while the Nasdaq is down closer to 0.5%. Despite the weakness in equities, Treasuries are actually trading modestly higher as crude sees modest gains. The only real asset class showing strength is crypto as bitcoin is up nearly 2%.

Overshadowed somewhat by the much stronger-than-expected Retail Sales report, yesterday’s update on Industrial Production for January missed forecasts by a wide margin showing no growth in January versus forecasts for an increase of 0.5%. January’s report marked the second straight month that Industrial Production was 1.5% or more below a 12-month high which is the largest decline from a peak since the COVID crash. Looking at the chart below, there have been plenty of other times when Industrial Production showed larger declines. That being said, in the majority of instances where Industrial Production dropped this much or more, a recession wasn’t far behind. There were exceptions but not a lot of them.

This doesn’t mean that a recession is imminent. Every period is different. What the current period has going for it is that consumer balance sheets were in great shape heading into the current FOMC tightening cycle, and the employment backdrop remains positive. The hope is that these factors will provide a long enough bridge to get over the valley of the manufacturing sector’s slowdown.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

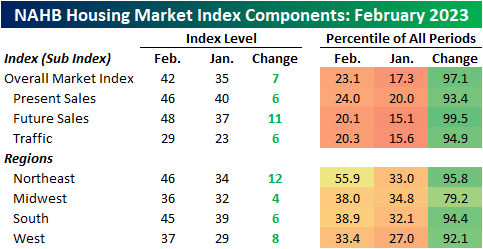

Homebuilder Sentiment Pops

Wednesday’s release of homebuilder sentiment from the NAHB showed a significant rebound in sentiment as the headline reading has risen in back-to-back months from the low of 31 in December up to 42 this month. While that is not a screaming endorsement of strength from homebuilders (in the past decade, the only times the index was this low was the past few months and the start of the pandemic), it does mark an improvement in sentiment that is consistent with the recent turnaround in mortgage rates and the rise in weekly mortgage applications.

While sentiment has risen in back-to-back months, the moves from January to February were historic across the report. The only index to not experience a monthly move that ranks in the top decile of all periods was the Midwest. Future Sales was the most impressive with its 11-point jump tied with November 1988 for the second largest month-over-month increase on record.

As for the headline index, the 7-point increase was the largest increase since the months of May, June and July 2020 when sentiment began to recover from the pandemic plummet. Prior to 2020, June 2013 was the last time sentiment has risen by as much. Click here to learn more about Bespoke’s premium stock market research service.

Bespoke’s Morning Lineup – 2/15/23 – Retail Sales Come in Hot

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“No company can afford not to move forward. It may be at the top of the heap today but at the bottom of the heap tomorrow, if it doesn’t.” – James Cash Penney

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures were already modestly weaker heading into the January Retail Sales report, but the much stronger-than-expected readings have added extra pressure to equity prices as Treasury yields continue to rise. The 10-year yield is on pace to close at its highest level of the year while the 2-year yield is knocking on its cycle highs from late October. Empire Manufacturing for the month of February was still negative but came in better than expected after showing a larger-than-expected improvement from January’s dismal readings. Still on the agenda today, we have Industrial Production, Capacity Utilization, Business Inventories, and Homebuilder sentiment. Lower rates had been helping the housing sector earlier this year, but increases in yields over the last week or so haven’t been helpful.

With Retail Sales on the front burner this morning, we wanted to provide a quick update on the performance of retail-related stocks so far this year. The two most popular ETFs tracking the retail sector are the VanEck Retail ETF (RTH) and the S&P Retail ETF (XRT). Depending on which one you look at, YTD performance varies greatly. RTH has rallied 5.45% since the start of the year, while XRT has nearly tripled that performance with a gain of 16.33%.

So, what explains the outperformance this year? Looking at the top ten holding of each ETF and their YTD performance, they may be retail-related ETFs, but they sure don’t have a lot in common. XRT is basically a broad-based equal-weighted ETF where no company has a weighting in excess of 2.5%. RTH, however, is a more top-heavy market cap-weighted tracker of the retail space. In RTH, Amazon.com (AMZN) accounts for over 20% of the holdings, Home Depot (HD) accounts for 8%, and Walmart (WMT) and Costco (COST) each have a weighting of about 6%.

As shown in the chart below, not one of the top ten holdings of XRT is also a top-ten holding of RTH, and all of the top ten holdings of XRT are up sharply YTD. In fact, the worst-performing top ten holding of XRT (Children’s Place) is still up over 25% YTD which is more than five percentage points better than the top performing top ten holding of RTH (AMZN).

The performance disparity between the two ETFs hasn’t just been confined to this year. Looking at the relative strength of the two ETFs over the last three years shows how they have traded off between periods when each one took the lead. From the early days of COVID through early 2021, XRT outperformed RTH by a wide margin, but during the bear market of 2022, it was RTH that outperformed as the largest cap retailers went down less than many of the smaller ones. This year, though, the tide has been turning in the first six weeks of the year. Despite tracking the same sector of the economy, the performance of both XRT and RTH over the last three years shows how even if you get the macro trend right, how you implement the trade will be just as, if not even more important than the premise behind the trade in the first place.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Inflation Concerns Easing

As we noted in an earlier post, this morning’s release of the NFIB Small Business Survey showed fewer and fewer respondents observing price increases. Similarly, while still high, fewer respondents to the survey are reporting inflation as their biggest problem. While the issue remains historically elevated and the predominant issue for small businesses, the percentage of respondents reporting inflation as their biggest issue fell to 26% in January. That compared to a peak of 37% last summer. As shown below, this reading still has a long way to fall to get back to pre-COVID norms, but at least it’s trending in the right direction.

In the table below, we break down the percentage of small business respondents that reported various issues as their most pressing this month. As mentioned above, inflation remains the single most commonly reported issue and that reading is also the most elevated with regards to its historical range. However, the six point decline month over month ranks in the bottom 1% of all month over month moves. At the same time, fewer respondents reported costs of insurance to be an issue. Government requirements and red tape also pulled back, albeit that was offset with a 4 percentage point jump (a 95 percentile month over month move) in the share reporting taxes as their biggest issue. When it comes to “poor sales,” only 4% of small businesses listed this as their number one problem — the same level it was at last month and in the bottom percentile of all readings in the survey’s history. When it comes to recessionary indicators, we would expect small businesses to list “poor sales” as their number one problem when things really start to slow down, and that simply hasn’t happened yet. Click here to learn more about Bespoke’s premium stock market research service.