The Bespoke Report – 4/21/23 – Are You Even Listening?

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

The buildup to earnings season is always full of anticipation, but it usually starts off slowly as the pace of reports doesn’t usually really get going until the second full week of the reporting period. This earnings season has proved to be no different. While there were some notable reports from companies like Tesla (TSLA), Netflix (NFLX), Goldman Sachs (GS), Johnson & Johnson (JNJ), Lockheed Martin (LMT), IBM, AT&T (T), Taiwan Semi (TSM), and Procter & Gamble (PG), the real fireworks won’t be until next week when more of the mega-cap stocks start to report.

While equities escaped the week with just modest losses, they felt heavy for most of the week. As things stand now, both the S&P 500 and Nasdaq remain stuck in a sideways range and have stalled out at their February highs and remain well off their highs from last August. For all the talk about whether we’re in a new bull market or still stuck in a bear, at this point it seems like neither. If you want to call it a bear market, it looks about as savage as a koala, and if you’re going to go the bull route, it’s raging more like a cow than a bull.

Continue reading this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.

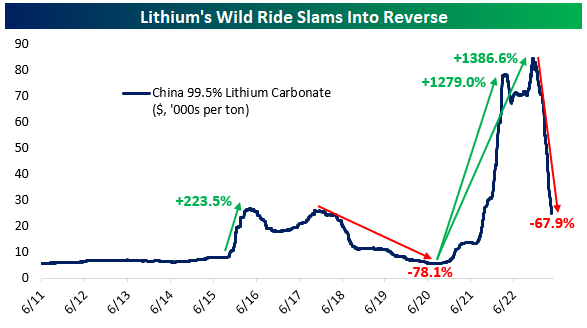

Lithium: The Cycle Continues

If you haven’t checked the price of lithium lately, you might be in for a surprise. Spot prices for lithium carbonate in China have collapsed by two-thirds since hitting record highs in November of last year. Prices have gone from $84k per ton to $25k per ton. That unwinds the vast majority of a spectacular surge that played out from 2020 to 2022. Lithium initially surged 1,279% from July 2020 to March 2022 as part of the broader explosion of commodity prices and booming demand for electric vehicles, eventually peaking up 1,387% from the post-COVID lows. It’s easy to forget that this critical battery input had already gone through one such cycle. A 224% rally in 6 months during late 2015 and early 2016 before a long, slow bear market that saw prices down 78% over several years.

In the equity market, the price cycle hasn’t been as dramatic in percentage terms, but there has still nonetheless been a double cycle of surging stock prices in 2016 followed by a grinding bear market, and then an even more dramatic surge through late 2022 that is now sliding into reverse. On Thursday, Chile’s government announced reforms to its lithium extraction policy. While existing contracts with firms that operate in the rich lithium brine deposits of the Chilean Atacama desert will be honored, the market is looking at weaker lithium prices and the fact that existing contracts will be replaced by less favorable ones 10+ years down the line and hitting lithium players. SQM is off 21% today while ALB is 10% lower.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Earth Day 2023: “Invest in our Planet”

Tomorrow will mark Earth Day, an annual event in support of environmental protection. Befitting of this year’s theme “Invest in our Planet” in the charts below we check in on the performance of clean energy stocks via the iShares Global Clean Energy ETF (ICLN). As shown, ICLN has been stuck in a sideways trend over the past year with the 200-DMA essentially flat since the fall. At the moment, price is sandwiched between the 200-day and its 50-DMA. While time will tell if the 50-DMA provides any support, the past week has seen ICLN fail to break out of the downtrend off of last summer’s highs.

That downtrend also traces back even further to the early January 2021 high which was put in place following the massive run in clean energy stocks during the first year of the pandemic.

ICLN is comprised of a number of clean energy stocks from around the globe. In the snapshot from our Chart Scanner below, we show the ETF’s eight largest US-based holdings. As the ETF is trending sideways, these individual holdings’ trends are all over the place. For example, while Bloom Energy (BE) and Consolidated Edison (ED) are trending sideways, First Solar (FSLR) has been in a steady long-term uptrend. Conversely, Plug Power (PLUG) and Sunrun (RUN) have traded in steady downtrends for some time now with the former near 52-week lows.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Bespoke’s Morning Lineup – 4/21/23 – Crawling into the Weekend

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“By day the banished sun circles the earth like a grieving mother with a lamp.” – Cormac McCarthy

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Futures this morning have moved modestly into positive territory after trading lower overnight, but after two straight days of modest declines for stocks, there’s a heavy feeling into the weekend. The only economic data on the calendar this morning are preliminary PMI data for April from S&P. In reports for other countries we have seen already this morning, the general trend has been one of weaker readings in manufacturing and improvement in services.

Treasuries are generally trading higher this morning with the biggest moves coming at the short end of the curve. In Fedspeak overnight, Philadelphia Fed President Patrick Harker made some common sense comments when he said that “We need to be a little cautious here to not just respond to the current level of inflation, but where we think it’s going.”

With tomorrow being Earth Day, we wanted to take a quick look at how global equities look heading into the weekend and as we’re close to four full months into the (no longer) new year. While the S&P 500 has been struggling to even take out its February high, the highs from last August before Powell’s Jackson Hole speech tanked the market still loom above. Global equities, however, have fared better. In addition to trading right at the February highs, the MSCI All Country World ETF (ACWI) is also right at the highs from last August as the low-$90s range is a level that has acted as resistance multiple times in the last seven months. Bulls will point to the fact that during the pullback that followed the last unsuccessful breakout, ACWI made a higher low, while bears will highlight the fact that volume during the last leg higher was anemic. Whichever way it breaks from here, though, the move is likely to be a significant one.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Homebuilders Breaking Out Like It’s…

It’s hard to get over how well the homebuilder stocks have been performing lately. As shown in the charts below of stocks in the S&P 1500 Homebuilder group, these names are nearly universally in steep six-month uptrends and breaking out as we type.

Below is another way to see just how crazy the run has been for the S&P 1500 Homebuilder stocks lately. Most names are now up 30-40% year-to-date after rallying 5-10% over the last week. This has pushed them ~10% above their 50-DMAs, and many are trading more than two (or even three for some) standard deviations above their 50-DMAs in extreme overbought territory.

“Mr. Market” has either lost its mind or it’s predicting that all the current worries about housing in the months and quarters ahead are misguided.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Jobless Claims Nearing New Highs

Jobless claims have continued to weaken with this week’s release, rising by 5K to 245K versus expectations of no change from last week’s upwardly revised 240K print. At current levels, claims sit at the high end of the range since the start of 2022 and only a couple thousand below last month’s high.

Prior to seasonal adjustment, claims have essentially come in right inline with the reading for the same week last year and the few years prior to the pandemic. As shown in the second chart below, claims tend to experience a little bit of a bounce around this point of the year before resuming a move lower through the late spring.

Continuing claims were equally disappointing this week rising to 1.865 million, 40K above expectations. Although the increase to initial claims has not resulted in a new high, the 61K increase for continuing claims leaves the indicator at the highest level since late November 2021.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

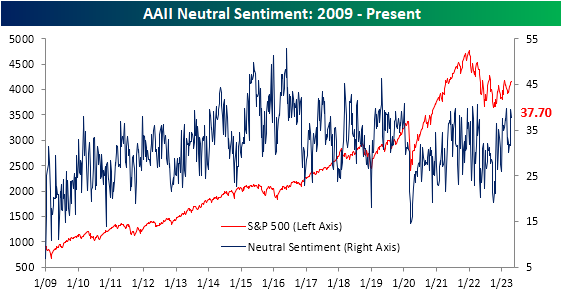

Bulls Keep Coming Back

The S&P 500 has been little changed in the past week resulting in little change to sentiment according to the latest AAII survey. 27.2% of respondents reported as bullish this week, up 1.1 percentage points versus the previous week. Albeit higher, that does not result in any sort of new high as bullish sentiment sits right in the middle of the past year’s range

Bearish sentiment likewise picked up this week rising from 34.5% to 35.1%. That is only the highest level in three weeks as bearish sentiment remains relatively muted versus the significantly elevated readings of the past year.

With that said, sentiment continued to favor bearishness with the bull-bear spread sitting at -7.9. This week marks the ninth in a row in which bearish sentiment outweighed bullish sentiment.

Given both bullish and bearish readings rose, each group borrowed from the neutral pool which pivoted off of a recent high of 39.5% down to a still elevated 37.7%.

Factoring in other sentiment surveys, there was more bullish tones. The NAAIM Exposure index indicated active managers added long exposure to equities and the Investors Intelligence survey showed the highest bull-bear spread since the first week of 2022. That leaves the AAII survey as the only one of the three with sentiment readings that are more bearish than historically normal.

Have you tried Bespoke All Access yet?

Bespoke’s All Access research package is quick-hitting, actionable, and easily digestible. Bespoke’s unique data points and analysis help investors better visualize underlying market trends to ultimately make more informed investment decisions.

Our daily research consists of a pre-market note, a post-market note, and our Chart of the Day. These three daily reports are supplemented with additional research pieces covering ETFs and asset allocation trends, global macro analysis, earnings and conference call analysis, market breadth and internals, economic indicator databases, growth and dividend income stock baskets, and unique interactive trading tools.

Click here to sign up for a one-month trial to Bespoke All Access, or you can read even more about Bespoke All Access here.

Bespoke’s Morning Lineup – 4/20/23 – Claims High, Philly Blunted

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Computers are magnificent tools for the realization of our dreams, but no machine can replace the human spark of spirit, compassion, love, and understanding.” – Lou Gerstner

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

There was nothing especially insightful or controversial about the above quote from Lou Gerstner, former Chairman and CEO of IBM, when he made it years ago, and it has been applicable for the entire history of computers – that is until now. With the rise of AI tools, whether computers have sentience has become a topic of debate, and as the technology improves, those on the side that believes computers can in fact express compassion, love, and understanding will only grow.

You can ponder what computers with feelings will mean for mankind later (maybe, if you observe, as you celebrate 4/20 day later on), but for now, we have the thick of earnings season to deal with, and this morning, investors aren’t particularly pleased with what they see. The major driver of market weakness this morning is Tesla (TSLA) which is down over 7% after reporting weaker-than-expected margins.

Outside of TSLA yesterday, most earnings reports after the close were better than expected with three-quarters of companies reporting topping EPS forecasts. This morning has been another story, though, as only half of the companies reporting have beat estimates on the bottom line. One trend that could be weighing on markets this morning is guidance. Since yesterday’s close, eight companies have lowered guidance while just two (Calix Networks and D.R. Horton) have managed to raise guidance. It’s only a one-day snapshot, but if it becomes a more persistent trend, it would be a cautionary sign for the economy.

Economic data just released showed that jobless claims came in higher than expected on both an initial and continuing basis, and both are either at or near 52-week highs. The Philly Fed report on manufacturing also came in much weaker than expected and fell to a post-Covid low. Not only that but Prices Paid also dropped sharply falling to its lowest level since June 2020 while Prices Received actually went negative for the first time since May 2020. Later on, we’ll get updates on Existing Home Sales and Leading Indicators.

Related to the broader economy, crude oil just can’t seem to trade and stay above $80 per barrel. Earlier this month, it looked like crude would finally get the push it needed to get there when OPEC+ announced its surprise production cut. In immediate response to that news, prices spiked from the mid $70 to above $80 per barrel, but then completely stalled and traded in a sideways range through the Easter holiday. The fact that there was no follow-through to the announcement was a warning sign.

After Easter, prices traded to build on their gains from earlier in the month, but any upside was completely squashed at the 200-day moving average (DMA) this week. Yesterday, crude oil traded back down below $80 per barrel, and this morning, it is trading down even further and within a dollar of its 50-DMA. The fact that prices can’t catch and hold on to a bid for more than a few days doesn’t say much for the fundamental backdrop of crude.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.

Fixed Income Weekly: 4/19/23

Searching for ways to better understand the fixed income space or looking for actionable ideas in this asset class? Bespoke’s Fixed Income Weekly provides an update on rates and credit every Wednesday. We start off with a fresh piece of analysis driven by what’s in the headlines or driving the market in a given week. We then provide charts of how US Treasury futures and rates are trading, before moving on to a summary of recent fixed income ETF performance, short-term interest rates including money market funds, and a trade idea. We summarize changes and recent developments for a variety of yield curves (UST, bund, Eurodollar, US breakeven inflation and Bespoke’s Global Yield Curve) before finishing with a review of recent UST yield curve changes, spread changes for major credit products and international bonds, and 1 year return profiles for a cross section of the fixed income world.

In this week’s report, we dive in to bank exposure to CRE.

Our Fixed Income Weekly helps investors stay on top of fixed-income markets and gain new perspectives on the developments in interest rates. You can sign up for a Bespoke research trial below to see this week’s report and everything else Bespoke publishes free for the next two weeks!

Click here and start a 14-day free trial to Bespoke Institutional to see our newest Fixed Income Weekly now!

Bespoke’s Morning Lineup – 4/19/23 – Financials and Everyone Else

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you want to build a ship, don’t drum up the people to gather wood, divide the work, and give orders. Instead, teach them to yearn for the vast and endless sea.” – Reed Hastings

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

Investors and traders are taking a breather this morning as they digest the latest round of earnings results. A higher-than-expected inflation print in the UK has contributed to the negative tone. Gold, oil, and bitcoin are also trading moderately lower as yields rise in what to this point has been a risk-off environment so far this morning.

It’s still early in earnings season, but we wonder if the batch of earnings since yesterday’s close will be a trend. Of the 23 companies reporting earnings since Tuesday’s close, 65% have exceeded EPS forecasts while just 55% have topped sales estimates. Neither of those rates is exceptionally strong, and the 55% revenue beat rate is weak.

Breaking down the numbers a little bit, though, shows an entirely different picture. Of the eight companies that reported weaker-than-expected EPS, all eight of them were from the Financials sector. In other words, ex Financials, the EPS beat rate was 100%. You can’t get much better than that! In terms of sales, the beat rate wasn’t as strong, but it was still 70%. It’s only one day, but if you’re a bear, the wave of weaker results has started to show up in full force- except it has only been evident in one sector. If that weakness remains ringfenced to the Financials, bulls may stay in the driver’s seat.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.