The Bespoke Report — 11/10/23

To read our weekly Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to Bespoke Premium.

Bitcoin: 52-Week High Two Years After a Record High

Even for a volatile asset class, it has been quite a week for crypto-related assets. With a gain of nearly 8% for the week, Bitcoin rallied to 52-week highs and crossed above 35K, 36K, and 37K in the process. Year to date, the largest cryptocurrency is up over 125%, but looking at the chart below, all of the year’s gains have been confined to a handful of trading days in January, March, June, and now.

Ethereum had an even bigger week, rallying by over 14.5% and nearly doubling the gain in Bitcoin. Unlike Bitcoin, Ethereum was trading just shy of its YTD high from back in April.

The fact that Bitcoin is at 52-week highs today is ironic given the fact that its all-time high of just below $69K was exactly two years ago today. Given where prices are now, it doesn’t seem likely that those highs will be tested again any time soon, although stranger things have happened.

The chart below shows Bitcoin’s drawdowns from all-time highs over time. Perhaps the most notable aspect of Bitcoin’s rally is the fact that even after rallying more than 100% this year, the current drawdown of 45% is deeper than the average drawdown of 40.4% for all days since 2016. Just to get back to that historical ‘average’ drawdown, Bitcoin would need to rally back above $40K.

Bespoke’s Morning Lineup – 11/10/23 – Going Out on a Positive Note

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We have so much to say, and we shall never say it.” ― Erich Maria Remarque, All Quiet on the Western Front

Below is some introductory commentary of today’s Morning Lineup. Start a two-week trial to Bespoke Premium to get full access.

Investors are doing their best to reverse yesterday’s weak tone and end the week on a positive note. Last Friday, we were finally able to buck the trend of declines heading into the weekend, and if the market could do it again today, that would be a positive sign. The only economic report on the calendar is Michigan Consumer Sentiment at 10 AM, and the inflation expectations components of that report will be the primary focus of the day- at least when it comes to scheduled data.

Unlike every other day this week where the S&P 500 traded higher on the day and the equal-weighted version traded lower, on Thursday, they both traded lower with declines of about 0.8%. In just the first four days of this week, the equal-weighted index underperformed the cap-weighted index by 1.5 percentage points, and over the last 200 trading days, the performance gap between the two indices now stands at over 15 percentage points. A gap that wide is practically unheard of, and since 1990, it has been wider on 55 trading days, and they all occurred in the periods spanning December 1998 through April 1999 and then briefly between March and April 2000.

The record performance gap between the market cap and equal weight versions of the S&P 500 topped out briefly above 20 percentage points for a day in March 2000, but there were multiple occurrences in the early 2000s and coming out of the Financial Crisis when the performance gap was over 20 percentage points in favor of the equal weight index. When you think about it, it makes sense as it would be easier for the smallest stocks in an index to see big moves (especially after a large market decline) than it would for the largest companies in the world.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

The Triple Play Report — 11/9/23

An earnings triple play is a stock that reports earnings and manages to 1) beat analyst EPS estimates, 2) beat analyst sales estimates, and 3) raise forward guidance. You can read more about “triple plays” at Investopedia.com where they’ve given Bespoke credit for popularizing the term. We like triple plays as an indication that a company’s business is firing on all cylinders, with better-than-expected results and an improving outlook. A triple play is indicative of positive “fundamental momentum” instead of pure fundamentals, and there are always plenty of names with both high and low valuations on our quarterly list.

Bespoke’s Triple Play Report highlights companies that have recently reported earnings triple plays, and it features commentary from management on triple-play conference calls, company descriptions and analysis, and price charts. Bespoke’s Triple Play Report is available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read this week’s Triple Play Report, which features 29 new stocks. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

Decker’s Outdoor (DECK) is an example of a company that reported an earnings triple play recently. As shown below, DECK has been in an uptrend for all of 2023, and it broke out hard after its most recent triple play. On 10/27, the company’s shares surged 19%, marking a new all-time high and representing DECK’s best earnings reaction day since 2013 on a percentage basis. After its huge earnings day, DECK continued to trek higher and is now up 60% YTD.

In our database going back to 2004 for Deckers Outdoor (DECK), the fiscal Q2 earnings report marks the footwear company’s strongest beats on both EPS and revenues. It’s not often that DECK reports a triple play either. In fact, DECK raised guidance for the first time since Q4 2010. This quarter’s report highlighted the strength of DECK’s brand portfolio, particularly HOKA and UGG, which saw a 30%+ increase in global consumer acquisition. The brands’ strong performance, especially HOKA achieving a 27% revenue increase, has been a compelling growth story. The chunky sole HOKA running shoes have gone viral it seems, benefiting the hardcore runner and those favoring comfortably casual options. With cold weather on its way, consumer trends have shown that UGG slippers are all the rage too, with the Tasman model all over TikTok and seemingly sold out everywhere. You can read more about DECK and the 28 other triple plays in our newest report by starting a Bespoke Institutional trial today.

Bespoke Investment Group, LLC believes all information contained in these reports to be accurate, but we do not guarantee its accuracy. None of the information in these reports or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

Historic Sentiment Shift

The S&P 500 and Nasdaq have extended their impressive winning streaks and that has resulted in a surge in bullish sentiment. The latest weekly AAII sentiment survey showed that 42.6% of respondents reported as bullish this week. That is now the highest level of bullish sentiment since the first half of August and perhaps more notably, a major turnaround from last week’s multi-month low of 24.3%.

As shown below, bullish sentiment’s 18.3 percentage point rise week over week is a historically large jump in optimism, especially in more recent years. That week-over-week increase ranks as the 22nd largest in the survey’s history. It also just barely edged out the 17.88 percentage point increase in November 2020 for the largest one-week increase since July 15, 2010, when it had risen 18.43 percentage points.

The surge in bullish sentiment borrowed heavily from those formerly reporting as bearish. Bearish sentiment jumped above 50% last week, the highest reading since last December, but was nearly cut in half this week as it came in at only 27.2%

Whereas the jump in bullish sentiment was historically large, the resulting drop in bearish sentiment is even more significant ranking as the fourth largest on record.

Given there were historic moves across both bullish and bearish readings, the bull-bear spread in turn has experienced a top 1% week-over-week move. Only one week ago, the spread indicated that bears outnumbered bulls by a wide margin of 26 percentage points. Rising an astounding 41.4 points week over week, that spread is back in favor of bulls at 15.4.

Bespoke’s Morning Lineup – 11/9/23 – Can It Keep Going?

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If you’re lonely when you’re alone, you’re in bad company.” – Jean-Paul Sartre

Below is some introductory commentary of today’s Morning Lineup. Start a two-week trial to Bespoke Premium to get full access.

Futures are basically flat this morning as the Nasdaq and S&P 500 each look to extend their winning streaks to ten and nine, respectively. The only data on the calendar today is jobless claims at 8:30, but there is a decent amount of Fedpseak to navigate including Chair Powell at 2 PM. With the market going up every day now for nearly two weeks, you can imagine that investor sentiment has improved. In this morning’s latest update to the AAII sentiment survey, bullish sentiment surged from 24.3% up to 42.6% which is the highest level since August. Bearish sentiment, conversely, has been nearly cut in half falling from just over 50% (50.3%) down to 27.2%.

As treasury yields have collapsed over the two weeks, short-term returns on long-term US Treasuries have surged. Take the iShares 20+ Year US Treasury ETF (TLT). Over the last two weeks, it has surged over 7% putting its two-week change in the 99th percentile relative to all other ten-day moves in the ETF’s history. It’s still down over 7% since the end of August, but that’s a story for another day.

Given the magnitude of the recent move and the big losses we have seen in TLT in recent months, it shouldn’t come as a surprise that the ETF’s day-to-day volatility has also become elevated. Over the last 50 trading days, TLT’s average daily move has been 1.10% (up or down) which ranks in the 94th percentile relative to all other periods. The only times where this measure was higher were during the Financial Crisis, when S&P downgraded the sovereign debt rating of the US from AAA, briefly during COVID, and most recently, late last year and into early this year.

While volatility in the Treasury market is historically high, volatility in the equity market remains low. Over the last 50 trading days, the S&P 500 tracking ETF (SPY) has been just 0.65% which ranks right in the middle of its historical range.

With TLT averaging a daily move of over 1.1% it has been about 45 bps more volatile than SPY over the last 50 trading days. Since the inception of TLT in late 2002, there were just 17 trading days spanning late 2010 and into early 2011 and just another 5 trading days in July 2015 where the spread was wider. In other words, you don’t see this very often.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

S&P 500 Gains Despite Bad Breadth

The S&P 500 is fighting (unsuccessfully at this point) for its eighth positive session in a row today (the longest winning streak for the index in exactly two years). But looking under the hood at the past two sessions, there has been some underlying weakness. Although Monday and Tuesday saw the S&P 500 rise 17.5 bps and 28.4 bps, respectively, net daily breadth (advancers less decliners) was negative on both days. Whenever we hear talk of weak breadth on market up days, comparisons are usually made to the 1999/2000 period right before the Dot Com bubble’s peak. While it has been very uncommon for the S&P 500 to be up on back-to-back days when breadth was negative, not all (or even most) of the prior occurrences were isolated to just the period leading up to the Dot Com peak.

In the table below, we show 19 prior times that the S&P 500 rose in back-to-back sessions with negative daily breadth readings on both days and no other occurrences in the prior three months. The most recent occurrence was back in June 2021, and one thing that stands out is just how bad breadth has been in this period. On Monday and Tuesday, cumulative breadth was at -267, and the only prior instance with worse breadth over the course of the two up days was in July 2015. While returns were outright negative for the following six months after that July 2015 occurrence, as a whole, these past occurrences with gains on negative breadth have not been an especially bearish or bullish signal. On both an average and median basis, performance was generally in line with the S&P 500’s performance for all periods since 1990.

In looking at the table above, on most of the days when the market was up and breadth was negative, the magnitude of the gains was very small, and in many cases, the S&P 500 didn’t even move a tenth of one percent (10 bps) on either day. With that in mind, we filtered the table above to show only days when the S&P 500 was up at least 10 bps on each of the days when breadth was negative. Adding in that criteria, the 19 prior occurrences get whittled down to just six, and in this case, four of the six occurrences were in the months leading up to and after the Dot Com peak. While forward returns over the next week were positive all six times, average and median returns over the next one and three months were actually negative. Longer-term, six and twelve-month returns were split with a wide variance between average and median performance. These past examples suggest that while weak breadth on back-to-back positive days for the S&P 500 is not an outright negative, it’s hardly a positive indicator either.

Bespoke’s Morning Lineup – 11/8/23 – Listless Wednesday

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Libraries should be open to all—except the censor.” – John F Kennedy

Below is some introductory commentary of today’s Morning Lineup. Start a two-week trial to Bespoke Premium to get full access.

Futures are little changed this morning but biased to the positive side, as the direction of the market is listless with little in the way of economic data or major earnings reports to speak of. Perhaps the most notable move has been in crude oil, where WTI is down over 1% after falling through its 200-day moving average yesterday.

Yesterday’s gain for the Nasdaq was the index’s eighth straight positive day in a row and the longest streak of consecutive gains since November 2021. In the process of this 8.3% rally, the Nasdaq has also managed to reclaim both its 50 and 200-day moving averages (DMA)- levels it was below before the streak started. While the Nasdaq has managed to trade back above both of its key moving averages, it finished the day right at the downtrend that has been in place since the summer highs, so that is a potential roadblock as the rally looks to keep going.

Eight-day winning streaks are nothing out of the ordinary for the Nasdaq. Since the index’s inception back in 1971, there have been 86 prior winning streaks of at least eight days with the longest, back in 1979, stretching to 19 days. In the current streak, we’re not even halfway there. What is much more uncommon for the Nasdaq is to start an eight-day winning streak below both its 50 and 200-DMAs and by the eighth day of the streak to trade back above both of those levels. Since 1971, there have only been ten prior periods where that occurred (red lines in the chart).

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

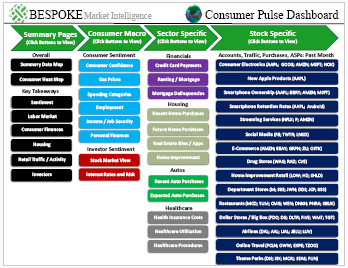

Bespoke’s Consumer Pulse Report — November 2023

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Bespoke’s Morning Lineup – 11/7/23 – A Day of Rest

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Man is the only creature who refuses to be what he is.” – Albert Camus

Below is some introductory commentary of today’s Morning Lineup. Start a two-week trial to Bespoke Premium to get full access.

And on the seventh day, the market rested. After six straight days of the rally looks like it’s taking a day off as equities, crude oil, gold, bitcoin, and even treasury yields are lower. Some of the concerns this morning can be tied to comments made by Minneapolis Fed President Kashkari who said he cannot rule out further rate hikes. On the economic calendar, it’s another light session this morning as will be the case most of the week even as the quantity of earnings reports remains very busy.

Over in Europe, the major indices are all down between 0.1% and 0.5%. PPI for the region was down an incredible 12.4%, and what was even more incredible was that it was a smaller decline than expected! In Germany, construction data was weaker than expected and showed the weakest level of activity since April 2020.

While momentum in the market pulled back yesterday, last week’s rally was accompanied by exceptionally strong breadth. As an example, the S&P 500’s 5-day advance/decline (A/D) line surged to +1,476 as of Friday which ranked as the 7th highest reading dating all the way back to 1990. The chart below shows historical readings in the 5-day A/D line, and the reason it only goes back to 2008 is that before that there were no readings that ever exceeded +1,400. That’s due in at least part to the fact that around that time is when the popularity of ETFs really started to explode creating what has become the current all-or-nothing nature of the market.

The chart below shows the performance of the S&P 500 going back to 2008 on a log scale, and the red dots show every other time that the 5-day A/D line reached +1,400 or higher. As shown, these types of readings occurred at all different phases of the market cycle. While the late 2021 occurrence right near the market top sticks out like a big pimple, other occurrences don’t look nearly as ominous.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.