Bespoke’s Morning Lineup – 1/12/24 – It’s Earnings Season

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“He not only made me believe—he made us all believe.” – John Dockery, on Joe Namath’s performance in Super Bowl III

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Earnings season kicked off this morning as the major banks along with Delta (DAL) and UnitedHealth (UNH) have all reported earnings this morning. Concerning bottom-line results, five of the eight companies reporting have exceeded results, but only four of the eight managed to exceed top-line results. Of the companies reporting, only JP Morgan (JPM) is trading higher, and the biggest loser has been UnitedHealth (UNH) which is down over 5%, and given its high share price, that is having a large impact on Dow futures this morning.

Futures for the S&P 500 and Nasdaq are also lower this morning, and that’s partly a result of earnings news but also rising tensions in the Middle East as a US-led group launched airstrikes in Yemen on Houthi targets. As you might guess, oil prices have spiked higher in response, and as of this morning are trading up just about 4%.

In economic news, PPI for December was just released, and unlike yesterday’s CPI, the numbers were weaker than expected. At the headline level, PPI declined 0.1% on a m/m basis (+0.1% expected) and rose 1.0% on a y/y basis (1.3% expected). Core PPI was also weaker with the m/m reading coming in unchanged (0.2% expected) and rising 1.8% y/y (2.0% expected).

Everyone loves a three-day weekend, right? While you would think that, there is not much to like about the equity market’s historical performance during the holiday-shortened week coinciding with Martin Luther King Jr Day. While President Reagan signed the holiday into law as a Federal Holiday in 1983, it wasn’t until 1998 that the stock market started to close in observance of the holiday. The chart below shows the performance of the S&P 500 from the Friday before MLK Jr Day through the Friday after. As shown, the median performance has been a decline of 0.32% with gains just 38% of the time. The worst of those weeks was just two years ago when the S&P 500 declined 5.7% in the four-trading day week. While the holiday week has historically been weak, it is worth pointing out that the period leading up to the holiday has typically been better. On a month-to-date basis through the Friday before MLK Jr Day, the S&P 500’s median performance since 1998 has been a gain of 0.88% with positive returns 59% of the time.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

Claims Ratio Spiking

Overshadowed by the hotter than expected CPI print, initial jobless claims at least came in healthier than expected this morning. Initial claims came in at 202K, down 1K from last week’s upwardly revised level of 203K. At current levels, initial claims are down near some of the lowest levels of the past year. Zooming out, those are also some of the lowest levels since the late 1960s which could paint a historically rosy picture for the labor market.

Taking a look at claims before seasonal adjustment, one of the first couple weeks of the year have often marked the annual peak in claims. Assuming this week does in fact mark that seasonal high, it would measure roughly inline with other years since 2018 save for 2021 when claims were working off extremely elevated pandemic levels. Looking forward over the first half of the year, unadjusted claims face seasonal tailwinds.

In addition to initial jobless claims posting a strong reading, continuing claims came in below expectations falling to 1.834 million compared to expectations of an uptick to 1.87 million. That also marks back-to-back weekly declines in continuing claims as current levels are now down 91K versus the mid November high of 1.925 million. That level is also back below last spring’s highs. That means there has been at least some respite in what more generally has been an upward trend in continuing claims over the past year and a quarter.

In all, both initial and continuing claims have come off their best levels put in place in the fall of 2022 but have each seen steady improvement in recent weeks after a lackluster 2023. However, that does not exactly put the two in parity, and there is at least one way of chopping up the data which comes off as less optimistic than the historically strong levels.

Below we take the ratio of the four week moving averages of continuing claims versus initial claims. While far from a perfect recessionary indicator, it has generally spiked during, albeit particularly in the later stages of, past recessions. Given initial claims have returned to historically low levels while the pivot lower in continuing claims has been less pronounced and more recent, this ratio has rocketed higher over the past six months. In fact, it has risen 31% in that span. Prior to 2020, each instance of an increase of that size occurred at the tail ends of recessions, namely those of the 1970s and early 1980s. However, in the post pandemic period, swings of that size have greater precedence with three other even larger increases occurring over the past few years.

Bespoke’s Morning Lineup – 1/11/24 – CPI High, Claims Low

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I hear ya, Ton’, but that was before inflation” – Christopher Moltisanti

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Futures are modestly low this morning, but it could be worse given the stronger-than-expected CPI reading for December where both headline and core CPI topped consensus forecasts. Jobless claims, meanwhile, showed strength with initial claims falling to 202K from last week’s level of 209K and continuing claims falling to 1.843 million from 1.855 million in the prior week.

“Did you see The Sopranos last night?” 25 years ago today, if someone asked you this question at work on Monday morning, you probably had no idea what they were talking about. With each passing week, though, The Sopranos became a show Americans planned their Sunday nights around, and by the time “Made in America” aired eight years and five months later, 12 million people made sure they were in front of their TVs at 9 o’clock eastern to watch it. It seems so arcane now, but this was a time when there were no DVRs, and the term binge-watching didn’t exist. The Sopranos, like Seinfeld, Friends, and a host of other shows before it, was “Must See TV”. If you weren’t in front of your TV to watch them, you missed them, and the next morning you were in the dark. Raise your hand if you remember desperately trying to get home from wherever on a Sunday night only to get stuck in traffic or delayed by a train or bus and missing the first half hour.

Just for kicks, we were curious to see which current members of the S&P 500 have been the best-performing stocks since the first episode of The Sopranos on January 10, 1999. Perhaps the most interesting aspect of this analysis is that 30% of the index’s components didn’t even exist in their current form back in January 1999. Of the ones that did, the list below summarizes the 25 top performers. It’s also worth noting that 25 stocks in the index are down since the first episode of The Sopranos, including AIG, Ford (F), Citigroup (C), and Carnival Cruise (CCL).

Looking at the list of winners, there are a lot of unexpected names. With a gain of over 46,000%, Apple (AAPL) has been the second-best performing stock (and probably the most expected name) in the index, but its gain has been less than half of Monster Beverage’s (MNST) rally of over 108,000%. Then, at number three, shares of Old Dominion Freight (ODFL) have gained over 40,000%. Given all the trucks that Tony and his crew jacked over the years, ODFL must have been paying quite a substantial pizzo to avoid any trouble!

What’s also interesting about the list below is the names that aren’t on it. While mega-cap stocks like Meta (META), Alphabet (GOOGL), and Netflix (NFLX) weren’t public yet, Amazon.com (AMZN) and Microsoft (MSFT) were, but with gains of ‘only’ 3,700% and 920%, respectively, they didn’t make the list. Ironically enough, Nvidia (NVDA) wasn’t public yet either as its IPO wasn’t until 12 days after the Sopranos premiere. “Oh, poor baby. What do you want, a Whitman’s Sampler?”

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

The Closer – Greenhouse Gas, Wage Growth Slowing, Products Building – 1/10/24

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we start out with an update on House voting and Fedspeak (page 1) followed by a dive into greenhouse gas emissions (page 2). We then check in on the Atlanta Fed’s measure of wage growth (page 3). Next, we recap another weak demand 10 year note reopening (page 4) before finishing with a review of the massive build in petroleum product inventories (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Junk Bonds Crushing Long-Term Treasuries

Since the bond market peaked in late 2021 just before the Fed embarked on its attempt to tame inflation by hiking rates, it has been painful to be an investor in “risk-free” Treasuries at nearly all points on the curve. The most pain has been felt at the long-end of the Treasury curve on notes expiring in 10-20+ years.

While the 20+ year Treasury ETF (TLT) is down 28% on a total return basis over the last two years, you may be surprised to see that the high-yield (junk) bond ETF (HYG) is actually now up on a total return basis over the same time frame. HYG has also easily outperformed the aggregate bond market ETF (BND), which is down 7.4% over the last two years.

Going back five years instead of two, had you decided to go with the “safety” of long-term Treasuries (TLT) over the higher-risk junk bond space (HYG) back in early 2019, you’re still kicking yourself as HYG is up 18.3% over the last five years compared to a 10.6% decline for TLT over the same time frame.

As shown below, TLT was actually up nearly 50% YoY versus a decline of more than 10% for HYG at the time of the COVID Crash in early 2020 when the Fed cut rates to zero while riskier assets like stocks and junk bonds were tanking. But ever since the COVID Crash lows, long-term Treasury yields have been trending higher (meaning lower bond prices).

Because the high-yield bond ETF has a lower average duration than TLT, it has been spared the massive drop in price that long-term Treasury bonds have experienced. Couple that with high yield spreads being in a relatively good place, and HYG is currently trading close to a five-year high on a total return basis. TLT investors are jealous.

Just as longer duration worked against TLT as rates were rising, it reaps the rewards during periods when rates decline. Since the 10/19/23 peak in the 10-year yield, for example, TLT has rallied 16.3% while HYG is up less than half that (7.8%).

Bespoke’s Morning Lineup – 1/10/24 – Big Rally in Small Stocks

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Time makes more converts than reason.” – Thomas Paine

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

We’re looking at another flat morning for US equity futures this morning. Last we looked, S&P 500 futures were exactly unchanged, and both the S&P 500 and Dow were little changed. While there’s been little move in equities, US Treasury yields are lower as the 10-year yield has dipped back below 4%.

In terms of economic data, it’s a quiet morning. Mortgage applications surged over 9%, but the only other report on the calendar is Wholesale Inventories at 10 AM. The next major report will not be until tomorrow when the CPI for December is released. While it’s not economic data, investors will also be on the lookout for an announcement from the SEC regarding potential approval for a bitcoin ETF after yesterday’s disastrous turn of events where it was seemingly approved only but then taken back as the SEC claimed its X account was compromised.

In Asia, the Nikkei surged 2%, but most other major benchmarks in the region were lower, and in Europe, equities are just like US futures – flat as a pancake.

It’s now been 50 trading days since US markets made their Q4 lows on 10/27/23. One of the more impressive rallies has been the 20%+ gain in the small-cap Russell 2000. That move ranks as the largest 50-day rally in the index since 2020 and one of only 21 periods in the index’s history since 1979 that it rallied that much or more in a 50 trading-day period. Before the experiences during the early days of COVID, there was one occurrence in March 2019, but before that, you have to go back to 2012.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

Bitcoin Getting Back Up There

While most areas of financial markets are lower one week into the new year, bitcoin is already up double-digit percentage points. Since bottoming in late 2022, bitcoin has now rallied just under 200%, and as shown in the chart below, its price is starting to get back up to levels that have only been seen for a brief period of time back in 2021. In fact, at $46,800, bitcoin has only traded higher on 6.14% of days since the start of 2017 when it first crossed above $1,000.

Bespoke’s Morning Lineup – 1/9/24 – Keep it Together

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“When we put it all together, we’ve got to be perhaps the greatest club ever.” – Bill Sharman

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Markets are experiencing a bit of a turnaround Tuesday (in the wrong direction) this morning as a good chunk of yesterday’s gain is getting retraced this morning. Small Business Optimism from the NFIB topped forecasts reaching its joint-highest reading since September 2022, and the Trade Balance came in slightly narrower than expected. Perhaps the biggest headlines in the next 24 hours, though, will come in the crypto space where the SEC is expected to give a definitive answer regarding approval for a Bitcoin ETF.

Last week’s decline to kick off the year ended what had been simultaneous nine-week winning streaks for the S&P 500 and the Nasdaq and the longest such streak in decades. Given the weakness to kick off the year, a lot of investors went into the weekend thinking that maybe the rally had finally run its course, and the bears were going to be back in charge for 2024. Yesterday, though, the bulls made a stand as the S&P 500 rallied 1.4% to put it down just 0.13% on the year. Who knows what the rest of the year may bring, but one week doesn’t necessarily make a trend (even if it was the all-important first week of the year). Think back to the 1972 Lakers.

52 years ago today, the Lakers, led by Jerry West, Gail Goodrich, and Wilt Chamberlain ended a record 33-game win streak when Kareem Abdul-Jabbar dropped 39 to help lead the Milwaukee Bucks to a 120-104 win. While the end of the streak was undoubtedly a disappointment at the time, the Lakers still ended the season with a 69-13 record. They then sailed through the playoffs with just three losses in three rounds, ultimately winning the Championship over the Knicks. Even the best runs have their rough patches.

As mentioned above, after five full trading days, the S&P 500 is down just fractionally YTD with a decline of 0.13%, and the average performance of stocks in the index is a decline of 0.23%. Overall, 230 stocks in the index are up YTD, so it’s been a draw all around. While there hasn’t been much movement at the index level, on an individual stock level, there have been some extremes at each end of the spectrum with a handful of ‘stars’ already up over 5% YTD and an even larger number down over 5%.

Starting with the biggest winners, 18 stocks in the S&P 500 have already rallied 5% on the year, and the top five performers are all from the Health Care sector with Moderna (MRNA) leading the way posting a gain of 16.1% YTD. Rounding out the top five, Eli Lilly (LLY) is continuing its run from last year with an additional gain of 7.4%. Outside of the Health Care sector, some of the more notable names on the list include Verizon (VZ), which doesn’t often find itself on a top performer list, and NVIDIA (NVDA), which always seems to be near the top of a top performer list no matter what time frame you look at.

While 18 stocks are already up at least 5% YTD, 27 stocks are already down 5% on the year. The most notable of the losers is Boeing (BA) as it’s down over 12% following its 8% decline on Monday. Tech was a top-performing sector last year, but it has run into a bit of profit-taking in the first week of 2024 as one-third (9) of the stocks listed are all from that sector and more specifically, the semiconductor group.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.

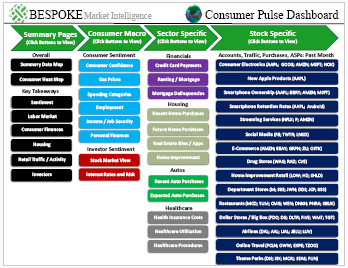

Bespoke’s Consumer Pulse Report — January 2024

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Bespoke’s Morning Lineup – 1/8/24 – Welcome Back

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“All truths are easy to understand once they are discovered; the point is to discover them.” – Galileo

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

We may be eight days into the year already, but from a market perspective, today seems like the first day back. While there isn’t any economic news on the calendar, there’s been a ton of announcements from individual companies concerning guidance and Q4 performance. This week also marks the unofficial start of Q4 earnings season, and we’ll have the JP Morgan Healthcare Conference and the 2024 Consumer Electronics Show. It’s also a full trading week!

The biggest individual stock story of the morning is Boeing (BA) which is trading down around 7.5% after a door panel on an Alaskan Air (ALK) flight blew off mid-flight. In response to the event, the FAA has ordered the grounding of all 737 MAX 9 jets in the US.

Boeing can’t seem to catch a break this decade, but towards the end of last year, the 40%+ rally in the stock suggested that maybe the worst of the company’s problems were behind it. This morning, though, the stock is poised to gap down to just above its 50-day moving average (DMA) in what would be the worst downside gap for the stock since 6/11/2020.

As painful as the decline is for BA shareholders this morning, historically the stock has tended to bounce back following downside gaps of at least 5%. The chart below compares the stock’s median performance following 5%+ downside gaps in the stock to its average performance for all periods since 1980. Outside of the one month, the stock’s median performance and frequency of positive returns were better than the average for all periods and in many cases, significantly so. That obviously doesn’t guarantee anything going forward, but even in the post-COVID period, the stock’s performance, especially over the following three, six, and twelve months, has tended to be positive.

Sign up for a two-week trial to Bespoke Premium to continue reading more of today’s macro analysis.