The Triple Play Report — 3/1/24

An earnings triple play is a stock that reports earnings and manages to 1) beat analyst EPS estimates, 2) beat analyst sales estimates, and 3) raise forward guidance. You can read more about “triple plays” at Investopedia.com where they’ve given Bespoke credit for popularizing the term. We like triple plays as an indication that a company’s business is firing on all cylinders, with better-than-expected results and an improving outlook. A triple play is indicative of positive “fundamental momentum” instead of pure fundamentals, and there are always plenty of names with both high and low valuations on our quarterly list.

Bespoke’s Triple Play Report highlights companies that have recently reported earnings triple plays, and it features commentary from management on triple-play conference calls, company descriptions and analysis, and price charts. Bespoke’s Triple Play Report is available at the Bespoke Institutional level only. You can sign up for Bespoke Institutional now and receive a 14-day trial to read this week’s Triple Play Report, which features 28 new stocks. To sign up, choose either the monthly or annual checkout link below:

Bespoke Institutional – Monthly Payment Plan

Bespoke Institutional – Annual Payment Plan

Hims and Hers Health (HIMS) is an example of a company that reported an earnings triple play recently.

HIMS has solid earnings history, as shown in the snapshot below from our Earnings Explorer. The telehealth company had its IPO in January of 2021 and has never missed a top-line estimate in 12 earnings reports. In Q4, HIMS’s revenue grew an impressive 65% YoY as it increased its subscriber count 48%. Having recently launched customized weight loss offerings, which are of course very popular, HIMS is benefitting from “customized solutions designed around addressing the underlying causes of weight gain.” Subscribers in that category are essentially all opting for a personalized treatment. “Hers” dermatology has been another key driver of the company’s success. You can read more about HIMS and the 25 other triple plays in our newest report by starting a Bespoke Institutional trial today.

Bespoke Investment Group, LLC believes all information contained in these reports to be accurate, but we do not guarantee its accuracy. None of the information in these reports or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

Bespoke Market Calendar — March 2024

Please click the image below to view our March 2024 market calendar. This calendar includes the S&P 500’s historical average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup – 3/1/24 – There She Blows

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Wilderness is impersonal. It does not care whether you live or die. It does not care how much you love it.” – Lee Whittlesey

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

The new month has started quietly in terms of equity futures trading, but activity will pick up at 10 AM Eastern with the releases of Construction Spending, Michigan Sentiment, and ISM Manufacturing data. Beyond the data, upcoming Fedspeak holds particular interest following a busy data week. Outside the US, Asian and European markets began March positively. In China and Japan, PMI Manufacturing data meets expectations, while the same report for Europe exceeded expectations but remains firmly in contraction.

152 years ago today, President Grant signed legislation officially recognizing Yellowstone as the first national park in the country. One of Yellowstone’s highlights has always been Old Faithful. While hundreds of geysers reside in the park, Old Faithful is unique as its eruptions can be predicted with relative accuracy. Since its discovery in the 1800s, and likely for millennia before, it has erupted at consistent intervals. Geologically, Old Faithful is exceptionally reliable, but eruption intervals have lengthened from just over an hour in the 1930s to an average of 90 minutes since 2000. And no, climate change is not the culprit; geologists attribute the change to subterranean earthquakes altering water levels. While Old Faithful has been one of the most reliable geysers for centuries, its continuation is far from guaranteed. If you haven’t witnessed it, make sure you do.

Markets, like most geological patterns and global changes, are impossible to predict. However, investors seem to have their own “Old Faithful” – the S&P 500’s consistent monthly gains. While bulls have enjoyed the last four months, it’s safe to assume that when the current streak ends, Old Faithful will still erupt roughly every 90 minutes. Yellowstone historian Lee Whittlesey’s words about nature aptly apply to markets: they are impersonal, indifferent to individual wins or losses, and unconcerned with how attached you are to a particular investment.

February saw the latest S&P 500 monthly gain of 5.2%, impressive in any market. This raises the question of whether investors typically take profits after such significant gains in the early days of a new month. While the historical record is mixed, some initial weakness in March wouldn’t be surprising.

The table below shows instances since 1953 (the first full year of the NYSE’s current five-day trading week) where the S&P 500 rallied over 4% in February, along with its cumulative month-to-date (MTD) performance in the first five trading days of March. Of the nine prior occurrences, the first day of March had an average and median positive return, but the S&P 500 only closed higher slightly more than half the time. The second day generally saw positive and consistent returns, with MTD gains in eight out of nine instances. However, MTD returns declined thereafter. By the fifth trading day, while the average performance remained positive (+0.44), the median change was a modest decline (-0.07%), with gains occurring only four out of five times. This compares to an average gain of 0.30% and positive returns 61% of the time for all other Marches since 1953. Overall, these figures are inconclusive, but as mentioned earlier, some weakness at the beginning of the month wouldn’t be unexpected.

For more analysis of global equities and economic readings released this morning, read today’s full Morning Lineup with a two-week Bespoke Premium trial.

The Best and Worst Performing Stocks of February 2024

The average S&P 500 stock rose 3.87% in February even though the index itself was up more than 5%. You can check out the performance of various ETFs across asset classes in February in this post, but below we take a look at the best and worst-performing individual S&P 500 names during the month.

While NVIDIA (NVDA) got a lot of attention (as always) after its most recent blowout earnings report, two stocks outdid the “King of AI” in February: Constellation Energy (CEG) and Ralph Lauren (RL).

Additional big winners in February included 20%+ gainers like Quanta Services (PWR), GE HealthCare (GEHC), Axon Enterprise (AXON) — the maker of Tasers and video software for police departments, Tapestry (TPR), and Uber (UBER). Other notables include Diamondback Energy (FANG), NXP Semi (NXPI), General Electric (GE), Vulcan Materials (VMC), and Eli Lilly (LLY). And finally, even Disney (DIS) managed to make the list of the 30 biggest winners in February with a gain of 16.17%.

Not everything went up during the month, however. In fact, of the S&P’s 500 stocks, 350 were up and 150 were down in February. That’s pretty weak breadth for a 5%+ up month.

Below is a list of the 30 S&P 500 stocks that fell the most in February. Notably, three of the five biggest losers were from the Communication Services sector: Paramount (PARA), Charter (CHTR), and Warner Bros. (WBD). Other big blue chips that fell in February include Amgen (AMGN), Adobe (ADBE), Palo Alto Networks (PANW), Comcast (CMCSA), and Deere (DE).

A 5% February: What Worked and What Didn’t

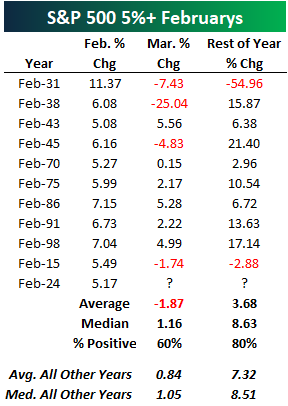

The S&P 500 finished February with a gain of more than 5% for just the 11th time in the index’s history since 1928. Below is a look at prior 5%+ gains in February along with the S&P 500’s performance in March and for the remainder of each year. The last time we had a 5% February was 2015. That March, the S&P fell 1.74%, and the index fell 2.88% from the end of February through year-end. Let’s hope we don’t see that type of action for the remainder of 2024, although a repeat of 2015 would be a lot better than what investors experienced in 1931 when the S&P rallied 11.37% in February only to fall 54.96% for the rest of the year!

Below is a look at our key ETF performance matrix highlighting total returns across asset classes in February, year-to-date, and year-over-year. Mid-cap growth (IJK) was the best area of US markets in February with a 9.58% gain. Dividend stocks (DVY) were the weakest area with a gain of just 1.16% during the month. Looking at sectors, Consumer Discretionary (XLY), Industrials (XLI), and Materials (XLB) actually performed the best in February, beating out Tech’s (XLK) gain of just 4.7% even though the semis (SMH) were up 14%.

Outside of the US, China (ASHR) finally had a big month along with Israel (EIS), which gained 8.6%. Mexico (EWW) and Spain (EWP) were the only two country ETFs that fell in February.

Natural gas (UNG) once again fell sharply, adding to its year-over-year decline of more than 50%. Finally, fixed income ETFs were broadly lower in February, led down by the 20+ Year Treasury ETF (TLT).

Within the S&P 500, there are 67 stocks that show up in at least one of eight “AI” ETFs traded here in the US. As shown below, the 67 “AI” stocks in the S&P were up an average of 5.7% in February compared to a gain of 3.6% for the 433 non-AI stocks. On the year, the 67 “AI” stocks are up 5.9% versus a gain of 2.6% for the non-AI stocks. Given how much some of the most well-known AI names like NVIDIA (NVDA) are up so far in 2024, it’s surprising to us that there isn’t even more separation in performance between the AI and non-AI groups.

Bespoke’s Matrix of Economic Indicators – 2/29/24

Our Matrix of Economic Indicators provides a concise summary analysis of the US economy’s momentum. We combine trends across the dozens and dozens of economic indicators in various categories like manufacturing, employment, housing, the consumer, and inflation to provide a directional overview of the economy.

To access our newest Matrix of Economic Indicators, start a two-week free trial to either Bespoke Premium or Bespoke Institutional now!

Bespoke’s Morning Lineup — 2/29/24

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We must walk consciously only part way toward our goal, and then leap in the dark to our success.” – Henry David Thoreau

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

When looking at the market’s longer-term trend, we like to use a chart of the S&P 500’s 200-day moving average on its own with the daily price changes removed from the chart completely in order to eliminate the day-to-day noise and smooth the trend out. What’s notable here is that the S&P’s 200-day just recently took out its prior all-time high made in early 2022, ending a streak of 460 trading days without a new all-time high for the 200-DMA. While the S&P made a new all-time high on its daily price chart back in January, a new all-time high for the smoothed out 200-DMA is yet another confirmation of the current bull that has been legging higher for the last month or so.

For more analysis of global equities and economic readings released this morning, read today’s full Morning Lineup with a two-week Bespoke Premium trial.

Beware of February 29th

While we can’t buy more time, tomorrow marks the rare occasion that we’ll get an extra day in a year. Leap years, as they’re known, seem straightforward at first glance – every four years, right? However, there’s a small twist. Typically, a year divisible by four is a leap year, but years ending in ’00 are only leap years if they’re divisible by 400. For example, 2000 qualified as a leap year, but 1700, 1800, and 1900 did not.

Now, let’s look at historical data. Since the New York Stock Exchange adopted the five-day trading week in late 1952, the S&P 500’s average performance on the last trading day of February has been flat, with a median change of 0.00%. However, when the last trading day falls on Leap Day (February 29th), performance has been weaker. The S&P 500’s median performance dips slightly to a decline of 0.13% compared to a small gain of 0.06% on the last trading day of non-leap year Februarys. Interestingly, the last trading day of February, regardless of being a leap year or not, has shown weakness in recent years, experiencing negative returns in each of the past nine years. Whether or not the pattern plays out this year remains to be seen, but even if it does, it would be a small price to pay for an extra day!

Bespoke’s Morning Lineup – 2/28/24 – US Takes a Breather

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Truth is not determined by a majority vote.” – Pope Benedict XVI

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

After gains in four of the last five days, equity futures were indicated lower ahead of some key GDP and inflation data this morning. Along with lower equity futures, bond yields are also lower, and that is welcome news for the housing market where Mortgage applications fell over 5% last week after falling more than 10% in the week before that.

US stocks have led the way during the recent bull market, especially since the lows of October 2022. The S&P 500 ETF (SPY) has gained 42.2% since then, compared to 31.0% for the rest of the world (iShares MSCI ACWI ex US ETF, ACWX). However, most of this outperformance occurred after late October. As the chart below shows, both SPY and ACWX were performing similarly until then.

Year-to-date, only the Japan ETF (EWJ) has outperformed SPY, with a gain of nearly 8%. However, international markets have shown recent strength. While the S&P 500 gained 2.05% last week, ETFs for China, Germany, Italy, and France all outperformed it. Only India’s ETF declined.

Looking at all ten country ETFs, most are near or at 52-week highs, except China (MCHI). While they haven’t experienced the same rapid ascent as the US (bottom chart), they have still reached significant levels.

For a closer look at how the market performed following prior moves like we saw yesterday, read today’s full Morning Lineup with a two-week Bespoke Premium trial.

The Closer – Fed Pricing, Home Prices, Durables – 2/27/24

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look into tonight’s earnings as well as the changes to Fed pricing (page 1). We then review the latest Conference Board and Case-Shiller data (page 2) before pivoting over to the latest hard manufacturing data (page 3). We finish with a recap of today’s healthy 7 year note auction (page 4).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!