The “Smart Money Indicator” suggests that the “smart money” trades at the end of the trading day once all of the day’s events have shaken out, while the “dumb money” trades at or near the open in reaction to the day’s news. We like to track the intraday action of the market over time. While we’re not totally on board with the “Smart Money” theory, we do like to see the market finishing the trading day strong. Buying in the final hour or two of the trading day means investors are comfortable owning shares overnight. A market that opens up strong and then drifts lower throughout the trading day is one we’d prefer to avoid.

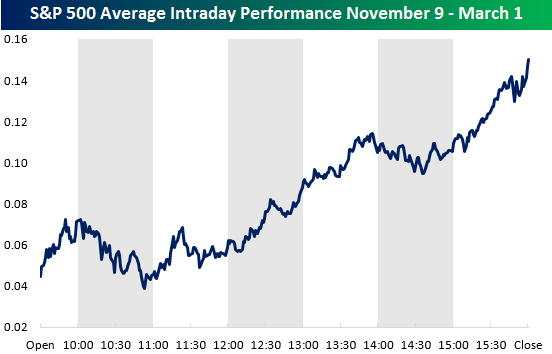

Below is a chart showing the average intraday pattern that the S&P 500 took from the close on Election Day 2016 (11/8/16) through the index’s last all-time closing high made on March 1st. This was a period where the market experienced a major move higher, and aside from slight pullbacks from 10 AM to 11 AM ET and 2PM to 2:30 PM, investors were buying, buying, buying all day long. The buying was especially strong in the final hour of trading, which suggests institutional investors were rushing to put money to work. The post-election move through the end of February was a massive buying event that brought quite a bit of new money into the market.

So how has the intraday pattern looked since the market peaked on March 1st? Have investors been selling into the close or stepping in to “buy-the-dip” late in the day? In today’s Chart of the Day (available to all paid clients), we answer these two questions and provide a chart of the S&P’s intraday pattern during the month of March. Start a no-obligation two-week free trial to Bespoke’s research platform to see the report now.