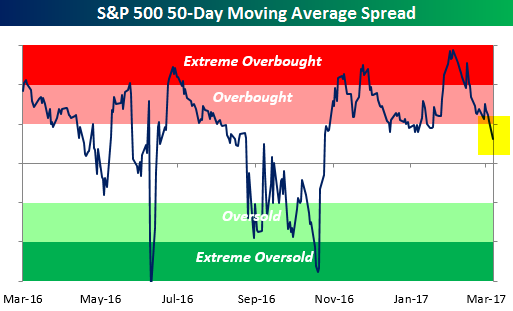

With the S&P 500 giving up earlier gains and trading lower on the day, the index is poised to close at non-overbought levels (>1 standard deviation above its 50-DMA) for the first time since 2/2. For reference, any close below 2,371.42 would move the index into neutral from overbought territory.

At a streak of 31 trading days overbought, this is the seventh longest streak of overbought closes in the current bull market and the eighth streak of 30 or more trading days. In today’s Chart of the Day (available to all paid clients), we took a closer look at prior streaks during the current bull market where the S&P 500 ended streaks of 30 or more trading days above its 50-DMA to see what patterns played out regarding its performance going forward. Sign up for a free-trial below to check it out!