When it comes to corporate actions in times of financial duress, one of the hardest decisions for a company to make is cutting its dividend. In companies known for paying dividends, the dividend is considered sacrosanct, so the last thing the company wants to do is lose credibility with investors by cutting it. In spite of that, when times are tough companies often have no other choice, and as the last couple of years have shown, it has become increasingly common for companies to cut their payouts.

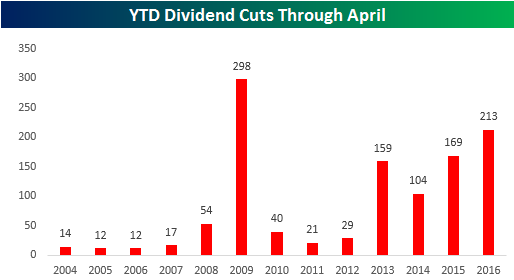

Based on data from the Standard and Poors monthly dividend report, through the first four months of the year, 213 US companies have announced dividend cuts (upper chart right), which is the most cuts through April since the depths of the Financial Crisis in 2009, when 298 companies cut their payouts.

Based on data from the Standard and Poors monthly dividend report, through the first four months of the year, 213 US companies have announced dividend cuts (upper chart right), which is the most cuts through April since the depths of the Financial Crisis in 2009, when 298 companies cut their payouts.

In today’s Chart of the Day, we highlight prior periods where the revisions spread turned positive after extended periods of a negative spread including how the overall equity market performed going forward.

Continue reading today’s Chart of the Day by starting a 14-day no-obligation free trial to our paid research platform.