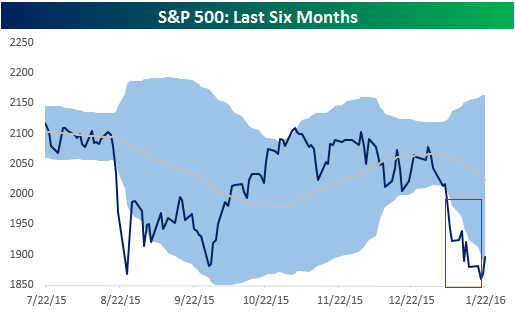

Through yesterday’s close, the S&P 500 closed more than two standard deviations below its 50-day moving average for eleven straight days. While just one day of closing more than two standard deviations below the 50-DMA is noteworthy enough, eleven is practically unheard of! Thankfully, it is looking like today’s rally will help to end this miserable streak, but even if the closing bell rang right now, the S&P 500 would still be oversold (>1 standard deviation below 50-DMA).

Through yesterday’s close, the S&P 500 closed more than two standard deviations below its 50-day moving average for eleven straight days. While just one day of closing more than two standard deviations below the 50-DMA is noteworthy enough, eleven is practically unheard of! Thankfully, it is looking like today’s rally will help to end this miserable streak, but even if the closing bell rang right now, the S&P 500 would still be oversold (>1 standard deviation below 50-DMA).

In today’s Chart of the Day, we took a look at prior periods where the S&P 500 closed more than two standard deviations below its 50-DMA for at least ten trading days and then analyzed market performance following each of those periods.

To continue reading our Chart of the Day, enter your info below and start a free Bespoke research trial. During your trial, you’ll also receive access to our model stock portfolios, daily market alerts, and weekly Bespoke Report newsletter.

[thrive_leads id=’59052′]