Jul 3, 2025

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, in a recap of a busy day of economic data, we lead off with a rundown of the June payrolls report (page 1) including an update on wages (page 2). We also check in on ISM Service data and the market’s reaction to today’s releases (page 3). We close out with a look into demographic readings for jobless claims (pages 4 and 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Jul 3, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Governments are instituted among Men, deriving their just powers from the consent of the governed.” – Declaration of Independence

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Happy Fourth! In an outcome that most would not have predicted over the last several days and weeks, the House is likely to pass the Reconciliation Bill ahead of the July 4th holiday. Just yesterday, the odds of passage by that date were less than 50%, but the bill cleared a procedural vote overnight, and Polymarket now has the odds of passage at 91%. Whatever side of the aisle you position yourself, the ability of Speaker Johnson to pass legislation over the last six months with such a slim majority has been impressive.

That’s the biggest news event of the market day so far, but there’s a jam-packed economic calendar this morning that includes Jobless Claims, Non-Farm Payrolls, Factory Orders, and ISM Services. Besides being a busy day for data, it’s also a short session as the equity market closes at 1 PM ahead of the holiday, and the bond market closes at 2 PM.

Despite the big political news and the busy day of data ahead, futures are eerily quiet as the S&P 500, Nasdaq, and Dow are all indicated to open less than 0.10% higher. Crude oil is marginally lower, gold is unchanged, and treasury yields are lower. That last point is notable; for all the talk about how the Reconciliation Bill will be a budget buster and blow out the deficit, the 10-year yield has been going down as passage of the bill has become more likely. From a longer-term perspective, too, the 10-year yield is the same now as it was on Election Day.

Heading into the July 4th holiday, the fireworks of the second quarter have put eight of the eleven sectors into overbought territory. Over the last five sessions, every sector has traded higher, and Utilities (XLU) is the only sector ETF with a gain of less than 1%. Leading the way to the upside, Materials (XLB) have rallied over 5% pushing the sector into extreme overbought territory and a gain of nearly 9% YTD.

Jul 2, 2025

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin by looking at how UK Gilts are digesting the country’s fiscal concerns (page 1). We then check in on Tesla (TSLA) deliveries and collapse in shares of Centene (CNC) (page 2). We continue with a checkup on other Health Care stocks and the industry’s labor figures (page 3). We then finish with a review of brand level breakdowns of vehicle sales (page 4) and remittance data from Mexico (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Jul 2, 2025

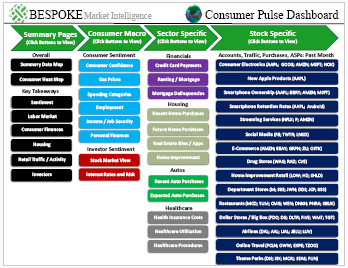

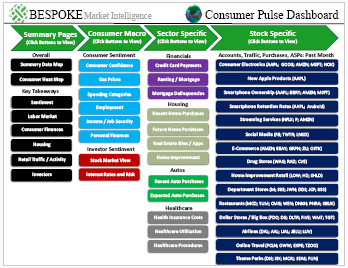

Bespoke’s Consumer Pulse Report is an analysis of a huge consumer survey that we run each month. Our goal with this survey is to track trends across the economic and financial landscape in the US. Using the results from our proprietary monthly survey, we dissect and analyze all of the data and publish the Consumer Pulse Report, which we sell access to on a subscription basis. Sign up for a 30-day free trial to our Bespoke Consumer Pulse subscription service. With a trial, you’ll get coverage of consumer electronics, social media, streaming media, retail, autos, and much more. The report also has numerous proprietary US economic data points that are extremely timely and useful for investors.

We’ve just released our most recent monthly report to Pulse subscribers, and it’s definitely worth the read if you’re curious about the health of the consumer in the current market environment. Start a 30-day free trial for a full breakdown of all of our proprietary Pulse economic indicators.

Jul 2, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Never do things others can do and will do, if there are things others cannot do or will not do.” – Amelia Earhart

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

To view yesterday’s CNBC interview from Closing Bell Overtime, click the image below.

US futures are little changed this morning as the S&P 500 looks to erase Tuesday’s modest losses. The major issue of the day will continue to be the Big Beautiful Bill and whether the House can pass the Senate’s version. A vote on that will be held either today or tomorrow, depending on when members can return to DC for the vote. Even when representatives return, passing the bill will be no easy task, as the slim Republican majority means Speaker Johnson can only afford a few no votes from his caucus. Betting against Johnson, however, hasn’t been a profitable strategy so far this year.

Overnight in Asia, equities were mixed with Japan falling just over 0.5% while Hong Kong rallied by a similar magnitude. The weakness in Japan stemmed from comments by President Trump, who expressed doubt that a deal with Japan would be reached by July 9th, in which case he could increase tariffs on the country to 35%.

The tone in Europe has been much more positive, with the STOXX 600 trading up about 0.5%. Unemployment in Europe ticked up to 6.3% which was higher than the 6.2% forecast, while Italy saw its jobless rate surge from 6.1% to 6.5%. That weakness should help to keep the ECB biased towards more easing.

In the US this morning, employment is also at the fore following this morning’s release of the ADP Employment report, which showed a 35K decline in payrolls in June, which was the first decline in over two years and well below the consensus forecast for growth of 95K. The ADP report has been consistently weaker than government data in recent months, and we’ll get the June Non-Farm Payrolls report tomorrow morning, but for now, this weakness lends to concerns over economic growth against a backdrop of uncertainty related to trade. With this report, you can practically hear President Trump’s fingers tapping out the next Truth Social post to Fed Chair Powell.

As we highlighted in the Chart of the Day, yesterday’s trading was all about rotation, where the best-performing areas of the market in Q2 lagged while the Q2 laggards outperformed. Another example of the rotation was in sector performance. The scatter chart below compares the performance of S&P 500 sectors during Q1 (x-axis) versus on 7/1 (y-axis). Here, you can see the rotation from the Q2 haves to the Q2 have-nots. The five worst-performing sectors of Q2 were the five best performers yesterday. Technology and Communication Services, easily the best-performing sectors of Q2, were the only two sectors to trade lower yesterday. As Andy Warhol once said, everyone gets their 15 minutes of fame, and yesterday it was the Q2 laggards’ chance to grab the spotlight.

Jul 1, 2025

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with a review of the Senate passing of the spending bill and the latest news on tariffs (page 1). Next, we review the day’s PMI data (page 2) before getting into job openings readings from the JOLTS report (page 3) and Indeed.com (pages 4 and 5). We finish with the June update of the Logistics Managers’ Index (pages 6 and 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!