Apr 22, 2025

Log-in here if you’re a member with access to the Closer.

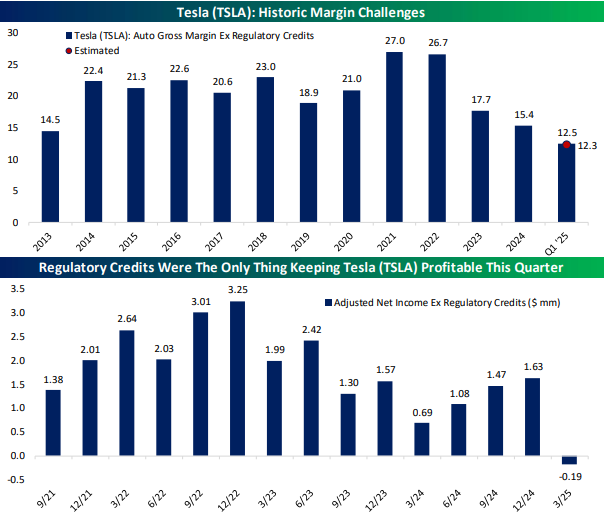

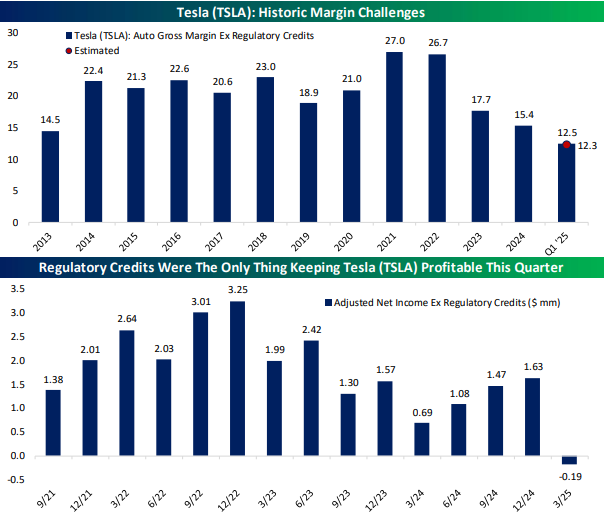

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we kick off with an earnings rundown including results from Tesla (TSLA) (page 1). We then update our 5 Fed Manufacturing Composite (page 2) in addition to a closer look at the Philly Fed’s Services component (page 3) and the service readings for Richmond too (page 4). Next, we discuss the theme of the dollar’s reserve currency status (page 5) before closing out with an update on Bitcoin (pages 6 and 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Apr 21, 2025

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with an overview of the brutal performance of 60/40 portfolios (page 1) followed by some commentary regarding the pros and cons of gold (page 2). We then take a look at how it’s been the worst start to a Presidential administration on record with regards to stock performance (page 3) and also show the performance so far of a number of other assets (pages 4-6). We close out with an update on positioning data (pages 6 and 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Apr 17, 2025

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with further commentary regarding the increasingly contentious relationship between President Trump and Fed Chair Powell (page 1). We then provide an update of our Five Fed Manufacturing Composite (pages 2 and 3). After a recap of the latest earnings reports (page 4), we close with a look into how the latest sell off has impacted the United States’ share of global market cap (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Apr 16, 2025

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with an evaluation of Fed Chair Powell’s comments today (page 1) followed by a look into the high correlation between stocks (page 2). After that, we dive into the latest earnings (page 3) followed by the Bank of Canada rate decision and TICS data (page 4). We close out with reviews of today’s NY Fed services data (page 5) and the latest update to industrial production (page 6).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Apr 15, 2025

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with commentary regarding the comedown in volatility including a general overview of where markets are (page 1). We then dive into import prices and the latest earnings (page 2) followed by an update on the Empire Manufacturing data released today (page 3). We then finish with a look at the performance of AI stocks (page 4) and where that leaves their valuations (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Apr 14, 2025

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we lead off with the earnings results of luxury goods brands (page 1) followed by a discussion surrounding the rates environment (pages 2 and 3). We also check in on volatility and auto stocks (page 3) before running through the latest NY Fed day (pages 4 and 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!