Bespoke Short Interest Report – 1/25/18

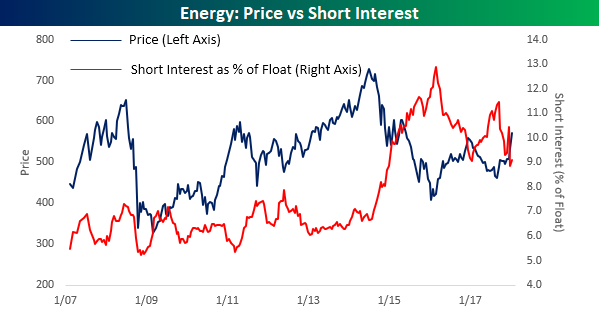

Short interest figures for the middle of January were released after the close on Wednesday, so we have just updated our regular report on short interest trends for the market, sectors, and individual stocks for clients. Below we wanted to quickly highlight how trends in short interest for the Energy sector have changed over the last several months as well as provide a snapshot of the stocks with the highest levels of short interest as a percentage of float. The top chart compares the average short interest as a percentage of float for S&P 1500 Energy sector stocks since 2007, and the table below lists the 13 stocks in the S&P 1500 that have more than 40% of their float sold shortThe list below shows the 23 stocks in the S&P 1500 that have more than a third of their free-floating shares sold short.

Starting with the Energy sector, investor concerns toward the sector have really abated since early 2016 when the average stock in the sector had nearly 13% of its float sold short. That peak in short interest occurred right at the lows, and since then short interest has drifted lower as prices have rallied. What’s interesting to note, though, is that at current levels average short interest on stocks in the sector is still elevated relative to the sector’s history before the crash in prices. Before 2015, average SIPF levels moved in a range of between 5% and just over 7%. Therefore, if the sector has stabilized, it seems as though there are still a number of shorts hanging on hopting for another leg lower in prices. If you are bullish on Energy, this is a positive contrarian signal.

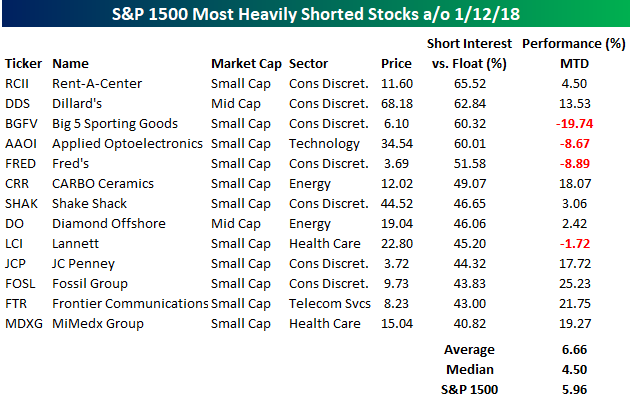

In terms of the stocks with the highest levels of short interest (as a percentage of float, Rent-A-Center (RCII) tops the list with close to two-third of its float sold short. Right behind RCII, another three stocks have more than 60% of their float sold short. Those are high readings! It’s not a surprise that three of the four stocks at the top of the list are form the Consumer Discretionary sector, and in total that sector accounts for seven of the thirteen names listed.

In terms of performance, the most shorted stocks are up an ominous average of 6.66% so far this year, which is slightly ahead of the S&P 1500 as a whole. Despite all the negativity towards the Consumer Discretionary sector, though, five of the seven names on the list are up so far in 2018, so they have been a positive influence on the overall performance.

For a more detailed look at short interest data on a regular basis, sign up for a monthly Bespoke Premium membership now!

Bespoke Short Interest Report — 11/28/17

Short interest figures for the middle of November were released after the close on Tuesday, so we have just updated our regular report on short interest trends for the market, sectors, and individual stocks for clients. Below we wanted to quickly highlight the stocks with the highest levels of short interest as a percentage of float. The list below shows the 23 stocks in the S&P 1500 that have more than a third of their free-floating shares sold short. Through yesterday’s close, the 23 stocks listed below have risen an average of 2.31% (median: 1.23%) compared to the 1.03% gain for the S&P 1500. So, there hasn’t been much of a performance disparity in either direction.

Of the 23 names listed, 13 are up so far this month with the largest gains coming from Bristow Group (BRS), Lannett (LCI), and Carbo Ceramics (CRR), which are each up over 20%. To the downside, there have also been some big losers with stocks like Frontier Communications (FTR), Red Robin Gourmet (RRGB), and 3D Systems all down over 25%.

In terms of sector representation, over a third of the 23 stocks listed below are from the Consumer Discretionary sector. Of those nine, the most shorted stock is Shake Shack, which has over 60% of its float sold short. The interesting thing about SHAK is that despite the fact that short interest has and continues to be exceptionally high, the stock has been relatively stable, trading in a range between $30 and $40 for the last year.

For a more detailed look at short interest data on a regular basis, sign up for a monthly Bespoke Premium membership now!

Short Interest Report – 10/25/17

This content is for members onlyBespoke Short Interest Report – 10/16/17

This content is for members onlyShort Interest Report – Most Heavily Shorted Stocks

Short interest figures for the middle of September were released after the close on Tuesday, so we have just updated our regular report on short interest trends for the market, sectors, and individual stocks for clients. Below we wanted to quickly highlight the stocks with the highest levels of short interest as a percentage of float. The list below shows the 29 stocks in the S&P 1500 that have more than a third of their free-floating shares sold short. Through yesterday’s close, the 29 stocks listed below have been crushing the market with an average gain of 8.14% (median: 6.03%) compared to the 1.24% gain for the S&P 1500. So unlike August where the most heavily shorted stocks were creamed, they’ve seen quite a bounce-back in September.

Of the 29 names listed, just six stocks are down so far this month, and none of them are down by 10%. To the upside, six stocks are up by over 10%, and four of those have rallied more than 25%! In terms of sector representation, Consumer Discretionary has dominated the list with nearly half (14) of the 29 stocks shown. Behind Consumer Discretionary, the sector with the second most number of stocks listed is Energy with just four, so it’s pretty clear that Consumer Discretionary stocks are very much out of favor.

In terms of individual stocks, the most heavily shorted stock in the S&P 1500 is Applied Optoelectronics (AAOI) which has nearly three-quarters of its float sold short, and behind AAOI another nine stocks have more than half of their float sold short. These names include Dillard’s (DDS), RH (where the CEO just purchased 14K shares on Tuesday), and Shake Shack (SHAK).

For a more detailed look at short interest data on a regular basis, sign up for a monthly Bespoke Premium membership now!