B.I.G. Tips – Retail Sales Slow

The October Retail Sales report missed expectations this morning on both a headline and core basis. In addition to the weaker than expected reading for October, September’s report was also revised lower.

Breadth in this month’s report was also negative for the first time since April. Of the thirteen sectors tracked in the report, just five showed growth while eight declined. On the positive side, Non-Store retail was the main bright spot with m/m growth of 3.11%. That’s the last thing every traditional retailer wants to hear and could be indicative of another wave of retrenchment on the part of consumers as the weather gets colder and case counts rise. Electronics and Appliances also reported strong sales growth likely aided by the launch of the iPhone 12. On the downside, Clothing and Sporting Goods both saw m/m declines of over 4%, while sales at General Merchandise retailers dropped 1.1%.

While the monthly pace of retail sales is back at all-time highs, the characteristics behind the total level of sales have changed markedly in the post COVID world. In our just-released B.I.G. Tips report, we looked at these changing dynamics to highlight the groups that have been the biggest winners and losers from the shifts. For anyone with more than a passing interest in how the COVID outbreak is impacting the economy, our monthly update on retail sales is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!

B.I.G. Tips – Top Earnings Season Triple Plays (So Far)

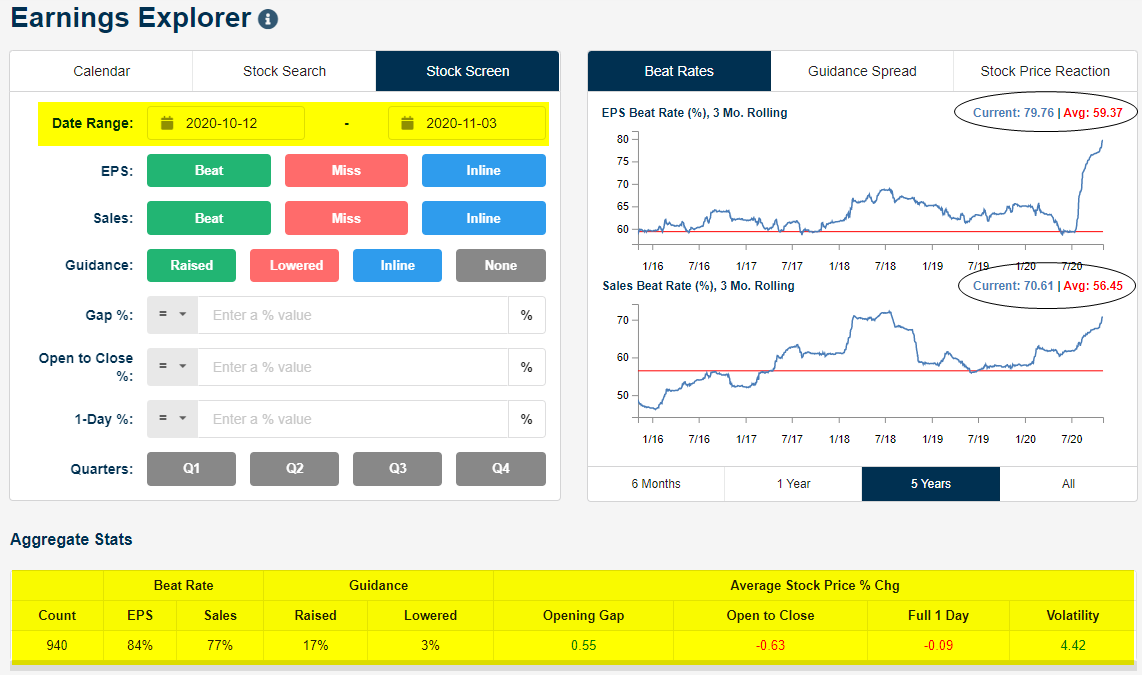

We’ve been banging the drum loudly over the last few weeks highlighting the extremely high earnings beat rates and upside guidance numbers so far this season. Using our Earnings Explorer tool, through yesterday, 940 companies had reported Q3 numbers since the reporting period began on October 12th. Of these, 84% beat consensus analyst EPS estimates while 77% beat consensus revenue estimates. At the same time, 17% of companies have raised forward guidance while just 3% have lowered guidance.

Long-term Bespoke subscribers know how much we like earnings triple plays, but for those that haven’t heard of the term, we came up with it back in the mid-2000s. An earnings triple play is a company that beats EPS estimates, beats revenue estimates, and raises forward guidance all in the same quarterly earnings report. Investopedia.com is one of the best online resources for financial markets education, and they’ve actually given us credit for coining the “triple play” term on their website. We consider triple play stocks to be the cream of the crop of earnings season, and we are constantly finding new long-term buy opportunities from this basket of names each quarter.

This earnings season there have already been a massive number of earnings triple plays. We went through the list of this season’s triple plays to find the ones that currently have the most attractive set-ups. Today we have identified 37 stocks that made the cut. To see these names, simply start a two-week free trial to Bespoke Premium today. Upon sign-up, you’ll unlock our Top Triple Plays report!