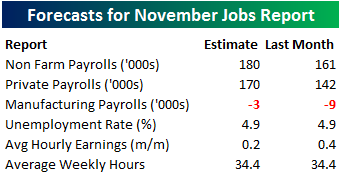

Heading into tomorrow’s Non Farm Payrolls (NFP) report for November, economists are expecting an increase in payrolls of 180K, which would be a 19K increase from last month’s weaker than expected reading of 161K. In the private sector, economists are expecting an increase of 170K, which would be an improvement of 28K from October. The unemployment rate is forecasted to remain unchanged at 4.9%. Growth in average hourly earnings is expected to slow to 0.2% from last month’s reading of 0.4%, while hours worked is forecast to remain unchanged at 34.4.

Heading into tomorrow’s Non Farm Payrolls (NFP) report for November, economists are expecting an increase in payrolls of 180K, which would be a 19K increase from last month’s weaker than expected reading of 161K. In the private sector, economists are expecting an increase of 170K, which would be an improvement of 28K from October. The unemployment rate is forecasted to remain unchanged at 4.9%. Growth in average hourly earnings is expected to slow to 0.2% from last month’s reading of 0.4%, while hours worked is forecast to remain unchanged at 34.4.

With such high stakes surrounding the report, the market will likely have a big reaction to the upside or downside based on how the number comes in relative to expectations. To that end, we just published our eleven-page monthly preview for the November jobs report. This report contains a ton of analysis related to how the equity market has historically reacted to the monthly jobs report, as well as how secondary employment-related indicators we track looked in September. We also include a breakdown of how the initial reading for September typically comes in relative to expectations and how that ranks versus other months.

For anyone with more than a passing interest in how equities are impacted by economic data, this report is a must read. To see the report, sign up for a monthly Bespoke Premium membership and get 10% off for life ($89/month).