One typical characteristic about a rally early on in a market or economic cycle is that breadth is extremely positive. Following a deep and prolonged downturn in the market or the economy, things get so beat down that any improvement tends to lift all or most boats early on. Then, the deeper you get into the cycle, the thinner breadth becomes as certain sectors start to fade. In this regard, when the market or economy peaks, breadth usually shows signs of narrowing before the actual high.

One typical characteristic about a rally early on in a market or economic cycle is that breadth is extremely positive. Following a deep and prolonged downturn in the market or the economy, things get so beat down that any improvement tends to lift all or most boats early on. Then, the deeper you get into the cycle, the thinner breadth becomes as certain sectors start to fade. In this regard, when the market or economy peaks, breadth usually shows signs of narrowing before the actual high.

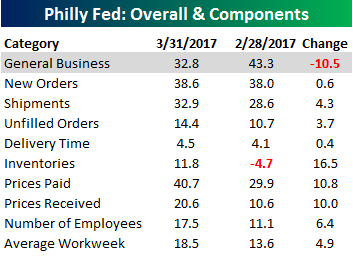

That’s what makes yesterday’s release of the Philly Fed Manufacturing report for March so interesting. While the headline index showing General Business Conditions declined m/m following February’s surge to the 30+ year high, all nine of the report’s sub-indices showed m/m gains. That’s a rare trend. To illustrate, going back to 1980, there have only been three other monthly reports where the index of General Business Conditions declined m/m, but every other sub-index increased. Those occurrences were in May and September of 1996 and December 2003.

In a B.I.G. Tips report sent out to subscribers earlier, we summarized the results of an analysis we did of prior periods where, like the current period, breadth in the Philly Fed report has been strong for multiple months in a row. Even more interesting than where these prior periods occurred during the economic cycle was how the equity market performed in the months after these prior periods of broad strength. To see the results of this insightful analysis, sign up for a monthly Bespoke Premium membership now!