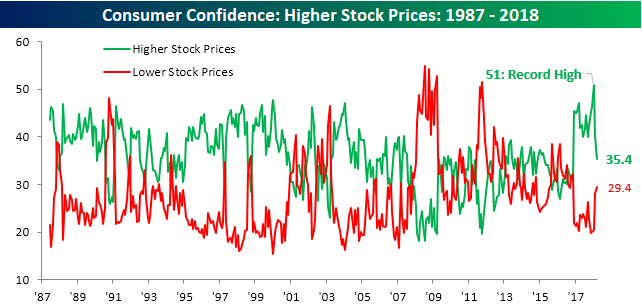

Two months ago, when the January Consumer Confidence report was released, we noted in a Chart of the Day report how bullish sentiment towards US equities had hit a record high. In that report, we noted how “Similar examples of periods where sentiment was tilted to the bullish side are few and far between, but overall, forward returns were mixed and volatility picked up.”

While consumers finally fell in love with equities again in January, the romance has soured quickly. In this month’s Consumer Conference report for the month of March, the percentage of consumers looking for higher stock prices dropped to 35.4%, for a two-month decline of over 15 percentage points! Meanwhile, the percentage of consumers looking for lower stock prices has ticked up from a ten-year low of less than 20% in November to 29.4% now. It has only been two months, but the shift in sentiment towards equities by US consumers has been swift.

In a B.I.G. Tips report sent to clients today, we looked at prior periods where consumers soured so quickly on the stock market. In the report, we highlight how the market typically does following these rare bearish swings. If you’re interested in the report, you can read it by signing up for a Bespoke Premium membership now!