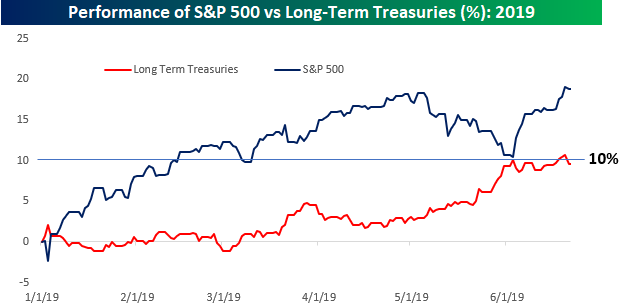

While the relationship between the performance of equities and US Treasuries has changed over time, throughout most of the bull market in equities off the March 2009 lows, positive equity performance has coincided with weaker performance in Treasuries and vice versa. This year has bucked that trend. While the S&P 500 has rallied nearly 19% on a total return basis, long-term Treasuries, as measured by the Merrill Lynch Long-Term Treasury index, have rallied just under 10% and were actually up over 10% on the year through last Thursday’s close. In our latest B.I.G. Tips report, we provided an analysis of prior years where equities and long-term treasuries both saw strong first half returns to see if there were any discernible trends for the second half. To see the report, sign up for a monthly Bespoke Premium membership now!