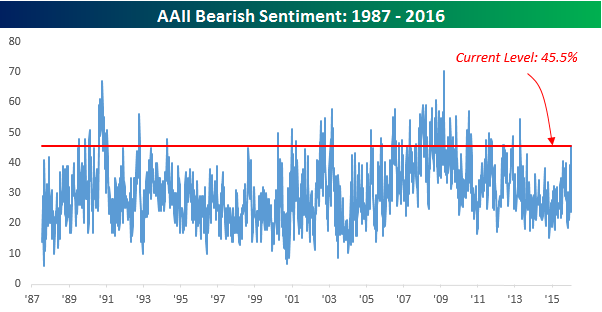

With the S&P 500 seeing its weakest eight-day start to a year in history, you would expect to see stock market sentiment become less optimistic. What is really surprising, though, is just how weak sentiment has become. According to the weekly sentiment survey from AAII, bullish sentiment dropped from 22.2% down to 17.9%. Not only is that the 45th week in the last 46 weeks where sentiment has been below 40%, but this week’s level of bullish sentiment is the lowest weekly reading in more than ten years (April 2005). As bullish sentiment declined to the lowest levels in a decade, bearish sentiment has also been on the increase, although not to quite the same degree. In this week’s survey from AAII, bearish sentiment increased from 38.3% up to 45.5%. That’s a high reading, but you only have to go as far back as 2013 to find the last time bearish sentiment was higher than the current level.

So what does this all mean? We just published a complete analysis of the S&P 500’s performance following prior periods of extreme low readings in bullish sentiment. While sentiment is typically considered to be contrarian in nature, just how consistent has it been. The results may surprise you.

See our B.I.G. Tips report by signing up for a monthly Bespoke Premium membership now. Click this link for a 10% discount ($89/month).