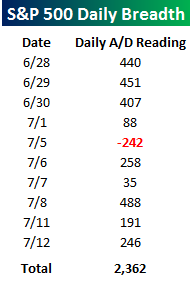

As we have highlighted in prior reports, by a number of measures the ten-day rally that followed the two-day sell-off following the Brexit vote was right up there with the strongest rallies on record. Not only was the rally in the S&P 500 extremely impressive, but breadth was nothing to sneeze at either. The table to the right shows the S&P 500’s daily Advance/Decline reading during that 10-day run. As shown, there were four different days where the S&P 500 had a daily breadth reading of +400 or more. That doesn’t happen very often! Over the entire 10-day span, the S&P 500’s 10-day A/D reading reached an unheard of +2,362.

As we have highlighted in prior reports, by a number of measures the ten-day rally that followed the two-day sell-off following the Brexit vote was right up there with the strongest rallies on record. Not only was the rally in the S&P 500 extremely impressive, but breadth was nothing to sneeze at either. The table to the right shows the S&P 500’s daily Advance/Decline reading during that 10-day run. As shown, there were four different days where the S&P 500 had a daily breadth reading of +400 or more. That doesn’t happen very often! Over the entire 10-day span, the S&P 500’s 10-day A/D reading reached an unheard of +2,362.

Earlier today, we sent an analysis of the market’s performance following prior extreme moves in short-term breadth to Bespoke Premium and Bespoke Institutional members. The list contains some interesting insights in how the market has performed following prior periods as well as how trends in breadth have changed over time. This one is can’t miss!

See the full B.I.G. Tips report by signing up for a monthly Bespoke Premium membership now. Click this link for a 10% discount ($89/month).