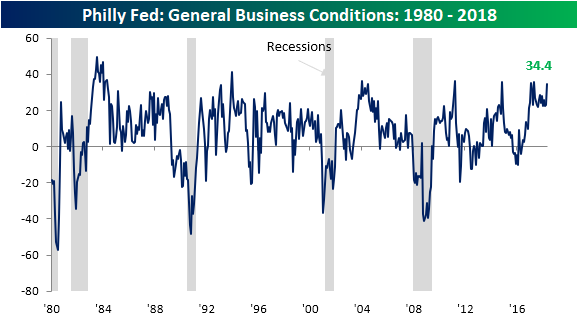

As mentioned in a post earlier today, today’s headline reading in the Philadelphia Fed Manufacturing report came in stronger than expected and registered its 18th straight reading above +20 in the history of the survey. While the current streak of +20 readings is unprecedented, there have been two other periods in the history of the survey (dating back to 1980) where it was above +10 for at least a year and a half (18 months). In a just-published B.I.G. Tips report for Bespoke Premium and Bespoke Institutional clients, we analyzed the S&P 500’s performance during each of those periods to see if there were any parallels to today.

From a more shorter-term perspective, we also looked at how a key internal breadth indicator of the S&P 500 is currently at a critical juncture which could go a long way in determining the future path of the market.

If you are already a member, please log-in here to view the report. If you’re not yet a Premium subscriber and would like to see the report, please start a two-week free trial to Bespoke Premium now. Here’s a breakdown of the products you’ll receive.