Investors are preoccupied with trade issues and impeachment headlines this week, but earnings season is coming up right around the corner. Whether the earnings headlines provide a welcome break from all the back and forth between the US and China or Republicans and Democrats remains to be seen, but at least it will be a change of pace.

Once again this month, the key trend to watch this earnings season will be how often the term ‘China’ or ‘tariffs’ comes up in quarterly conference calls. Just this morning, the NFIB reported in its Small Business Sentiment report that “Tariffs are adversely affecting many small firms, with 30% reporting negative effects in NFIB’s September survey.”

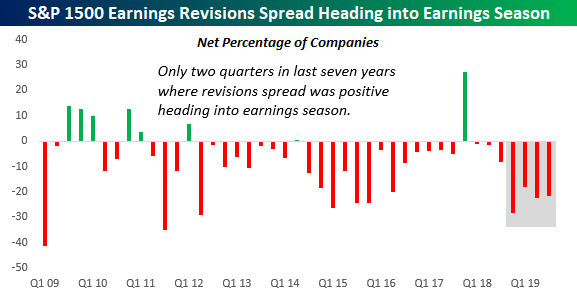

Based on the commentary, current trade policies are obviously making their presence felt. The only question is how much is priced in? Based on recent trends in analyst revisions, analysts have adjusted their forecasts by a decent amount. Over the last four weeks, analyst revisions have come in at a pace of two to one in favor of downside revisions. Analysts have raised EPS forecasts for just 312 companies in the S&P 1500 and lowered EPS forecasts for 634, which works out to a net of negative 322 or 21.5% of the stocks in the index. As shown in the chart below, this continues a trend that we have seen for four quarters now, where analysts have been consistently lowering forecasts in response to the impact of tariffs and other uncertainty related to trade.

We have just published our quarterly preview of the upcoming earnings season and what to expect in terms of the overall market and sector performance based on trends in analyst revisions. To gain access to the full report, start a two-week free trial to our Bespoke Premium package now. Here’s a breakdown of the products you’ll receive.