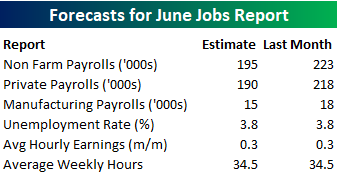

Heading into Friday’s Non-Farm Payrolls (NFP) report for June, economists are expecting an increase in payrolls of 195K, which would be a modest decline from May’s solid reading of 223K. In the private sector, economists are expecting an increase of 195K. With these increases, the unemployment rate is expected to remain low at 3.8%. An added area of focus, however, will come from average hourly earnings as inflation worries weigh on investor sentiment. Any stronger than expected reading in wage measures will likely be viewed as a negative for the market

Ahead of the report, we just published our eleven-page preview of the June jobs report. This report contains a ton of analysis related to how the equity market has historically reacted to the monthly jobs report, as well as how secondary employment-related indicators we track looked in June. We also include a breakdown of how the initial reading for June typically comes in relative to expectations and how that ranks versus other months.

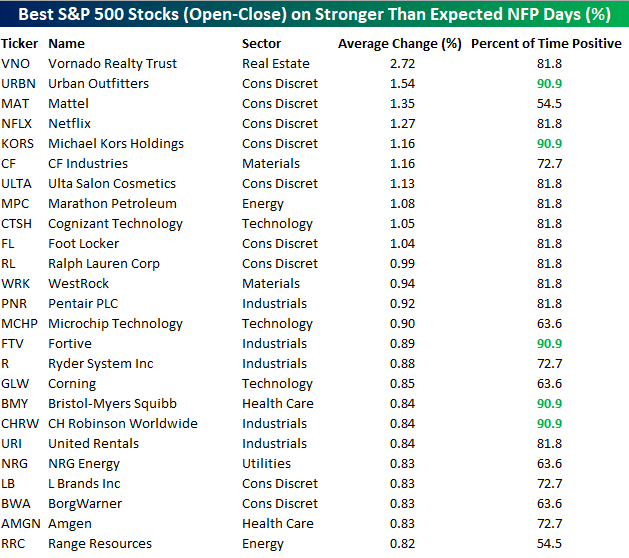

One topic we cover in each month’s report is the S&P 500 stocks that do best and worst from the open to close on the day of the employment report based on whether or not the report comes in stronger or weaker than expected. In other words, which stocks should you buy, and which should you avoid? The table below highlights the best-performing stocks in the S&P 500 from the open to close on days when the Non-Farm Payrolls report has been better than expected over the last two years.

Of the 25 top performing stocks on days when the NFP beats expectations, eight sectors are represented, and Consumer Discretionary leads the way with nine. Vornado (VNO) has been the best performing stock with an average open to close gain of 2.72%. VNO is followed by nine other stocks that have been up over 1%. In terms of consistency, Urban Outfitters (URBN), Michael Kors (KORS), Fortive (FTV), Bristol Myers (BMY), and CH Robinson (CHRW) have all been positive 90% of the time.

For anyone with more than a passing interest in how equities are impacted by economic data, this report is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!