Log-in here if you’re a member with access to our B.I.G. Tips reports.

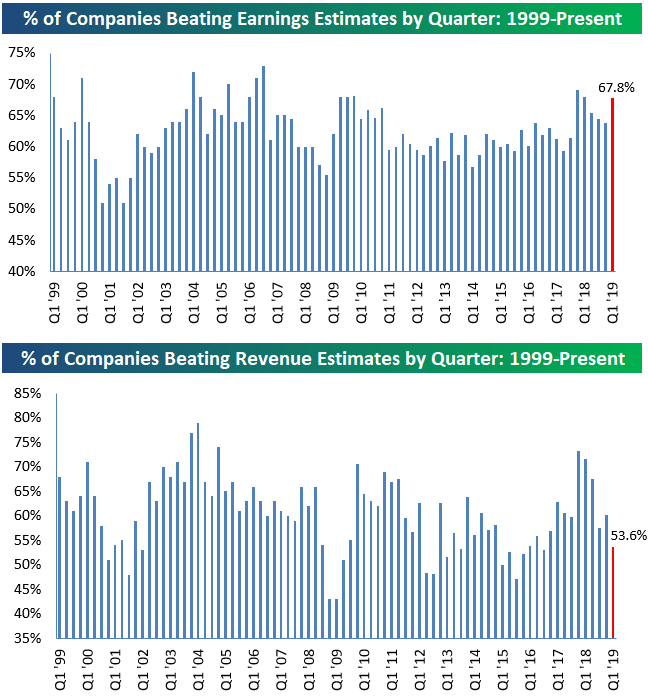

More than 500 stocks have reported their first quarter numbers so far this earnings season, which gives us a pretty large sample size to start analyzing overall trends. Through today, 67% of stocks that have reported this season have beaten bottom-line consensus EPS estimates. That’s a strong reading relative to the historical average of roughly 60% going back to 1999 (first chart below).

While the bottom line beat rate is strong, the top line has so far been lacking. As shown in the second chart below, only 53.6% of companies have managed to report stronger than expected revenues this season. This is definitely a concern now that we’re already about a quarter of the way through the reporting period. We would note, though, that last season we saw a similar trend as the top-line beat rate started very low before rebounding by the end of the reporting period and actually showing a sequential increase.

On another note, we’ve seen an interesting shift in guidance compared to the last two quarters. We’re also seeing some negative signs when it comes to how stock prices are reacting to earnings reports. To read our full earnings analysis, become a Bespoke Premium or Bespoke Institutional member and access the rest of this report. You can start a free two-week trial at THIS PAGE.