With fears of a recession on the rise, investors are looking for any potential signs of cracks in the economic picture. Tuesday’s ISM Manufacturing report, which showed the first contraction in the manufacturing sector in a couple of years, was one of those signs, but the stronger than expected report from the ISM Services report earlier today helped to allay those concerns. When it comes to the market, trade talks, or economic data, lately it seems like we’re simply running in place. For every good market day, tweet, or economic report, it seems as though there is a negative one to offset it. Today’s rally in equities looks to be an attempt by the market to break out of the rut it has been in, so will tomorrow’s payrolls report start another positive streak for the economy?

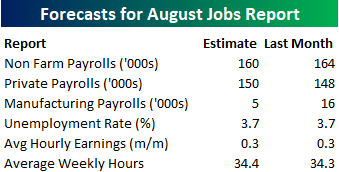

Heading into tomorrow’s report, economists are expecting an increase in payrolls of 160K, which would be a slight decline from July’s reading of 164K. In the private sector, economists are actually expecting a slight increase from July to 150K from 148K. Not surprisingly, job growth in the Manufacturing sector is expected to slow from 16K from 5K. The unemployment rate is expected to remain unchanged at 3.7%, average hourly earnings growth is expected to remain at 0.3%, and average weekly hours are expected to increase to 34.4 from 34.3.

Ahead of the report, we just published our eleven-page preview of the August jobs report. This report contains a ton of analysis related to how the equity market has historically reacted to the monthly jobs report, as well as how secondary employment-related indicators we track looked in August. We also include a breakdown of how the initial reading for August typically comes in relative to expectations and how that ranks versus other months.

For anyone with more than a passing interest in how equities are impacted by economic data, this August employment report preview is a must-read. To see the report, sign up for a monthly Bespoke Premium membership now!