Heading into Friday’s Non-Farm Payrolls (NFP) report for August, economists are expecting an increase in payrolls of 180K, which would be a 29K decline from last month’s stronger than expected reading of 209K. In the private sector, economists are expecting a slightly smaller increase of 172K, which would represent a similar decline as the headline number. The unemployment rate is forecasted to remain at an exceptionally low level of 4.3%. Growth in average hourly earnings is expected to decelerate to 0.2%, while average weekly hours worked is also forecast to remain unchanged at 34.5.

Ahead of the report, we just published our eleven-page monthly preview for the August jobs report. This report contains a ton of analysis related to how the equity market has historically reacted to the monthly jobs report, as well as how secondary employment-related indicators we track looked in August. We also include a breakdown of how the initial reading for August typically comes in relative to expectations and how that ranks versus other months.

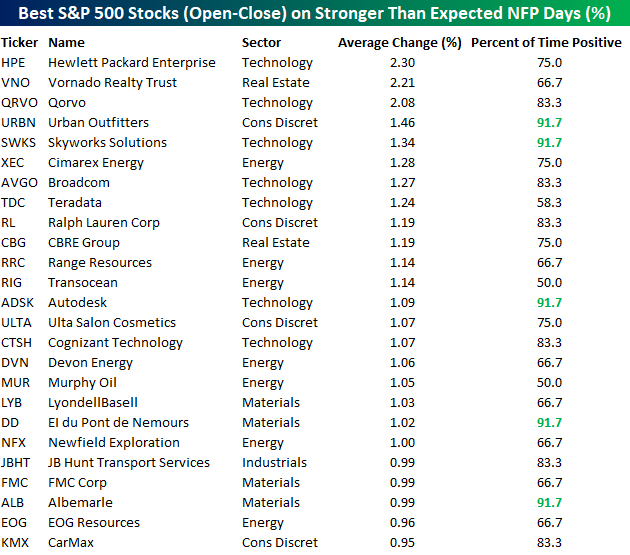

One topic we cover in each month’s report is the S&P 500 stocks that do best and worst from the open to close on the day of the employment report based on whether or not the report comes in stronger or weaker than expected. In other words, which stocks should you buy, and which should you avoid? The table below highlights the best-performing stocks in the S&P 500 from the open to close on days when the Non-Farm Payrolls report has been better than expected over the last two years. Of the 25 top performing stocks, seven sectors are represented, and Technology leads the way with seven. One of the top performing and consistently positive stocks on these days is Qorvo (QRVO) which has seen an average gain of 2.28% with positive returns 90% of the time.

For anyone with more than a passing interest in how equities are impacted by economic data, this report is a must read. To see the report, sign up for a monthly Bespoke Premium membership now!