Sometimes words just can’t do it justice, and while it seems like we have been using that phrase a lot recently, this week is certainly a fitting use of it. After the market rallied for two days to start the week on market expectations of a Clinton victory (or so the market thought) it followed with another two days of gains after Trump staged one of the biggest political upsets in US history. It was a perfect heads bulls wins, tails bears lose scenario!

On Friday things settled down a bit as the bond market was closed in observance of Veterans Day, but there was more than enough action in the week’s first four days to fill a whole month let alone a week. Before we go any further, we would like to extend a big thank you to all of our country’s veterans and their families. Again, words just can’t do it justice on how much you are all appreciated and we know how tough a job it must be.

While everyone is aware of what happened to markets this week, we wanted to quickly recap some of the major moves we saw across asset classes, and also mix in what investors can expect going forward. From there, we will recap the week’s economic data and where things stand with earnings season, and then finally give a brief recap of sentiment and emotions. We’ve all had a busy week, and hopefully this weekend we can all get some rest, because while there were fireworks this week, something tells us that they have only just begun.

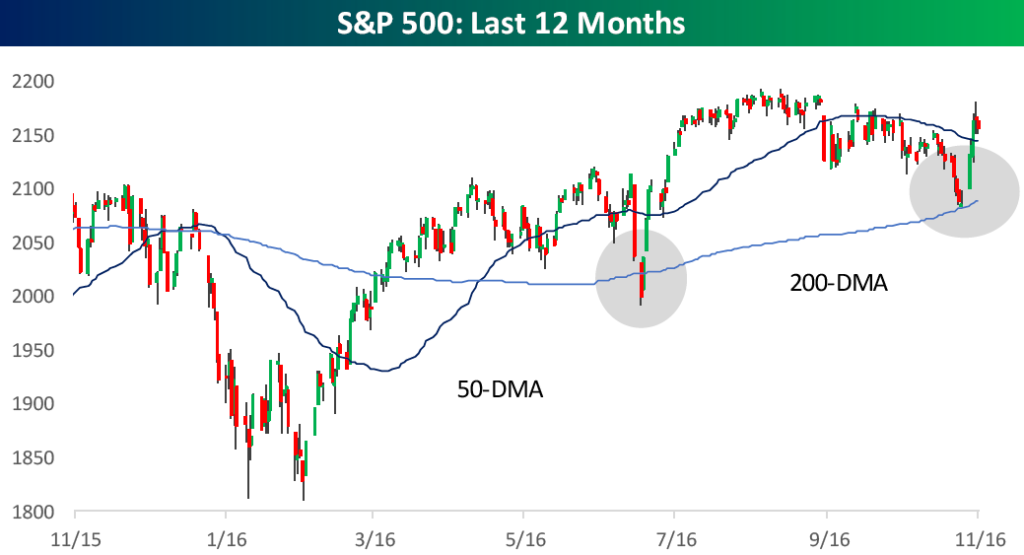

While politics seemingly drove this week’s trading, the seeds of the rally were planted in the technicals. As we pointed out in last week’s report, in the sell-off that lasted through one week ago, the S&P closed last Friday right above its 200-DMA. Then on Monday, the S&P 500 bounced and hasn’t looked back. As long time Bespoke clients are aware, we realize that while every different approach to investing has its flaws, they also have their strengths that should be tracked and studied. In terms of technicals, if you are going to focus on anything, you should always be aware of a security’s or asset class’ long-term moving averages. This week’s bounce was actually the second time in six months that the S&P 500 successfully bounced right at or around its rising 200-DMA.

If you’d like to see the rest of this week’s 40-page report covering the election and possible implications going forward, we cover it and much more in this week’s Bespoke Report newsletter, which we just sent to Bespoke subscribers. You can try out Bespoke’s subscription platform and read this week’s Bespoke Report by starting a 14-day free trial. Below is a look at recent asset class performance using our key ETF matrix.

Have a great weekend!