This week’s Bespoke Report newsletter is now available for members.

For several days, all the market could do was focus on the upcoming Jackson Hole speech from Fed Chair Jerome Powell. Will he signal in September or won’t he? Well the day finally came, and because the conference was changed from in-person to virtual, we all got to see the speech live on Friday morning. Powell didn’t say anything new, and since that followed a number of hawkish comments from other members of the committee, that was all bulls needed to conquer the day and push the S&P 500 to more record highs.

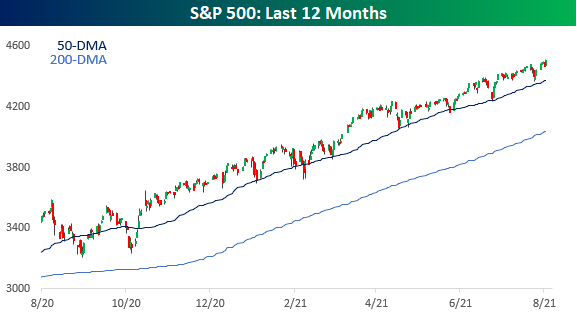

With the exception of last September and October, the S&P 500 has been in one of the steadiest uptrends ever. Tests of the 50-day moving average (DMA) are few, far between, and extremely short. Meanwhile, the S&P 500 is still maintaining ample social distance with the 200-DMA as that trend line shouts, “Remember me?”

In this week’s Bespoke Report, we cover a lot of different topics. Among them:

- A record number of records and Nasdaq 1,000 point milestones.

- A loot at some high-frequency COVID statistics,

- This week’s surge in crude oil and what it means for energy stocks going forward.

- A review of prior market responses to the GOMC Jackson Hole conferences.

- Bitcoin sentiment.

- Low volume rallies. Do they matter?

- The “Montana Curve”.

- Seasonality. And much more.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.