If you’re not yet a Bespoke subscriber, you can still get Bespoke’s 2017 Outlook Report with a 30-day free trial to Bespoke’s premium research! Click here to learn more.

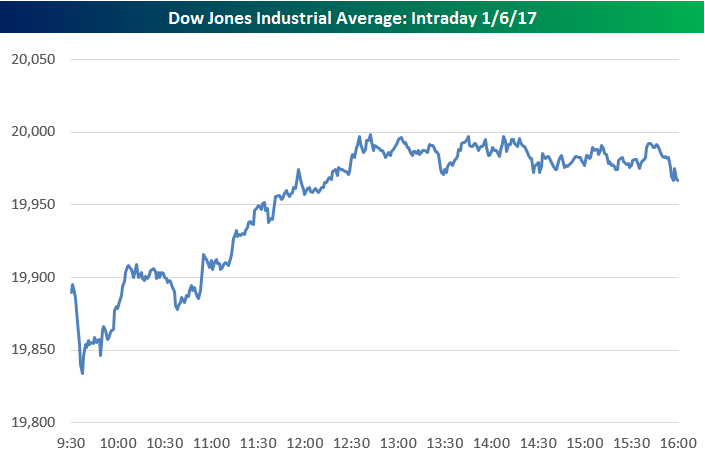

The chart below is included on page one of this week’s Bespoke Report newsletter, which was just sent to Bespoke Premium subscribers. Don’t tell traders that Dow 20,000 is just a meaningless number. While many like to mock the focus on big round numbers in the financial media, Friday’s action for the index shows that someone out there is using 20,000 as something more than just an arbitrary level. The chart highlights the intraday minute-by-minute action of the Dow Jones Industrial Average today. The closest the index had gotten to 20,000 prior to today was 19,987, but by mid-day Friday, it looked as if a cross of the 20,000 level was a shoe-in. It never happened, though.

All afternoon, the index got close to 20,000 — as close as 19,999.63 in fact — but every time it got near 20,000, sellers stepped in with force to not let it happen. It appears as if there are a large number of sell orders right at Dow 20,000. We’ll have to wait until Monday now to see if all of those sells are still in place.

Even though NYSE floor traders couldn’t wear their Dow 20,000 hats home for the weekend, it is important to note that all three major indices (Dow, S&P 500, Nasdaq) still hit new intraday highs today, which is quite a healthy sign for the market.

If you’d like to see the rest of this week’s Bespoke Report newsletter, take advantage of our one-month Bespoke Premium free trial offer that includes our 2017 Outlook Report. Sign up now at this page.

Have a great weekend!