This week’s Bespoke Report newsletter is now available for members.

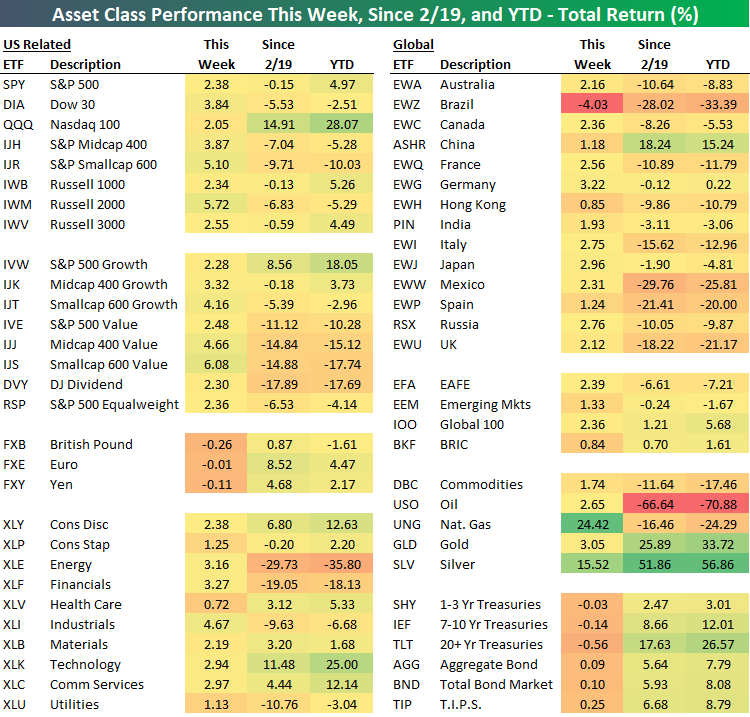

As shown below in our ETF Asset Class Performance Matrix, August has by all accounts come in like a bull for equities.

Every single equity ETF with the exception of Brazil (EWZ) was up this week. Top-performing ETFs overall this week were Natural Gas (UNG) and Silver (SLV) which saw gains of over 15%.

In the US, every major index ETF was up over 2% this week as small caps led the way higher as IJR and IWM both rallied more than 5%. Despite this week’s outperformance, those two ETFs are still the worst performers YTD and since the February high for the S&P 500. The Nasdaq 100 was uncharacteristically a laggard this week gaining ‘only’ 2.05%. Converse to the small caps, though, this week’s underperformance didn’t put much of a dent in the Nasdaq 100’s lead in terms of performance YTD and since 2/19.

Investors who have been waiting for value to take the lead over growth saw things move ever so slightly in their favor this week as the value-oriented ETFs in each market cap range outperformed their global peers. It was only modest outperformance, but you have to start somewhere!

Cyclical sectors led the way this week as Industrials, Financials, and Energy were the top performers as defensive-oriented sectors like Health Care, Utilities, and Consumer Staples lagged.

We discuss this week’s action across markets in our weekly Bespoke Report newsletter, including a detailed look at election trends and the moves in commodities this week. To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!