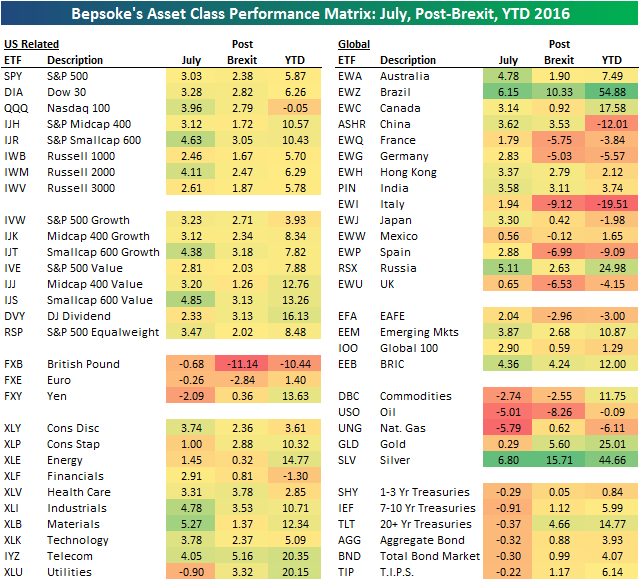

Below is an updated look at our asset class performance matrix using key ETFs traded on US exchanges. For each ETF, we highlight its percentage change so far in the month of July, its change since the close prior to the Brexit vote on June 23rd, and its year-to-date change. Industrials (XLI) and Materials (XLB) have been the top performing sectors in July, and both are now up more than 10% year-to-date. The Financial sector (XLF) is the only one still in the red for the year. Outside of the US, Brazil (EWZ) had another huge week with a gain of 6.15%. For the year, EWZ is now up 54.88%. That’s even better than Silver (SLV), which is now up 44.66%.

Each week, Bespoke sends clients across all of its subscription levels the Bespoke Report newsletter. If you’re looking for Bespoke’s analysis of current market internals, economic data, earnings beats and misses, individual stock ideas, and more, the Bespoke Report has it all.

Continue reading this week’s Bespoke Report by starting a 14-day free trial to our paid content below.

Have a great weekend!