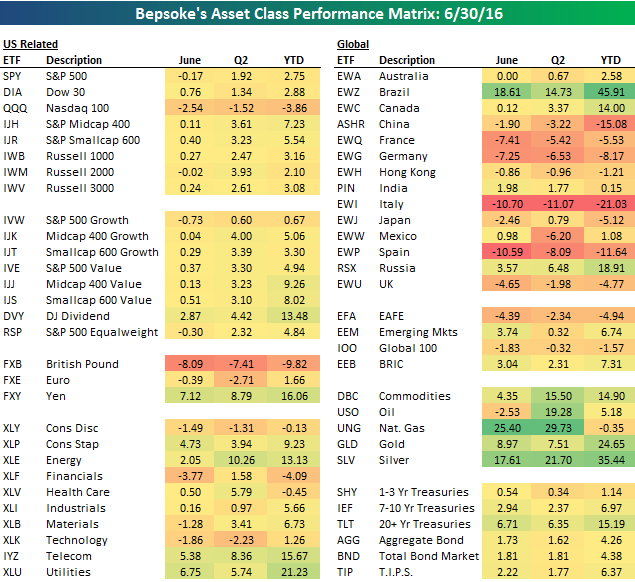

Below is a recap of financial market performance using our ETF Matrix which measures performance (in terms of price) of various ETFs. The version below contains performance figures for various ETFs (USD Price Changes) in the month of June, during the second quarter, and YTD. Focusing on Q2 (middle column), it was a modestly positive quarter for US equities as the only major index that was down during the quarter was the Nasdaq (-1.52%). All of the other indices featured were up anywhere from just over 1% (Dow Jones–DIA) to nearly 4% (Russell 2000-IWM). On a sector basis, Energy (XLE) contributed the most to the gains with a gain of 10.26%. Other sectors that were up more than 5% include Health Care (XLV), Telecom (IYZ), and Utilities (XLU).

In international markets, Brazil (EWZ) outdid every other country with its 14.7% gain. The only other country up over 5% was Russia (RSX), which was up 6.48%. On the downside, nearly all of the weakness was focused in Europe where Italy (EWI) dropped 11.1%, Spain (EWP) fell 8.1%, Germany (EWG) fell 6.53%, and France (EWQ) lost 5.42%. Closer to home, Mexico (EWW) was also weak with its decline of 6.2%.

In currencies, our ETFs were all over the place. The British Pound (FXB) fell 7.41%; it was actually up on the quarter heading into the Brexit vote. In the flight to safety trade that followed last week’s vote, investors also flocked to the Yen (FXY) as the ETF that tracks Japan’s currency was up 8.8%.

Finally, in commodities, all the ETFs shown were up sharply with DBC, USO (Oil), Nat Gas (UNG), and Silver (XLV) all up over 15%. Long term treasuries (TLT) also had a strong showing rallying 6.35%.

Each week, Bespoke sends clients across all of its subscription levels the Bespoke Report newsletter. If you’re looking for Bespoke’s analysis of current market internals, economic data, earnings beats and misses, individual stock ideas, and more, the Bespoke Report has it all.

Continue reading this week’s Bespoke Report by starting a 14-day free trial to our paid content below.

Have a great weekend and Happy 4th!