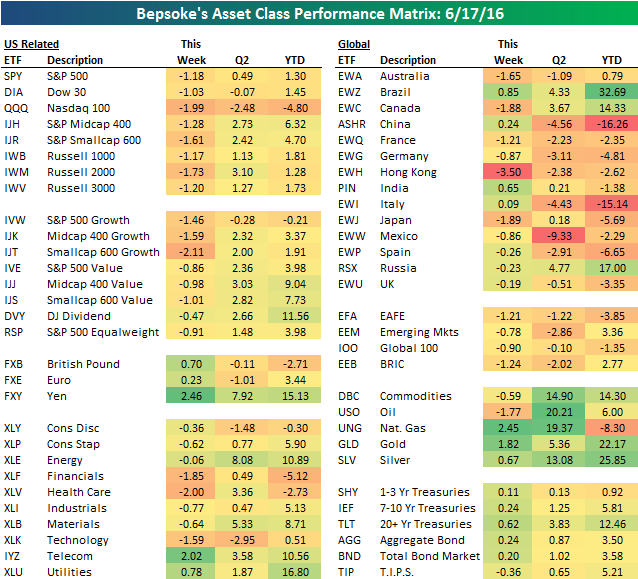

Below is a look at the recent performance of various asset classes using key ETFs tracked by Bespoke on a daily basis. The left side of the matrix is made up mostly of US equity ETFs, while the right side is made up of foreign equity market ETFs, commodity ETFs, and Treasury ETFs. US equities fell 1%+ across the board this week, with Health Care (XLV), Financials (XLF) and Technology (XLK) leading the way lower. These three sectors are the largest three sectors in the S&P, so they impacted the cap-weighted indices heavily. Telecom and Utilities were actually higher on the week, while the remaining five sectors were down marginally.

In the matrix, the darker the green shading, the better the performance. It’s been a few years since the commodities section of our matrix had the darkest green shading, but this asset class has finally staged a comeback in 2016.

Each week, Bespoke sends clients across all of its subscription levels the Bespoke Report newsletter. If you’re looking for Bespoke’s analysis of current market internals, economic data, earnings beats and misses, individual stock ideas, and more, the Bespoke Report has it all.

Continue reading this week’s Bespoke Report by starting a 14-day free trial to our paid content below.

Have a great weekend!