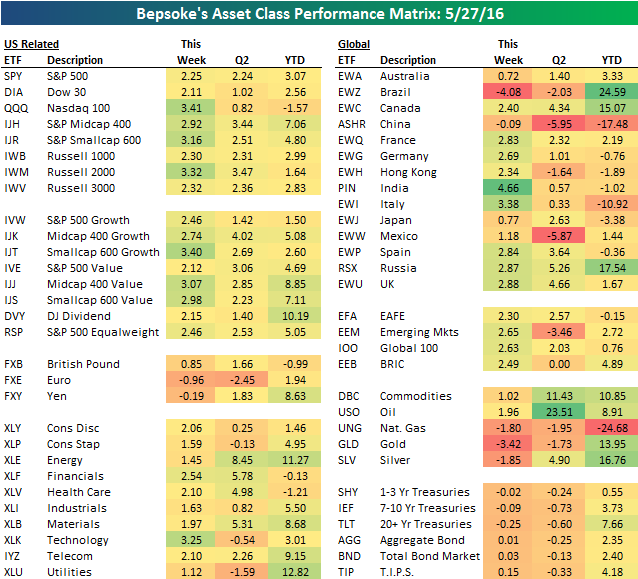

The S&P 500 (SPY) posted a nice gain of 2.25% this week, pushing the ETF up to +3.07% YTD. While the Nasdaq 100 (QQQ) gained even more this week at +3.41%, it’s still down 1.57% on the year. Looking at the ten S&P 500 sectors, Technology (XLK) — which had been underperforming recently — came roaring back this week with a gain of 3.25%. As the largest sector of the S&P 500 (20%), big gains for Tech usually mean big gains for the market.

Outside of the US, Brazil (EWZ) was down big with a decline of 4.08%. India (PIN), on the other hand, was up 4.66% — more than any other country ETF in the our asset class performance matrix below. One other country worth pointing out is Canada (EWC). Canada’s market was up 2.4% on the week, and it’s up 4.34% QTD. For the year, Canada has quietly posted a gain of 15.07%. All is well in the North when oil is rallying. The oil ETF (USO) is now up 23.5% quarter to date. Please have a look at this week’s asset class performance matrix below:

Each week, Bespoke sends clients across all of its subscription levels the Bespoke Report newsletter. If you’re looking for Bespoke’s analysis of current market internals, economic data, earnings beats and misses, individual stock ideas, and more, the Bespoke Report has it all.

Continue reading this week’s Bespoke Report by starting a 14-day free trial to our paid content below.

Have a great Memorial Day weekend!