This week’s Bespoke Report newsletter is now available for members.

How’s the glass? Half-full? No way. It’s not even half empty. It’s been emptied, put in the recycling machine, and crushed to pieces. We have a Fed chair talking about a ‘painful’ period of policy normalization, and a Treasury Secretary telling the public that a soft-landing is ‘conceivable’ with a little bit of ‘skill and luck.’ Somebody get us a rabbit’s foot and some four-leaf clovers, the fate of the world’s largest economy hinges on it! Need they be reminded of the famous quote: “Hope is not a strategy”?

We’re trying something a little different this week. With no economic data and little in the way of earnings news to speak of today, we’re sending out this week’s Bespoke Report early. Given the volatility in the market lately, we’re sure to miss some big moves throughout the trading day, but they’re unlikely to have a major impact on this year’s trends (famous last words).

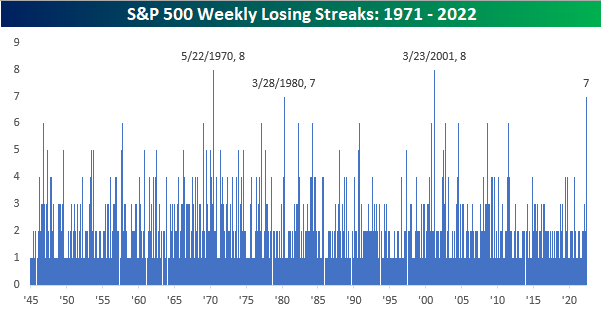

Barring a 3.1% rally on Friday, this week will mark the seventh straight week that the S&P 500 finished the week in the red. That would be the longest streak of weekly losses for the index since March 2001 and just the fourth streak of seven or more weekly losses in the post-WWII period. It’s a small sample size, but these types of streaks haven’t occurred during particularly positive periods for the equity market.

The snippet above is pulled from a page from this week’s Bespoke Report newsletter. If you’re not a Bespoke subscriber and you want to read this week’s full Bespoke Report (and access everything else Bespoke’s research platform has to offer), start a two-week trial to one of our three membership levels.