Each week, Bespoke sends clients across all of its subscription levels the Bespoke Report newsletter. If you’re looking for Bespoke’s analysis of current market internals, economic data, earnings beats and misses, individual stock ideas, and more, the Bespoke Report has it all. If you sign up for a subscription between now and Sunday, you’ll receive a 20% discount for the life of your membership! Simply choose one of the offerings below to gain access to some of the best research you’ll find anywhere. Here’s a matrix of the products included with each level of service.

Newsletter Annual – $316/yr (20% off)

Newsletter Monthly – $39/mo (20% off)

Premium Annual – $795/yr (20% off)

Premium Monthly – $79/mo (20% off)

Institutional Annual – $1595/yr (20% off)

Institutional Monthly – $155/mo (20% off)

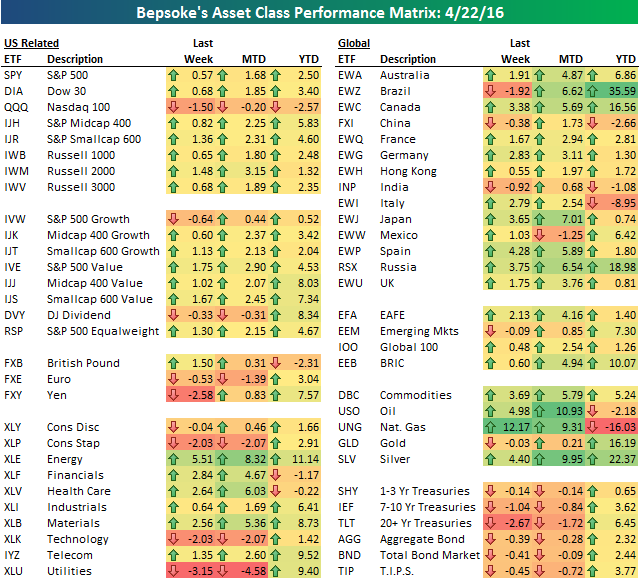

Below is a look at our asset class performance matrix using key ETFs traded on US exchanges. The S&P 500 (SPY) ETF traded up 0.57% this week — not much, but at least it wasn’t in the red like the Nasdaq 100 (QQQ). The Tech-heavy Nasdaq fell 1.5% due to negative earnings reports from high-profile names like Alphabet (GOOGL), Netflix (NFLX) and Microsoft (MSFT). QQQ is now underperforming SPY by more than 500 basis points year-to-date.

Looking at the ten sectors, we saw defensive areas get hit hard, while Energy, Financials, Health Care and Materials posted nice gains. Outside of the U.S., Brazil and India were the only countries in the red for the week, which left the Emerging Markets ETF (EEM) in the red as well. Commodities saw big jumps with the exception of gold, while Treasury ETFs were down across the board.

Have a great weekend!