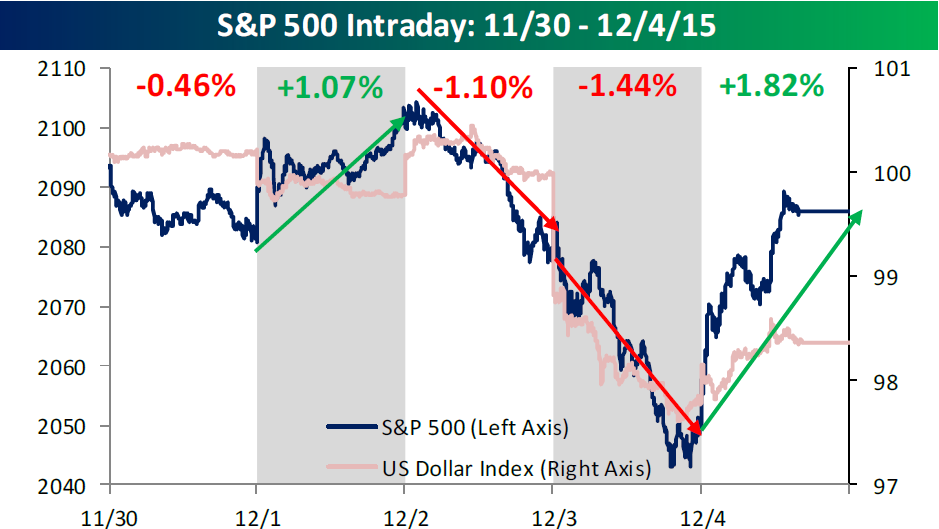

It’s always nice to end the week on a good note with a gain of close to 2% in the S&P 500, even if that 2% gain was still only barely enough to push the index into the black. In what was, by any standards, a volatile week for the equity market, the S&P 500 was whipped around by central bank jawboning and actions that pushed currencies and various asset classes around like a rag doll. After starting off the week with a relatively mild decline of 0.46%, the S&P 500 rallied 1.07% on Tuesday and then gave back all of those gains on Wednesday. On Thursday, ECB President Mario Draghi unveiled additional stimulus measures in the form of lower rates and added QE, but after a big buildup into the event, investors found themselves completely underwhelmed and sold anything they could get their hands on. At the end of the day, the S&P 500 was down 1.44% with a very important jobs report on deck for Friday. Friday’s jobs report came in better than expected, but with a December rate hike already fully priced into the markets, investors reacted positively sending the S&P 500 up 2% for the day and just over one point on the week. You wouldn’t think it, but with four straight daily moves of 1%+ up or down, the S&P 500 hasn’t seen this much day to day volatility since the August lows.

We’ve just published our weekly Bespoke Report newsletter, which is available to all Bespoke Newsletter, Bespoke Premium and Bespoke Institutional subscribers. You can read this week’s Bespoke Report by starting a 14-day free trial to our research services below.

[thrive_leads id=’60014′]