The End of Summer Hangover. The end of Labor Day weekend, when schools are back in session and summer starts to wind down, is always a tough time of year. After a summer of nice weather, swimming, hiking, outdoor sports, and hopefully even a vacation, Tuesday morning after the three-day Labor Day weekend can be rough. This year was no exception, and it was reflected in the performance of US and global equity markets.

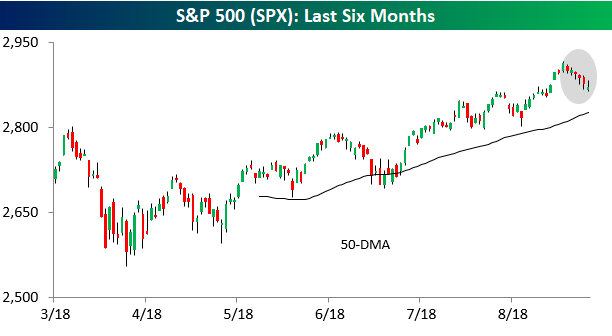

Take a look at the chart below. For six straight trading days now, the S&P 500 had a lower intraday high and lower intraday low than the prior day’s levels. That type of consistent selling with zero in the way of buying doesn’t happen very often. To find the most recent occurrence, you have to go all the way back to May 2012, and since 1982, it has only occurred eight other times.

We’ve just published our latest weekly Bespoke Report newsletter, which is available to subscribers across all three of our membership levels. Sign up here to read the report.

To get up to speed on our thoughts regarding the market’s direction going forward, choose any membership option and access this week’s full Bespoke Report newsletter after signing up! You won’t be disappointed. Some of the topics discussed in this week’s report include:

- Buyers Strike

- International/Domestic Dichotomy

- FAANGed Up

- Bear Market in Emerging Markets

- Economic Review

- Years Like 2018

- Back to School Review