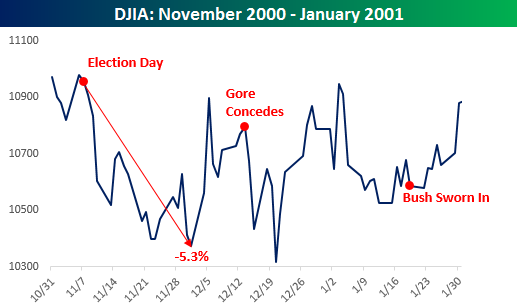

We just published a useful summary for clients of market returns in different sessions of Congress based on the political makeup of Washington, but what if the results of the vote are so close that we don’t have a winner tomorrow morning? Hopefully that isn’t the case (especially now that the Supreme Court is split right down the middle), but if that kind of scenario does unfold, the reaction of the markets likely wouldn’t be good. The chart to the right shows the performance of the DJIA following the 2000 election which wasn’t decided until well after Election Day. During that period of uncertainty, the DJIA declined 5.3% from the Election Day close to its low on 12/1/00. What is interesting to note, though, is that even with the uncertainty, on the day after the election in 2000, the DJIA only declined 45 points (0.41%). We can only imagine if that type of scenario played out this year, instead of a 45 point decline, we would be looking at a decline of more like 450 points.

We just published a useful summary for clients of market returns in different sessions of Congress based on the political makeup of Washington, but what if the results of the vote are so close that we don’t have a winner tomorrow morning? Hopefully that isn’t the case (especially now that the Supreme Court is split right down the middle), but if that kind of scenario does unfold, the reaction of the markets likely wouldn’t be good. The chart to the right shows the performance of the DJIA following the 2000 election which wasn’t decided until well after Election Day. During that period of uncertainty, the DJIA declined 5.3% from the Election Day close to its low on 12/1/00. What is interesting to note, though, is that even with the uncertainty, on the day after the election in 2000, the DJIA only declined 45 points (0.41%). We can only imagine if that type of scenario played out this year, instead of a 45 point decline, we would be looking at a decline of more like 450 points.

If you are interested in seeing our latest B.I.G. Tips report, Looking Past Election Day, sign up for a monthly Bespoke Premium membership and get 10% off for life ($89/month). There is no financial obligation whatsoever, and you can cancel at any time.