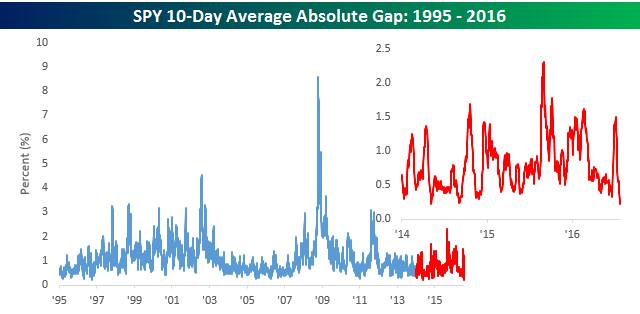

If you’re the type of person who turns on the financial news in the morning, you’ve likely noticed that on most days recently, futures have been little changed. In fact, using the S&P 500 tracking ETF (SPY) as a proxy, the S&P 500 has gapped up or down at the open by less than 0.2% for four straight days. And through yesterday, the ten-day average opening gap of SPY was a record low +/-0.215% (since 1994 when SPY started trading). To put this lack of volatility into perspective, the median opening gap for SPY going back to 1994 has been +/-0.76%!

In today’s Chart of the Day sent to paid subscribers, we look at periods where SPY had similar 10-day periods with low volatility at the opening bell and see how the market performed going forward. To view the report, please start a 14-day free trial below.