This week’s Bespoke Report newsletter is now available for members.

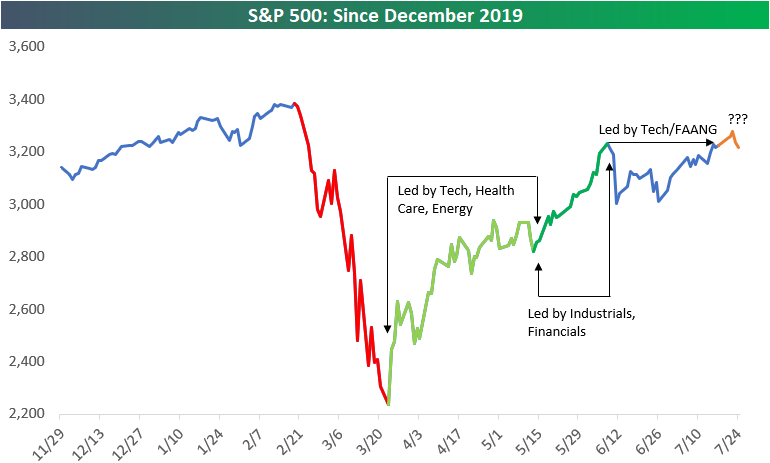

In our Bespoke Report from two weeks ago, we broke the bull market rally off the March lows into three acts, each of which had different leadership characteristics. With the S&P 500 eclipsing its 6/8 high this past Monday, we have provided an update to the three act chart below, and now wonder if we are in the beginning of Act IV.

To summarize each of the acts so far:

Act I spanned 3/23 through 5/13 and was led by Tech and stay at home names which were either the least impacted or even benefitted from the economic shutdown and stay at home orders. Health Care stocks benefitted given the race for a vaccine and treatments, while bombed out Energy stocks bounced.

Act II spanned nearly a month beginning on 5/13 through 6/8. During this phase of the rally, the re-opening stocks rallied along with cyclicals in the Industrials sector as well as Financials as it became clear that the first wave of the Covid outbreak was ebbing.

Act III began in early June as signs emerged that the south and southwest was starting to flare up. As re-openings were rolled back, investors rotated back into tech, work from home, and FANG stocks.

That leaves us where we are now. With the S&P 500 reaching new post-Covid highs this week (before pulling back on Friday), is this the beginning of a new act, and if so, which areas will lead the market going forward? In this week’s Bespoke Report, we break down the latest trends regarding Covid, the market, earnings, and the economy in order to help answer that question. To read the report and access everything else Bespoke’s research platform has to offer, start a two-week free trial to one of our three membership levels. You won’t be disappointed!